Get the free Transferring IRA Assets

Show details

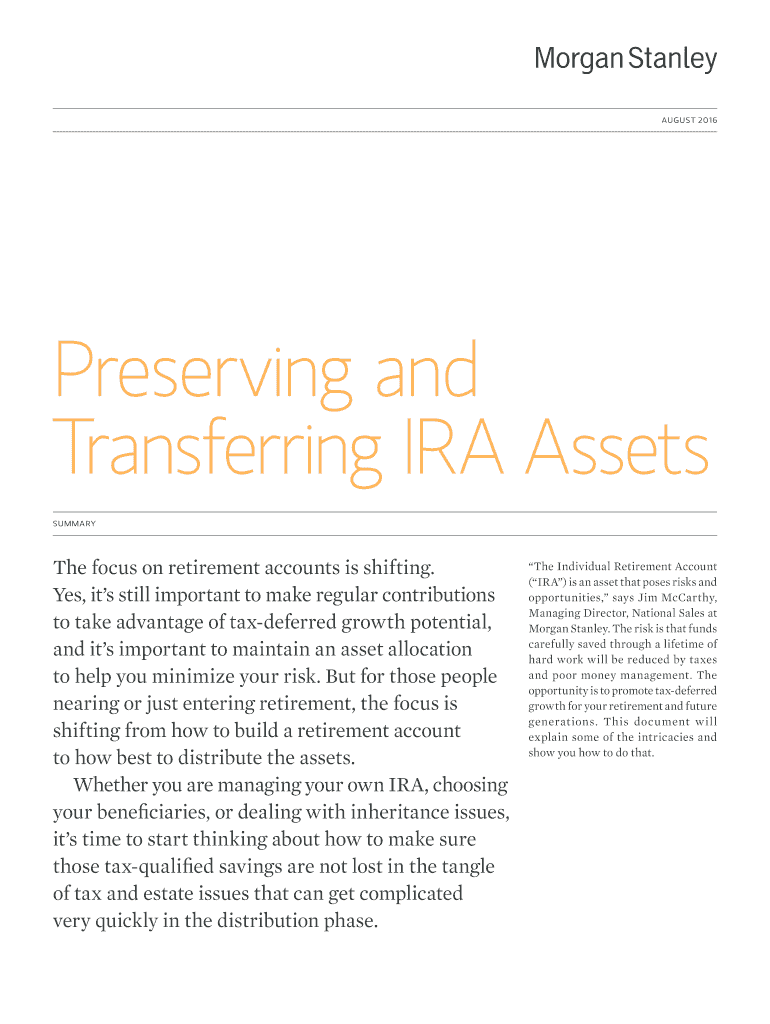

AUGUST 2016Preserving and

Transferring IRA Assets

Summary focus on retirement accounts is shifting.

Yes, its still important to make regular contributions

to take advantage of tax deferred growth

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transferring ira assets

Edit your transferring ira assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transferring ira assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transferring ira assets online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transferring ira assets. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transferring ira assets

How to fill out transferring ira assets

01

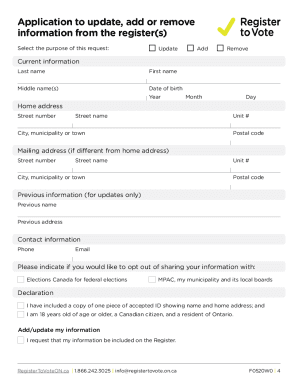

Gather all necessary documents, including the IRA account statements, transfer forms, and identification.

02

Verify if the receiving financial institution allows IRA asset transfers and review their specific requirements.

03

Complete the transfer form accurately, providing detailed information about the transferring and receiving IRAs.

04

Indicate the type of transfer (direct or indirect) and specify if it is a full or partial transfer of assets.

05

Double-check all information provided and ensure it matches the details on both the transferring and receiving accounts.

06

Submit the transfer form to the transferring financial institution, either online, by mail, or in person.

07

Wait for the transfer to be processed, which usually takes a few days to a few weeks.

08

Monitor the transfer to ensure it is completed successfully and notify the receiving financial institution if any issues arise.

09

Once the transfer is complete, review the new IRA account to ensure all assets have been properly transferred.

10

Consider consulting with a financial advisor or tax professional to understand any potential tax consequences or penalties.

Who needs transferring ira assets?

01

Individuals who want to switch financial institutions or consolidate their retirement accounts may need to transfer IRA assets.

02

People who have changed jobs and want to move their employer-sponsored IRA to a personal IRA may also require a transfer.

03

Retirees who want to move their retirement savings to a different financial institution for better management or investment opportunities may opt for an IRA asset transfer.

04

Those who inherit an IRA and wish to transfer the assets to their own IRA or to another eligible beneficiary may need to go through the transfer process.

05

Individuals who want to convert a traditional IRA to a Roth IRA or vice versa may need to transfer their IRA assets to a new account.

06

Anyone who wants to take advantage of better investment options or lower fees offered by a different financial institution may consider transferring IRA assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my transferring ira assets directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your transferring ira assets and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit transferring ira assets from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your transferring ira assets into a dynamic fillable form that you can manage and eSign from anywhere.

How can I fill out transferring ira assets on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your transferring ira assets by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is transferring ira assets?

Transferring IRA assets refers to moving assets from one Individual Retirement Account (IRA) to another.

Who is required to file transferring ira assets?

Individuals who are transferring their IRA assets are required to file the necessary paperwork.

How to fill out transferring ira assets?

To fill out transferring IRA assets, individuals need to complete the appropriate transfer forms provided by the financial institution where the IRA is held.

What is the purpose of transferring ira assets?

The purpose of transferring IRA assets is to change the custodian of the account or consolidate multiple IRAs into one.

What information must be reported on transferring ira assets?

The information that must be reported on transferring IRA assets includes details of the assets being transferred, account numbers, and the receiving financial institution.

Fill out your transferring ira assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transferring Ira Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.