Canada 3317E 2013 free printable template

Show details

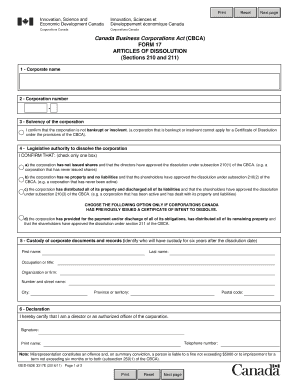

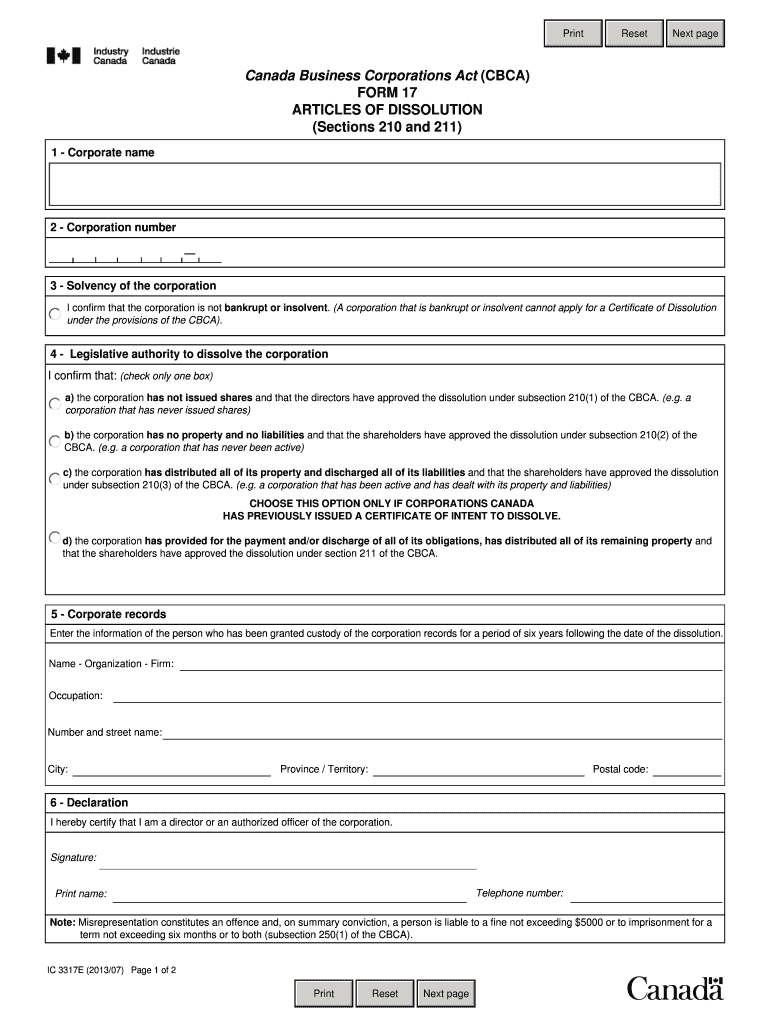

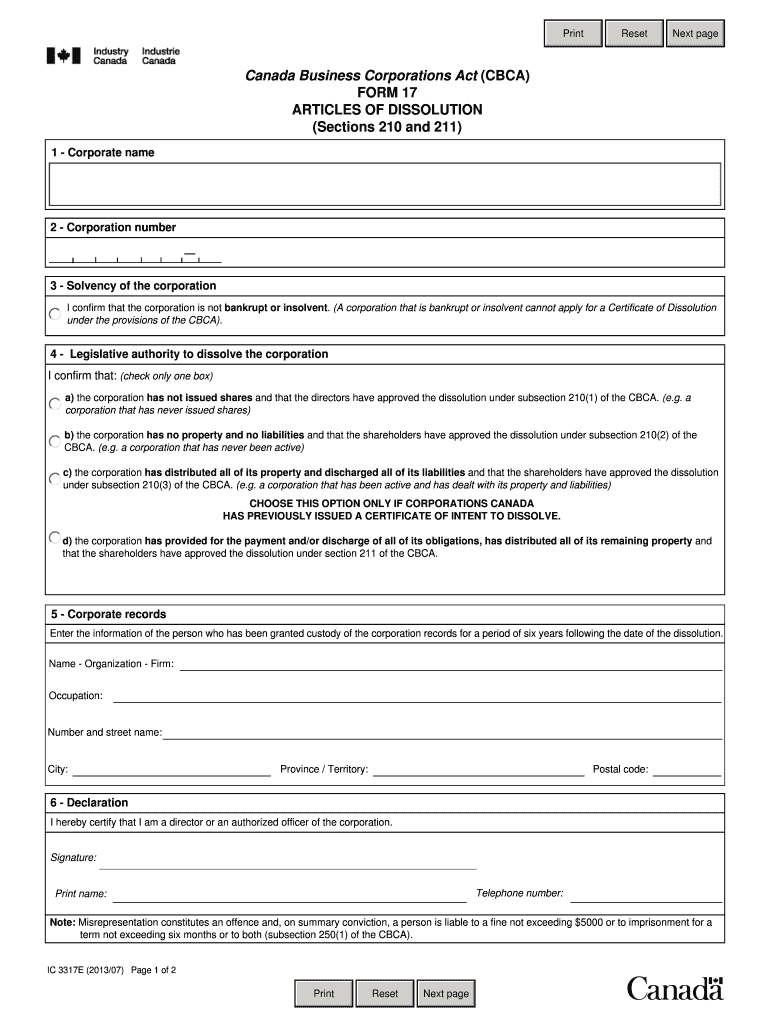

Print Reset Next page Canada Business Corporations Act (CBC) FORM 17 ARTICLES OF DISSOLUTION (Sections 210 and 211) 1 Corporate name — Corporation number 3 Solvency of the corporation I confirm

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada 3317E

Edit your Canada 3317E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 3317E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada 3317E online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada 3317E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 3317E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 3317E

How to fill out Canada 3317E

01

Begin by downloading Canada 3317E form from the official website.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated fields, including your name, address, and contact information.

04

Provide detailed information about your income sources as required.

05

List any deductions or credits that you are eligible for.

06

Review your completed form for accuracy.

07

Submit the form by mail or electronically as indicated in the instructions.

Who needs Canada 3317E?

01

Individuals who are applying for certain tax credits.

02

Taxpayers who need to report income that is relevant to specific benefit programs in Canada.

03

Anyone required to provide additional information to the Canada Revenue Agency (CRA) related to their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

How do I dissolve a CRA corporation in Canada?

When you want to permanently dissolve your corporation, you should send an application for dissolution to the government body that governs the affairs of your corporation. You should also file a final return and send us a copy of the articles of dissolution.

How do I file an article of dissolution in Canada?

To obtain a certificate of dissolution, fill and submit online your articles of dissolution. To obtain a certificate of intent to dissolve, complete and sign Form 19 – Statement of Intent to Dissolve (see Federal corporation forms) and submit it to Corporations Canada.

Can a business still run if its dissolved?

When administrative dissolution occurs, a business can still operate, have bank accounts, and accept payments. However, a creditor cannot go after any possible assets of that entity.

What happens to assets of a dissolved company Canada?

A dissolved corporation no longer legally exists. When an Ontario corporation is dissolved but still owns things (assets), those assets become property of Ontario.

What happens when a company is dissolved Canada?

Once a corporation is dissolved, it no longer has any legal existence, and its assets are distributed to its shareholders. There are two main ways to dissolve a corporation in Ontario, Canada: By filing articles of dissolution with the Corporations Canada; or.

What is the Article of dissolution in Ontario?

Articles of Dissolution under the Business Corporations Act (BCA) must be completed and filed by an Ontario business corporation to voluntarily dissolve the corporation. If the corporation has commenced business in Ontario, the dissolution must be authorized by the shareholders of the corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Canada 3317E electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Canada 3317E in minutes.

How do I fill out the Canada 3317E form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Canada 3317E and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out Canada 3317E on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your Canada 3317E. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is Canada 3317E?

Canada 3317E is a tax form used by Canadian taxpayers to report certain income, deductions, and credits to the Canada Revenue Agency (CRA).

Who is required to file Canada 3317E?

Individuals who have specific types of income, such as self-employment or business income, and meet certain income thresholds are required to file Canada 3317E.

How to fill out Canada 3317E?

To fill out Canada 3317E, gather all relevant financial documents, follow the form's instructions, and accurately report all required financial information. It's recommended to consult a tax professional if needed.

What is the purpose of Canada 3317E?

The purpose of Canada 3317E is to ensure that the CRA collects accurate information about taxpayers' income and deductions for proper tax assessment.

What information must be reported on Canada 3317E?

The information that must be reported on Canada 3317E includes income details, business expenses, deductions, and any relevant tax credits that apply.

Fill out your Canada 3317E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 3317e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.