Get the free Electronic Paystub Exemption Form - University of North Dakota - und

Show details

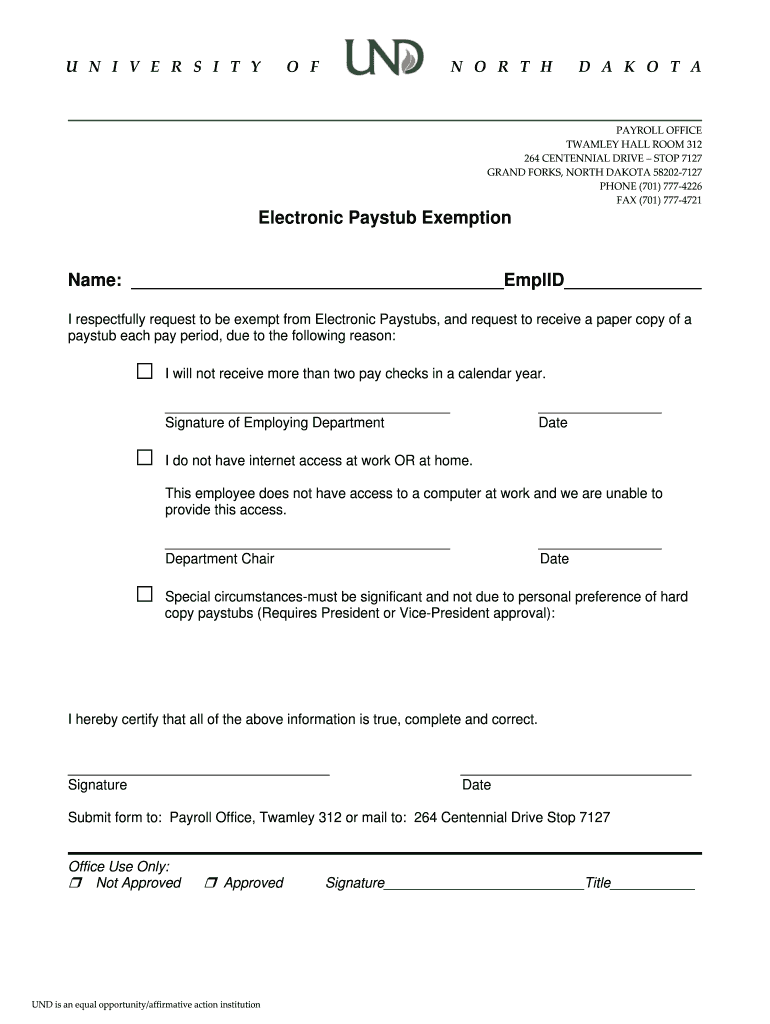

U N I V E R S I T Y O F N O R T H D A K O T A PAYROLL OFFICE TALLEY HALL ROOM 312 264 CENTENNIAL DRIVE STOP 7127 GRAND FORKS, NORTH DAKOTA 58202?7127 PHONE (701) 777?4226 FAX (701) 777?4721 Electronic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic paystub exemption form

Edit your electronic paystub exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic paystub exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit electronic paystub exemption form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit electronic paystub exemption form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electronic paystub exemption form

How to Fill Out Electronic Paystub Exemption Form:

01

Gather necessary information: Before starting to fill out the electronic paystub exemption form, make sure you have all the required information at hand. This includes your personal details, such as your name, address, Social Security number, and contact information. Additionally, you may need information about your employer, such as their name, address, and contact information.

02

Download the form: Find the electronic paystub exemption form on the official website of the relevant authority. Usually, it can be downloaded as a PDF file.

03

Personal information: Begin filling out the form by entering your personal information accurately and legibly. Double-check that all the information is correct to avoid any issues in the future.

04

Reason for exemption: In this section, you will need to state the reason why you are seeking exemption from electronic paystubs. Common reasons include not having access to a suitable device for electronic paystub viewing or not having a reliable internet connection. Provide a clear and concise explanation to support your request for exemption.

05

Supporting documentation: Depending on the requirements set forth by your employer or the relevant authority, you may be asked to submit supporting documentation along with the form. This could include evidence of not having access to electronic devices or proof of an unreliable internet connection. Attach these documents, if applicable, ensuring they are valid and up to date.

06

Review and submit: Once you have completed filling out the form, carefully review all the information provided to ensure accuracy. Any errors or missing details could delay the processing of your request. When you are satisfied that everything is correct, save a copy of the form for your records and submit it according to the specified instructions. This may involve mailing the form to the appropriate address or submitting it electronically through a designated portal.

Who needs electronic paystub exemption form?

01

Employees without access to electronic devices: Individuals who do not have access to suitable electronic devices, such as computers, smartphones, or tablets, may need to request an exemption from electronic paystubs. This could be due to financial constraints or personal circumstances.

02

Employees with unreliable internet connection: Workers who reside in areas with limited or unreliable internet connectivity may also require an exemption from electronic paystubs. In such cases, it may be challenging for them to consistently access and view their pay information online.

03

Individuals with disabilities: Some individuals with disabilities may face challenges in accessing or using electronic devices, making it necessary for them to request an exemption. This could include individuals with visual impairments or conditions that affect their ability to interact with digital interfaces.

Note: The eligibility criteria for an electronic paystub exemption may vary depending on the specific regulations set by the employer or governing authority. It is important to consult the official guidelines or seek clarification from your employer or HR department to determine if you qualify for an exemption.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my electronic paystub exemption form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your electronic paystub exemption form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute electronic paystub exemption form online?

pdfFiller makes it easy to finish and sign electronic paystub exemption form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my electronic paystub exemption form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your electronic paystub exemption form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is electronic paystub exemption form?

The electronic paystub exemption form is a form that allows individuals to opt out of receiving their pay stubs electronically.

Who is required to file electronic paystub exemption form?

Employees who prefer to receive their pay stubs in paper format are required to file the electronic paystub exemption form.

How to fill out electronic paystub exemption form?

To fill out the electronic paystub exemption form, individuals can usually access the form through their employer's HR or payroll department and provide their personal information and preference for receiving pay stubs.

What is the purpose of electronic paystub exemption form?

The purpose of the electronic paystub exemption form is to allow individuals to choose to receive their pay stubs in paper format rather than electronically.

What information must be reported on electronic paystub exemption form?

The information typically required on the electronic paystub exemption form includes personal details such as name, employee ID, and contact information, as well as the preference for receiving pay stubs.

Fill out your electronic paystub exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Paystub Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.