Get the free A non-profit financial education and credit counseling agency

Show details

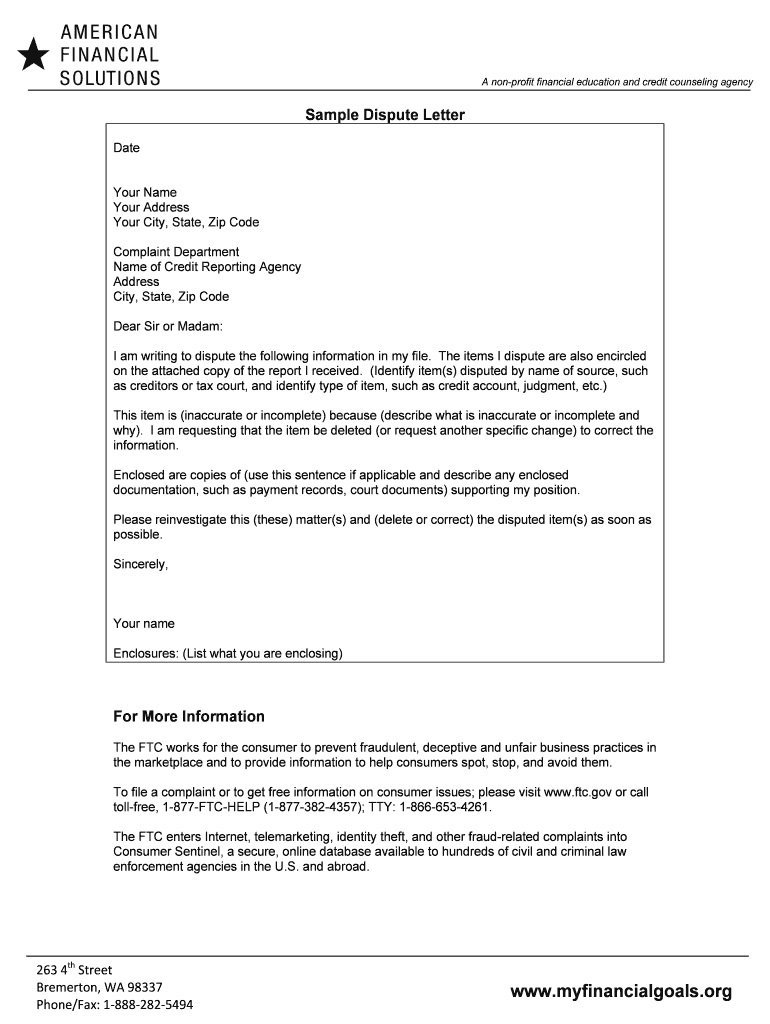

It also may show whether you ve been sued or arrested or have filed for bankruptcy. Companies called consumer reporting agencies CRAs or credit bureaus compile and sell your credit report to businesses. Three credit reporting agencies - Equifax TransUnion and Experian. If you want to obtain your credit score you will have to pay small fee approximately 10. If you ve been told you were denied credit because of an insufficient credit file or no credit file and you have accounts with creditors...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a non-profit financial education

Edit your a non-profit financial education form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a non-profit financial education form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a non-profit financial education online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a non-profit financial education. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a non-profit financial education

How to fill out a non-profit financial education

01

To fill out a non-profit financial education, follow these steps:

02

Start by gathering all necessary financial documents such as bank statements, pay stubs, and bills.

03

Create a budget to track your income and expenses. Determine your monthly income and fixed expenses such as rent or mortgage payments, utilities, and insurance.

04

Identify and categorize your variable expenses like groceries, transportation costs, entertainment, and debt payments.

05

Analyze your spending habits and identify areas where you can cut back or save money.

06

Set financial goals such as saving for emergencies, paying off debts, or investing for the future.

07

Create a plan to achieve your financial goals. This may involve increasing your income, reducing expenses, or seeking professional help.

08

Monitor your progress regularly and make adjustments as needed.

09

Educate yourself about financial literacy topics like budgeting, saving, investing, and managing debt. Attend workshops or seminars if available.

10

Seek guidance from a non-profit financial education organization or counselor if you need personalized assistance.

11

Keep track of your financial education progress and celebrate your achievements along the way.

12

Remember, financial education is an ongoing process, so continue learning and improving your financial skills.

Who needs a non-profit financial education?

01

Anyone who wants to gain financial knowledge and improve their financial well-being can benefit from a non-profit financial education.

02

Specific groups of people who may particularly benefit from non-profit financial education include:

03

- Low-income individuals and families struggling to make ends meet

04

- Young adults who have limited financial experience and need guidance on building a strong financial foundation

05

- Individuals with high levels of debt and need assistance with debt management and repayment strategies

06

- People facing life transitions such as marriage, divorce, retirement, or starting a business

07

- Individuals who want to improve their credit score and learn about responsible borrowing

08

- Entrepreneurs and small business owners seeking guidance on managing business finances

09

- Anyone who wants to take control of their financial future and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get a non-profit financial education?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific a non-profit financial education and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the a non-profit financial education in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your a non-profit financial education and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete a non-profit financial education on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your a non-profit financial education by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is a non-profit financial education?

A non-profit financial education is a program or initiative aimed at providing individuals or groups with information and resources to help them make informed financial decisions.

Who is required to file a non-profit financial education?

Non-profit organizations that receive funding or grants specifically for financial education programs may be required to file a non-profit financial education.

How to fill out a non-profit financial education?

To fill out a non-profit financial education, organizations must provide detailed information about their financial education activities, funding sources, and outcomes.

What is the purpose of a non-profit financial education?

The purpose of a non-profit financial education is to increase financial literacy and improve financial decision-making skills within communities or target populations.

What information must be reported on a non-profit financial education?

Information such as program expenses, funding sources, number of individuals served, and program outcomes may need to be reported on a non-profit financial education.

Fill out your a non-profit financial education online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Non-Profit Financial Education is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.