Get the free Avoiding Spousal Beneficiary Mistakes in 5 Easy Steps 2011-01-26. 2013 Spousal and D...

Show details

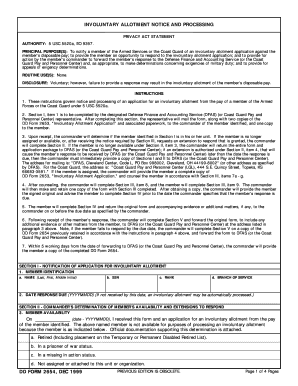

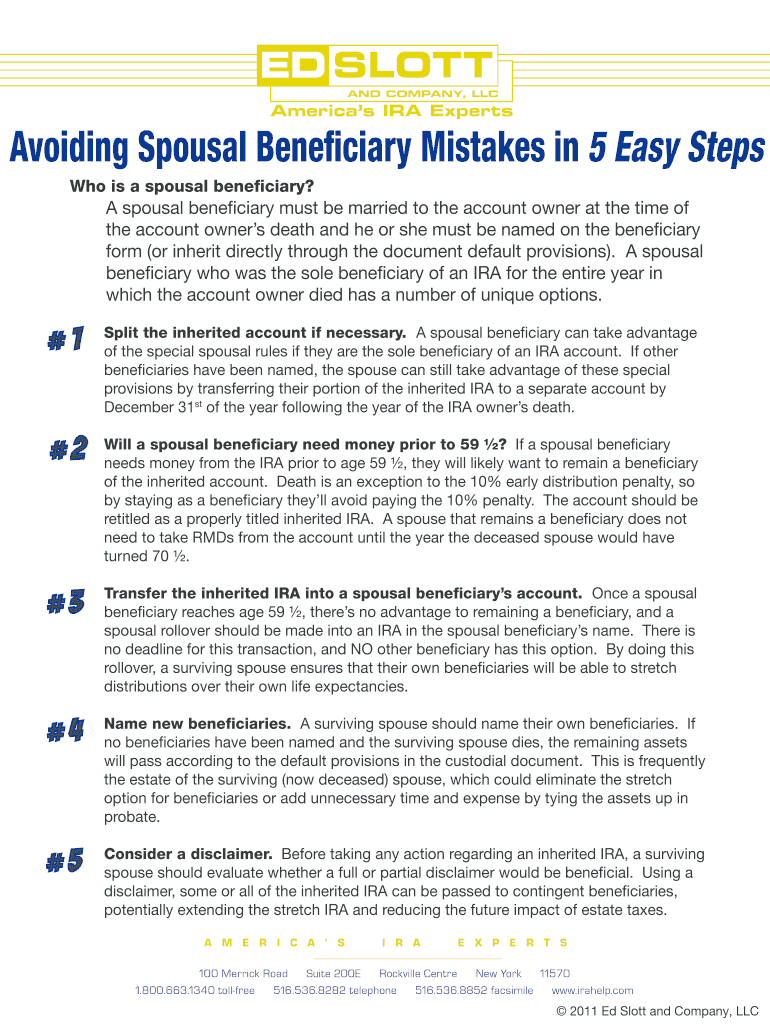

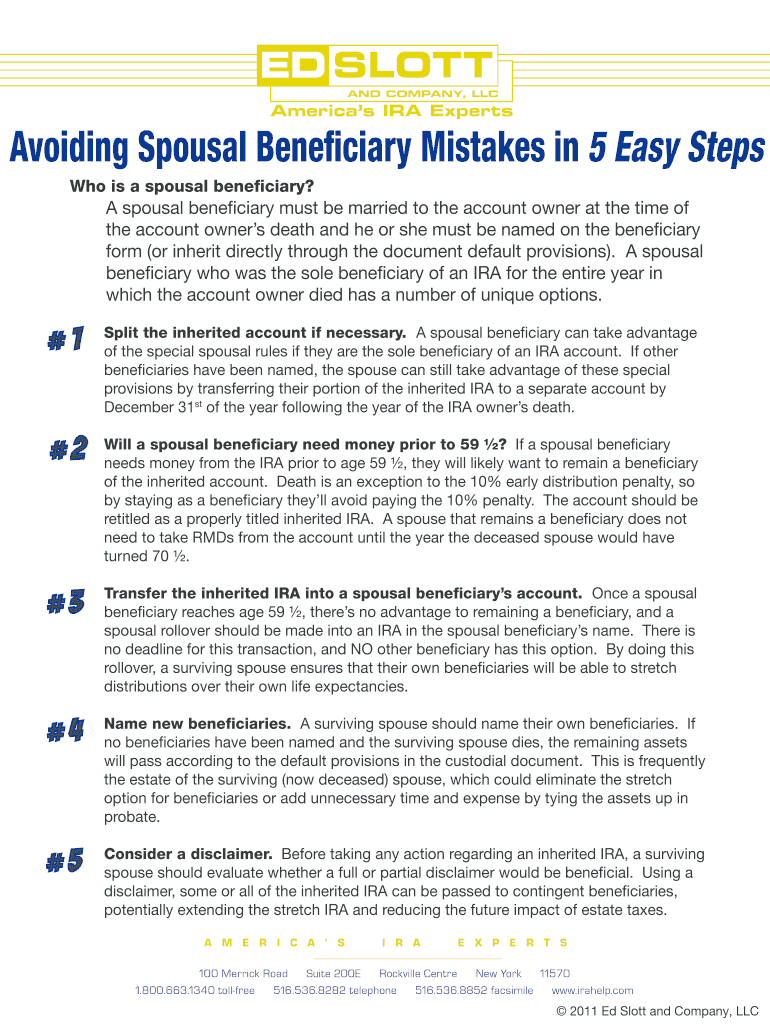

Avoiding Spousal Beneficiary Mistakes in 5 Easy Steps Who are a spousal beneficiary? A spousal beneficiary must be married to the account owner at the time of the account owner s death and he or she

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign avoiding spousal beneficiary mistakes

Edit your avoiding spousal beneficiary mistakes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your avoiding spousal beneficiary mistakes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit avoiding spousal beneficiary mistakes online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit avoiding spousal beneficiary mistakes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out avoiding spousal beneficiary mistakes

How to Fill Out Avoiding Spousal Beneficiary Mistakes:

Understand the importance of beneficiary designation forms:

01

Begin by familiarizing yourself with beneficiary designation forms, which are typically provided by retirement account providers or insurance companies.

02

These forms allow you to specify who will receive the assets in the event of your death.

Review and update beneficiary designations regularly:

01

It is crucial to review and update your beneficiary designations regularly, especially during significant life events such as marriage, divorce, birth, or death.

02

Failing to update beneficiary designations can result in assets going to unintended individuals or even winding up in probate.

Consider your retirement accounts and insurance policies:

01

Evaluate all your retirement accounts, including 401(k), Individual Retirement Accounts (IRA), or pension plans, to ensure you have designated the appropriate spousal beneficiary.

02

Similarly, review your life insurance policies, annuities, or any other insurance products that have beneficiary designations to avoid mistakes.

Consult a professional:

01

Seeking advice from a financial advisor or an estate planning attorney can be beneficial, particularly if you have complex beneficiary situations or significant assets.

02

Professionals can provide guidance on beneficiary selection, tax implications, and ensure your plans align with your overall estate planning goals.

Who Needs to Avoid Spousal Beneficiary Mistakes?

Married or Divorcing Individuals:

01

Married individuals or those going through a divorce should pay close attention to spousal beneficiary designations.

02

It is essential to update beneficiary designations to reflect changes in marital status and ensure assets are distributed correctly.

Individuals with Blended Families:

01

People in blended families, where there may be stepchildren or multiple sets of beneficiaries, need to be careful when selecting spousal beneficiaries.

02

Consider involving a professional to help navigate through potential complications and ensure everyone's interests are appropriately addressed.

Those with Retirement or Insurance Accounts:

01

Anyone with retirement accounts, such as 401(k)s or IRAs, should be aware of the potential consequences of incorrect spousal beneficiary designations.

02

Similarly, individuals with life insurance policies or other insurance products that involve naming beneficiaries must exercise caution to avoid mistakes.

In conclusion, properly filling out beneficiary designation forms and avoiding spousal beneficiary mistakes is crucial. Regularly reviewing and updating your designations, seeking professional advice when needed, and being aware of the risks associated with incorrect designations can help ensure your assets are distributed according to your wishes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send avoiding spousal beneficiary mistakes for eSignature?

When you're ready to share your avoiding spousal beneficiary mistakes, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the avoiding spousal beneficiary mistakes in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your avoiding spousal beneficiary mistakes and you'll be done in minutes.

How do I edit avoiding spousal beneficiary mistakes on an Android device?

You can edit, sign, and distribute avoiding spousal beneficiary mistakes on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is avoiding spousal beneficiary mistakes?

Avoiding spousal beneficiary mistakes refers to taking proactive steps to ensure that any errors or oversights are prevented when designating a spouse as a beneficiary in estate planning or financial documents.

Who is required to file avoiding spousal beneficiary mistakes?

Anyone who is designating a spouse as a beneficiary in their estate planning or financial documents is required to be vigilant in avoiding spousal beneficiary mistakes.

How to fill out avoiding spousal beneficiary mistakes?

To fill out avoiding spousal beneficiary mistakes, one should carefully review and update beneficiary designations regularly, seek professional advice if needed, and ensure that all relevant information is accurately documented.

What is the purpose of avoiding spousal beneficiary mistakes?

The purpose of avoiding spousal beneficiary mistakes is to prevent any potential misunderstandings, disputes, or financial complications that may arise if errors are made in designating a spouse as a beneficiary.

What information must be reported on avoiding spousal beneficiary mistakes?

On avoiding spousal beneficiary mistakes, one must report accurate and up-to-date information regarding the spouse's name, contact information, relationship to the beneficiary, and any specific instructions or conditions associated with the beneficiary designation.

Fill out your avoiding spousal beneficiary mistakes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Avoiding Spousal Beneficiary Mistakes is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.