Get the free Understanding your Credit Report and Credit Score. Understanding your Credit Report ...

Show details

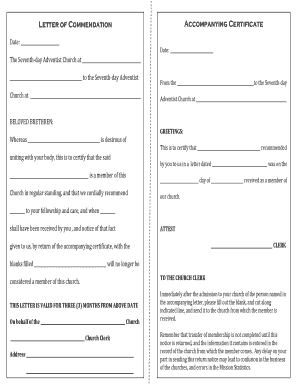

Check for errors and are not yours. Source TransUnion Canada CHERYL CONSUMER 1234 MAIN ST MONTREAL QC H1T 5S9 CONSUMER RELATIONS P. 3 times as follows 2011/09/12 2 2011/08/24 2 2011/07/30 3. BQE BANK 555 555-5555 last reported to us in 08/11. History. R1 means your last payment was made on time. about chequing and savings be included. From 2011/10/09 to 2011/04/07 there has been 5 reportings for the installment account with a monthly payment frequency and was reported delinquent 5 times as...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding your credit report

Edit your understanding your credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding your credit report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding your credit report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding your credit report

How to fill out understanding your credit report?

01

Start by obtaining a copy of your credit report from one of the major credit bureaus, such as Equifax, Experian, or TransUnion.

02

Review the sections of your credit report, including personal information, account history, and public records. Pay close attention to any errors or discrepancies that may negatively impact your credit score.

03

Understand the different components of your credit report, such as credit inquiries, payment history, credit utilization, and types of credit. This will help you better interpret your credit report and identify areas for improvement.

04

Identify any red flags or negative items on your credit report, such as late payments, delinquent accounts, or accounts in collections. Make note of these issues and develop a plan to address them and improve your credit standing.

05

Familiarize yourself with relevant credit terms and definitions. This will ensure that you understand the terminology used in your credit report and can effectively communicate with creditors and lenders.

Who needs understanding your credit report?

01

Individuals who are interested in monitoring and improving their credit score. Understanding your credit report is crucial for identifying any issues that may be negatively affecting your creditworthiness.

02

People who are planning to apply for loans, mortgages, or credit cards. Lenders often review an applicant's credit report to assess their creditworthiness. By understanding your credit report, you can proactively address any potential issues before applying for new credit.

03

Individuals who have experienced identity theft or fraud. Reviewing your credit report regularly can help you detect any unauthorized accounts or suspicious activity. By understanding your credit report, you can take necessary steps to protect yourself and mitigate potential damages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my understanding your credit report in Gmail?

understanding your credit report and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete understanding your credit report online?

With pdfFiller, you may easily complete and sign understanding your credit report online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the understanding your credit report electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your understanding your credit report in seconds.

What is understanding your credit report?

Understanding your credit report involves comprehending the detailed record of your credit history, which includes your borrowing and repayment activities, outstanding debts, and credit inquiries.

Who is required to file understanding your credit report?

Individuals seeking to improve their financial literacy, apply for credit, or monitor their credit health are encouraged to understand their credit report, though it is not a filing requirement.

How to fill out understanding your credit report?

To fill out understanding your credit report, review the report sections, identify the information each section contains, check for inaccuracies, and note any actions needed for credit improvement.

What is the purpose of understanding your credit report?

The purpose of understanding your credit report is to manage credit responsibly, identify errors, assess creditworthiness for future borrowing, and take steps towards improving one's credit score.

What information must be reported on understanding your credit report?

A credit report must include personal identification information, credit account details, payment history, current balances, credit inquiries, and any public records such as bankruptcies.

Fill out your understanding your credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Your Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.