Get the free Pay duties and taxes, customs duty for personal goods ... - DHL

Show details

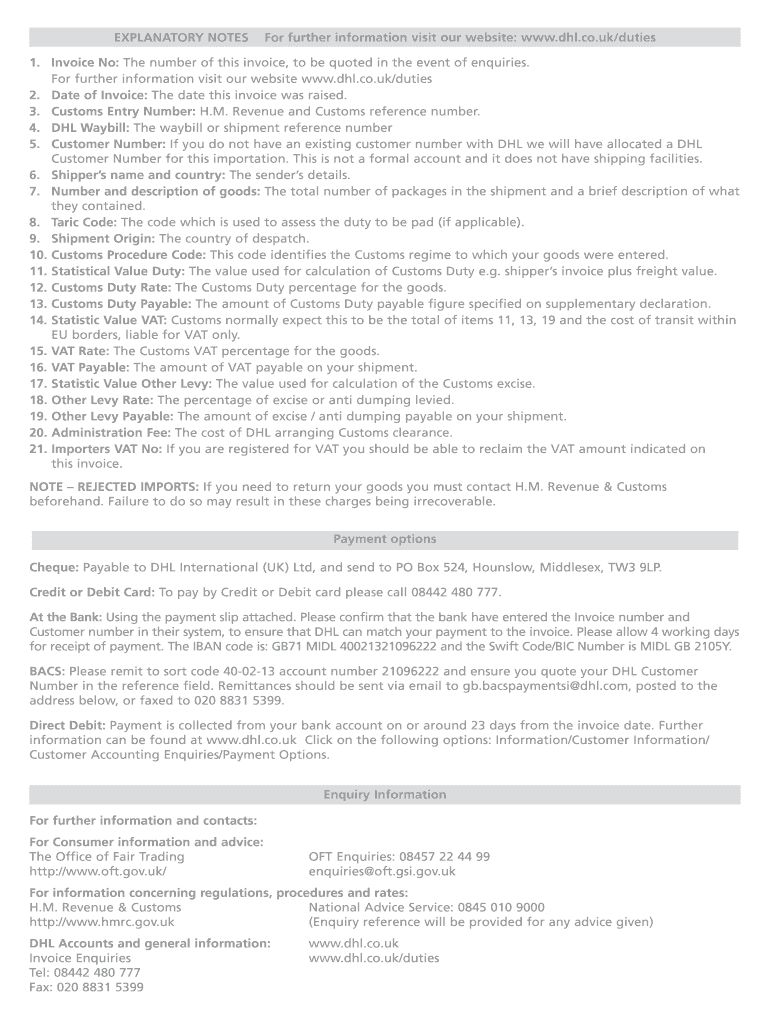

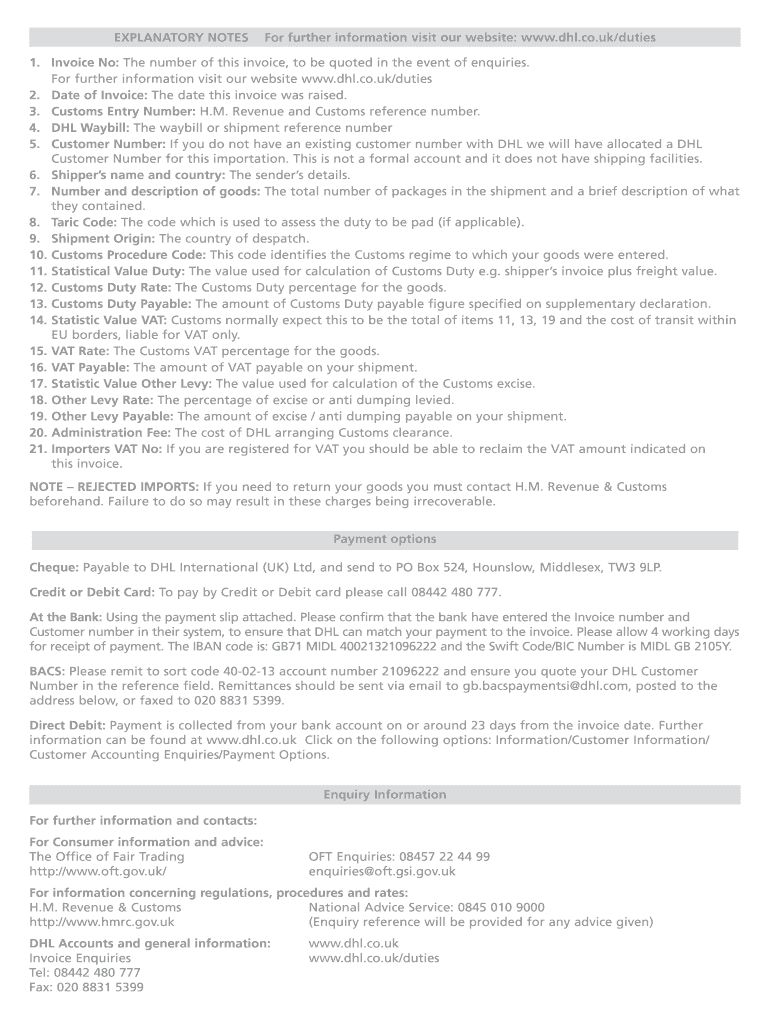

Please allow 4 working days for receipt of payment. The IBAN code is GB71 MIDL 40021321096222 and the Swift Code/BIC Number is MIDL GB 2105Y. Failure to do so may result in these charges being irrecoverable. Payment options Cheque Payable to DHL International UK Ltd and send to PO Box 524 Hounslow Middlesex TW3 9LP. 4. DHL Waybill The waybill or shipment reference number 5. Customer Number If you do not have an existing customer number with DHL we will have allocated a DHL 6. BACS Please...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pay duties and taxes

Edit your pay duties and taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay duties and taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pay duties and taxes online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pay duties and taxes. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pay duties and taxes

How to fill out pay duties and taxes

01

Gather all the necessary information regarding the payment of duties and taxes.

02

Identify the specific duties and taxes applicable to the transaction or item.

03

Fill out the appropriate forms or documents with accurate and complete information.

04

Calculate the amount of duties and taxes to be paid based on the applicable rates.

05

Submit the payment for duties and taxes to the relevant government agency.

06

Ensure that the payment is made within the specified deadline.

07

Keep a record of the payment receipt or proof of payment for future reference.

Who needs pay duties and taxes?

01

Anyone involved in international trade or importing/exporting goods may need to pay duties and taxes.

02

Individuals or businesses importing or exporting goods across borders.

03

Traders, importers, exporters, manufacturers, and distributors.

04

Customs agents, brokers, or clearance agents.

05

Individuals purchasing goods from overseas suppliers.

06

Individuals receiving packages or shipments from abroad.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pay duties and taxes in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pay duties and taxes and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete pay duties and taxes on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your pay duties and taxes. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit pay duties and taxes on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute pay duties and taxes from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is pay duties and taxes?

Pay duties and taxes refer to the responsibility of individuals or businesses to remit a certain amount of money to the government in order to import or export goods legally.

Who is required to file pay duties and taxes?

Any individual or business that engages in international trade and imports or exports goods is required to file pay duties and taxes.

How to fill out pay duties and taxes?

To fill out pay duties and taxes, one must accurately declare the value of the goods being imported or exported, calculate the applicable taxes and duties, and submit the necessary documents to the customs authorities.

What is the purpose of pay duties and taxes?

The purpose of pay duties and taxes is to generate revenue for the government, regulate international trade, protect domestic industries, and ensure compliance with trade regulations.

What information must be reported on pay duties and taxes?

The information that must be reported on pay duties and taxes includes the description and value of the goods being imported or exported, the country of origin, the customs tariff classification, and any applicable taxes and duties.

Fill out your pay duties and taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Duties And Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.