Get the free FAQs on Deducting Home Mortgage Interest.doc. Instructions for Form 1098 - owsley ca...

Show details

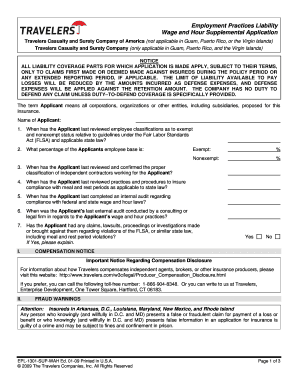

Five Tips About the First-Time Homebuyer Credit Documentation Requirements

Special Edition Tax Tip 2010-02

Claiming the First-Time Homebuyer Tax Credit on your 2009 tax return might mean a

larger

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faqs on deducting home

Edit your faqs on deducting home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faqs on deducting home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing faqs on deducting home online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit faqs on deducting home. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out faqs on deducting home

How to fill out FAQs on deducting home:

01

Start by identifying the common questions and concerns people have about deducting home expenses. This can include questions about mortgage interest deductions, property taxes, home office deductions, and any other relevant topics.

02

Clearly define each question and provide a concise and accurate answer. Make sure your answers are easy to understand and address the specific concerns of individuals seeking information about deducting home expenses.

03

Use examples and practical scenarios to further clarify your answers. This can help individuals better understand how the deduction process works and how it applies to their specific situations.

04

Organize your FAQs in a logical and user-friendly format. Consider categorizing questions based on topic or relevance, and include a table of contents or an index for easy navigation.

05

Update and review your FAQs regularly to ensure they remain up-to-date with the latest tax laws and regulations. This will help maintain the accuracy and relevance of your information.

Who needs FAQs on deducting home:

01

Homeowners: Individuals who own residential properties and want to minimize their tax liabilities by taking advantage of available deductions.

02

Renters: Even though renters generally cannot deduct home-related expenses, they may still have questions about the deductions available to landlords or property owners.

03

Tax Professionals: Professionals who provide tax services can benefit from having comprehensive FAQs on deducting home expenses. These FAQs can serve as a useful resource for answering client inquiries and staying updated on the latest tax regulations.

04

Real Estate Agents: Agents who work with homebuyers and sellers can also benefit from having a clear understanding of deducting home expenses. Having FAQs on this topic can help them provide accurate information and guidance to their clients.

In summary, filling out FAQs on deducting home requires thorough research, clear and concise answers, and regular updates to ensure accuracy. These FAQs are beneficial for homeowners, renters, tax professionals, and real estate agents seeking reliable information about deducting home expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute faqs on deducting home online?

pdfFiller has made it simple to fill out and eSign faqs on deducting home. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the faqs on deducting home in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your faqs on deducting home and you'll be done in minutes.

How do I complete faqs on deducting home on an Android device?

On Android, use the pdfFiller mobile app to finish your faqs on deducting home. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is faqs on deducting home?

Faqs on deducting home is a set of frequently asked questions related to the process of deducting home expenses for tax purposes.

Who is required to file faqs on deducting home?

Anyone who owns a home and wishes to deduct home-related expenses on their taxes may be required to file faqs on deducting home.

How to fill out faqs on deducting home?

To fill out faqs on deducting home, one must provide accurate information regarding their home expenses and follow the instructions provided by the tax authorities.

What is the purpose of faqs on deducting home?

The purpose of faqs on deducting home is to assist taxpayers in understanding the rules and regulations regarding the deduction of home-related expenses.

What information must be reported on faqs on deducting home?

The information reported on faqs on deducting home may include details on mortgage interest, property taxes, home office expenses, and other eligible deductions.

Fill out your faqs on deducting home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faqs On Deducting Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.