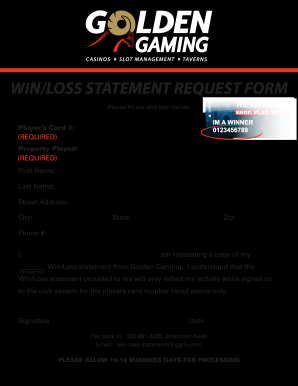

Indian Head Casino W-2GWin-Loss Request Form free printable template

Show details

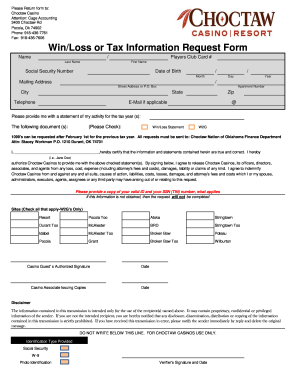

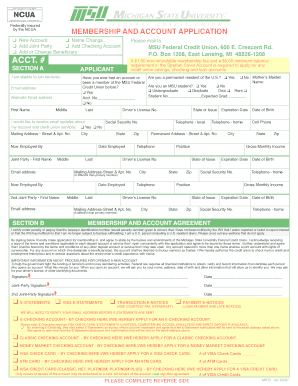

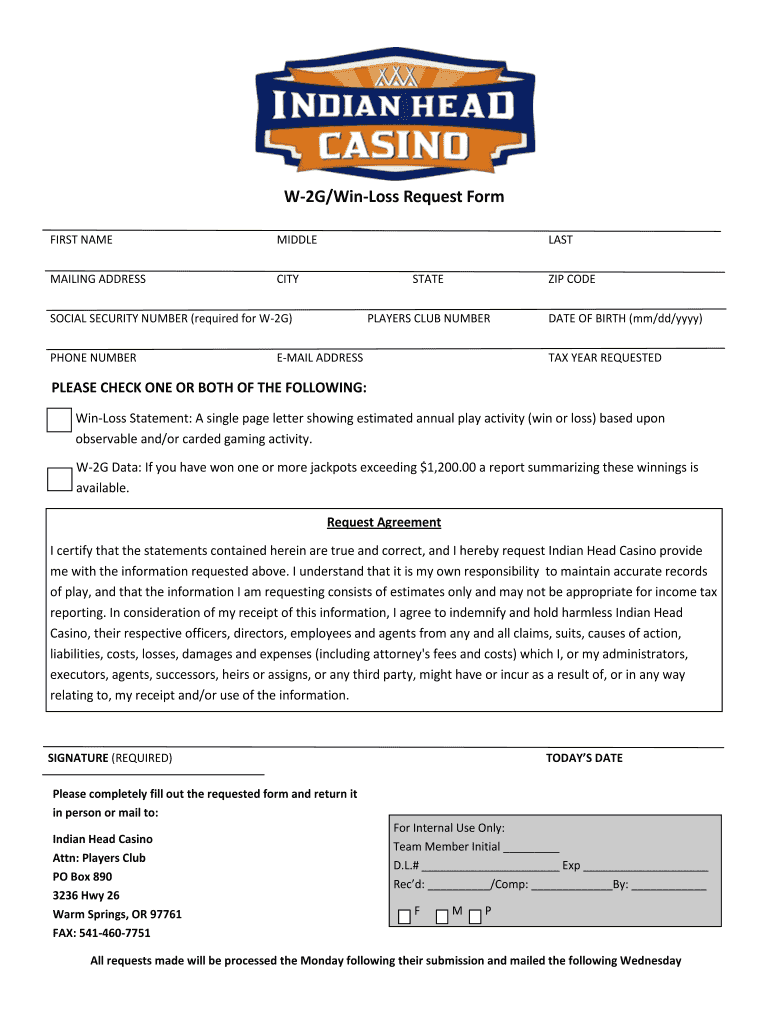

W-2G/Win-Loss Request Form FIRST NAME MIDDLE MAILING ADDRESS LAST CITY STATE SOCIAL SECURITY NUMBER (required for W-2G) PHONE NUMBER ZIP CODE PLAYERS CLUB NUMBER E-MAIL ADDRESS DATE OF BIRTH (mm/dd/YYY)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign win loss request form

Edit your loss request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Indian Head Casino W-2GWin-Loss Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Indian Head Casino W-2GWin-Loss Request Form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Indian Head Casino W-2GWin-Loss Request Form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Indian Head Casino W-2GWin-Loss Request Form

How to fill out Indian Head Casino W-2G/Win-Loss Request Form

01

Obtain the W-2G/Win-Loss Request Form from Indian Head Casino's website or customer service.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the date of your winnings or losses.

04

Provide details of your gaming activity, including the type of game played and the amount won or lost.

05

Sign and date the form confirming that the information provided is accurate.

06

Submit the completed form to the designated department at Indian Head Casino, either via mail or in person.

Who needs Indian Head Casino W-2G/Win-Loss Request Form?

01

Individuals who have won significant amounts of money at Indian Head Casino and need to report their winnings for tax purposes.

02

Players who wish to obtain a record of their gambling losses for tax deductions.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a win loss statement and a W2G?

Win/Loss Statements have a net win or loss of a single players account during a specific year. W2G is the reportable tax amount given to the IRS. 1099 is the reportable promotional gifts and/or winnings reported to the IRS.

Are win loss statements proof of gambling losses?

Can a win loss statement be used for tax purposes. Yes, you can use it for your tax year if you have won and lost money through gambling venues such as lotteries, raffles, horse races, and s. Remember, you can only deduct losses up to the amount of your winnings.

Is a win loss statement good enough for the IRS?

Can a win loss statement be used for tax purposes. Yes, you can use it for your tax year if you have won and lost money through gambling venues such as lotteries, raffles, horse races, and s.

How do you get a win loss statement?

0:00 0:41 Where do I find my win/loss statement? - YouTube YouTube Start of suggested clip End of suggested clip Welcome to bet mgm. Do you want to know how to find the win loss statement. And what it means don'tMoreWelcome to bet mgm. Do you want to know how to find the win loss statement. And what it means don't worry we can help all you need to do is log into your account using a pc. Then click on my account

Is a win loss statement the same as a W2G?

A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual win/loss statement.

What does a win loss statement mean?

What is a Win/Loss Statement? A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Indian Head Casino W-2GWin-Loss Request Form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Indian Head Casino W-2GWin-Loss Request Form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the Indian Head Casino W-2GWin-Loss Request Form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Indian Head Casino W-2GWin-Loss Request Form in minutes.

How do I edit Indian Head Casino W-2GWin-Loss Request Form on an iOS device?

Create, modify, and share Indian Head Casino W-2GWin-Loss Request Form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is Indian Head Casino W-2G/Win-Loss Request Form?

The Indian Head Casino W-2G/Win-Loss Request Form is a document used to report gambling winnings and losses to the Internal Revenue Service (IRS) for tax purposes. It helps players to track their gambling results for accurate tax filing.

Who is required to file Indian Head Casino W-2G/Win-Loss Request Form?

Individuals who have gambling winnings that meet or exceed certain thresholds set by the IRS are required to file the Indian Head Casino W-2G/Win-Loss Request Form. This typically includes winnings from slot machines, bingo, and keno.

How to fill out Indian Head Casino W-2G/Win-Loss Request Form?

To fill out the Indian Head Casino W-2G/Win-Loss Request Form, individuals should provide their personal details such as name, address, and taxpayer identification number, along with relevant details of their gambling activities, including dates, types of games played, winnings amount, and any losses.

What is the purpose of Indian Head Casino W-2G/Win-Loss Request Form?

The purpose of the Indian Head Casino W-2G/Win-Loss Request Form is to facilitate the reporting of gambling income and losses. It aids individuals in calculating their taxable income and supporting any claims for deductions related to gambling losses.

What information must be reported on Indian Head Casino W-2G/Win-Loss Request Form?

The information that must be reported on the Indian Head Casino W-2G/Win-Loss Request Form includes the player's name, address, taxpayer identification number, the type and date of the gambling activity, total winnings, and total losses incurred during that period.

Fill out your Indian Head Casino W-2GWin-Loss Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Head Casino W-2gwin-Loss Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.