Transamerica Distribution Request Form 2014 free printable template

Show details

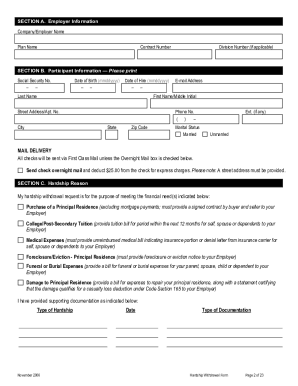

Your Loan will be considered paid in full if you have submitted your payment for the outstanding loan amount to your employer or have attached a money order or cashier s check to this form. Your outstanding loan balance will default and become taxable to you if Transamerica receives this form and your payment has not been received and processed. SECTION G. Income Tax Withholding The income tax withholding requirements vary depending on whether or not the distribution requested is an eligible...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign transamerica withdrawal processing time form

Edit your transamerica 401k withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transamerica withdrawal online login form via URL. You can also download, print, or export forms to your preferred cloud storage service.

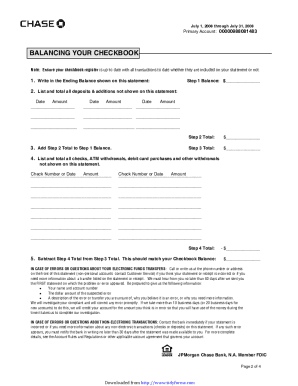

Editing transamerica 401k withdrawal online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit how to cash out transamerica 401k form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Transamerica Distribution Request Form Form Versions

Version

Form Popularity

Fillable & printabley

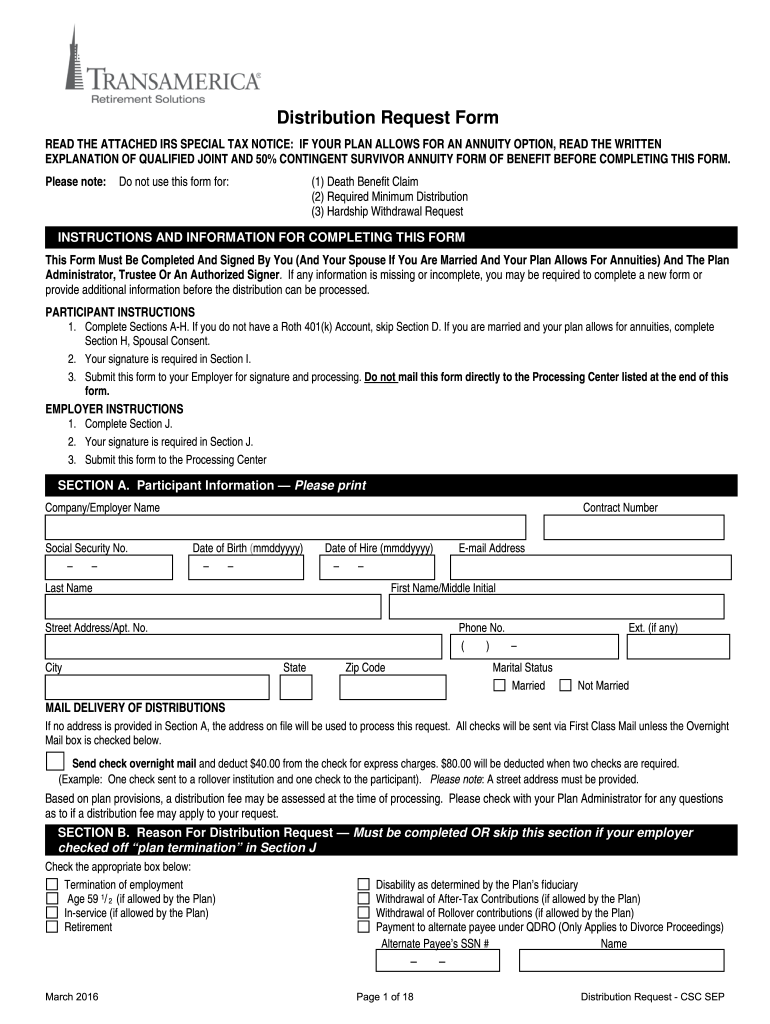

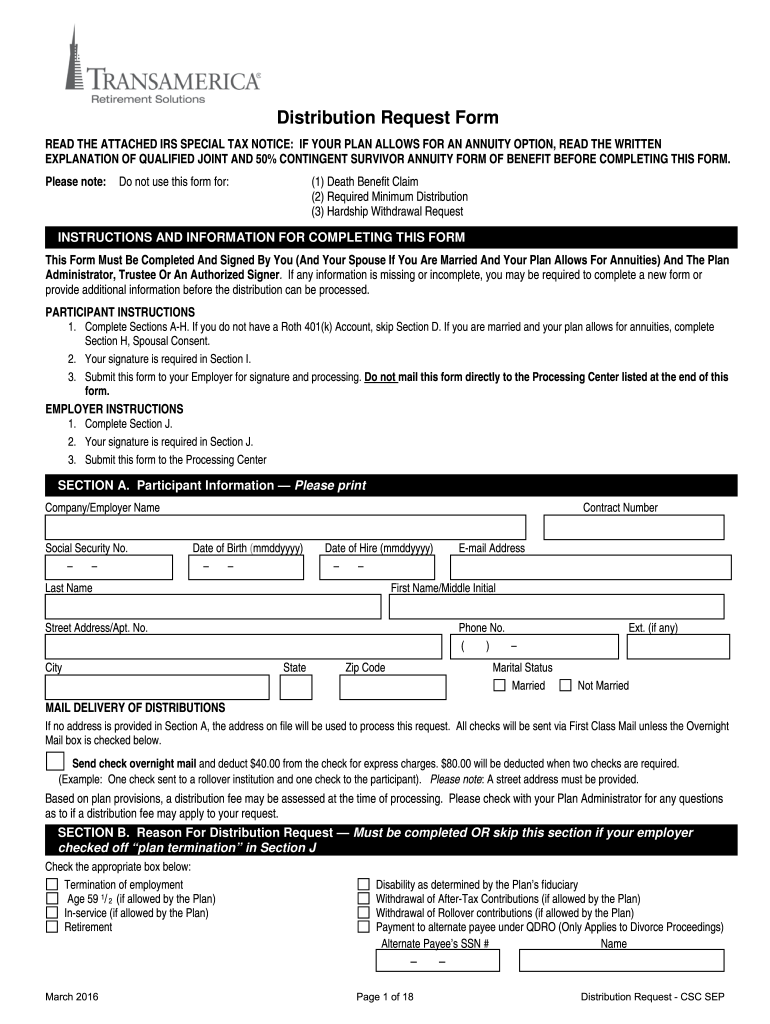

How to fill out transamerica retirement customer service form

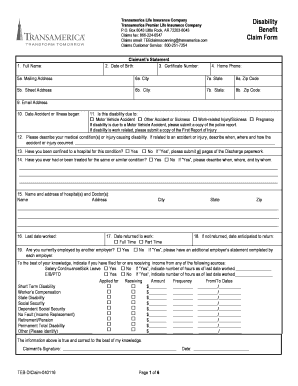

How to fill out Transamerica Distribution Request Form

01

Obtain the Transamerica Distribution Request Form from the official Transamerica website or your financial advisor.

02

Fill in your personal information such as name, address, and policy number in the appropriate fields.

03

Specify the type of distribution you are requesting (e.g., full withdrawal, partial withdrawal, etc.).

04

Indicate the amount you wish to withdraw or transfer.

05

Provide any additional documentation needed, such as identification or proof of eligibility.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to authorize the request.

08

Submit the form via mail, fax, or online, as instructed by Transamerica.

Who needs Transamerica Distribution Request Form?

01

Individuals who hold a policy or investment with Transamerica and wish to access their funds.

02

Beneficiaries or authorized representatives managing accounts after the policyholder's passing.

03

Financial advisors assisting clients in processing distributions from Transamerica accounts.

Fill

transamerica cash out 401k

: Try Risk Free

People Also Ask about can you withdraw money from transamerica

How do I withdraw money from Transamerica?

How long does it take Transamerica to process a withdrawal? You can apply for an in-service withdrawal by calling Transamerica at 800-755-5801 and requesting a withdrawal form.

Can I withdraw money from my 401k?

Yes, you can withdraw money from your 401k before age 59 ½. However, early withdrawals often come with hefty penalties and tax consequences. If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider.

How do I take money out of my retirement account?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

How much can you withdraw from hardship?

The CARES Act of 2020 allowed up to $100,000 in early hardship withdrawal distributions from 401(k) and IRA retirement savings plans without the usual 10% penalty.

How do I transfer money from my 401k to my bank account?

To transfer money from a 401(k) to a bank account, you should send a withdrawal request to the 401(k) plan administrator. It can take up to seven business days for the withdrawal to be processed, and you can expect to receive your funds shortly thereafter.

How long does it take to get money from Transamerica?

In most cases, it takes about 2 weeks from the time you leave a company for your 401(k) to be eligible for a distribution or rollover. You can confirm that your plan is able to be transferred by contacting Transamerica or your previous employer's HR department.

Is debt considered a hardship withdrawal?

However, even if your 401k plan does allow for hardship withdrawals, credit card debt usually doesn't qualify as a reason to make the withdrawal under hardship rules. The IRS outlines specific reasons you can make a hardship withdrawal: Paying for certain medical expenses.

How many times a year can you do a hardship withdrawal?

You can receive no more than 2 hardship distributions during a plan year. Generally, you may only withdraw money within your 401(k) account that you invested as salary contributions. You have an immediate and heavy financial need even if it was reasonably foreseeable or voluntarily incurred.

Can I withdraw money from Transamerica?

You can apply for an in-service withdrawal by calling Transamerica at 800-755-5801 and requesting a withdrawal form. Transamerica will process your withdrawal request within five business days (or as soon as administratively possible) after it receives your properly completed request.

How long does it take to get 401k withdrawal direct deposit?

Depending on your bank, a 401(k) loan direct deposit will take about two or three business days for the funds to reach your bank account.

What is a hardship withdrawal?

Hardship distributions A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

How can I withdraw my 401k from India?

On moving back to India, you can let your 401k be as it is till you turn 59 and a half (59½). Post that, you can withdraw the funds from your 401k in India either as a lump sum amount or monthly pension.

How long does Transamerica take to direct deposit?

Once the distribution is reviewed and approved, the payment will be processed. Payments are generally received within 7-10 business days for a check; 5-7 business days for direct deposit (if available).

How long does it take for Transamerica to approve a withdrawal?

How do I apply for a withdrawal? You can apply for an in-service withdrawal by calling Transamerica at 800-755-5801 and requesting a withdrawal form. Transamerica will process your withdrawal request within five business days (or as soon as administratively possible) after it receives your properly completed request.

Do you get penalized for taking a hardship withdrawal?

You will pay taxes on the amount you take out in the form of a hardship withdrawal. In addition to regular income taxes, you will likely pay a 10% penalty.

How long does it take to withdraw money from 401k?

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

What is the best way to withdraw money from 401k?

The most common way is to take out a loan from the account. This is usually the easiest and quickest way to access your funds. Another option is to roll over the account into an IRA. This can be a good choice if you want to keep the money invested for growth.

How long does it take to receive 401k payout?

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

How do I withdraw from 401k?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit transamerica 401k loan withdrawal straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing transamerica withdrawal online.

How do I fill out the how long does it take to get your money from transamerica form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign transamerica distribution request form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit transamerica distribution request on an iOS device?

Use the pdfFiller mobile app to create, edit, and share transamerica hardship withdrawal from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

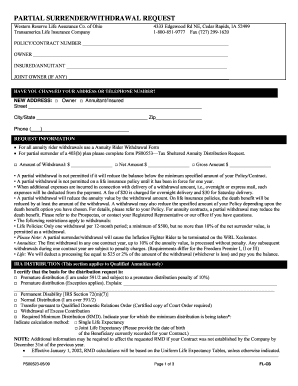

What is Transamerica Distribution Request Form?

The Transamerica Distribution Request Form is a document used to request distributions or withdrawals from a Transamerica account, often related to retirement plans or other investment products.

Who is required to file Transamerica Distribution Request Form?

Individuals who wish to withdraw funds from their Transamerica investment accounts or retirement plans must file the Transamerica Distribution Request Form.

How to fill out Transamerica Distribution Request Form?

To fill out the Transamerica Distribution Request Form, individuals must provide personal details, account information, the type of distribution requested, and any required signatures or verification information.

What is the purpose of Transamerica Distribution Request Form?

The purpose of the Transamerica Distribution Request Form is to formally request and document the withdrawal of funds from a Transamerica account, ensuring compliance with policies and regulations.

What information must be reported on Transamerica Distribution Request Form?

The form typically requires personal identification information, account number, type of distribution (such as lump sum or periodic payments), and any tax-related details.

Fill out your transamerica withdrawal form 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transamerica 401k Distribution Form is not the form you're looking for?Search for another form here.

Keywords relevant to transamerica withdrawal form pdf

Related to transamerica withdrawal form ira

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.