Get the free Roth IRA Account Transfer Form - Companies of the MP 63 Fund

Show details

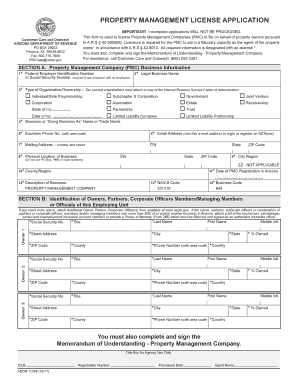

Request for Transfer or Conversion to a Roth IRA 3 (Complete only for a conversion from a traditional IRA) I authorize and direct you, the Present Custodian/Trustee of my traditional IRA, to convert

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira account transfer

Edit your roth ira account transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira account transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira account transfer online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roth ira account transfer. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira account transfer

How to fill out a Roth IRA account transfer:

01

Gather the necessary documents: Before beginning the transfer process, gather all the required paperwork, such as your current Roth IRA account statement, beneficiary information, and identification documents.

02

Choose the receiving institution: Decide on the financial institution where you want to transfer your Roth IRA account. Research different institutions to ensure they offer the desired investment options, customer service, and fees that align with your financial goals.

03

Contact the receiving institution: Reach out to the chosen receiving institution to inquire about their specific requirements and procedures for transferring a Roth IRA account. They will provide you with the necessary forms, instructions, and any additional information needed.

04

Fill out the transfer request form: Fill out the transfer request form provided by the receiving institution. Provide accurate and complete information about your current Roth IRA account, including the account number, balance, and account holder's details. Follow the instructions carefully to avoid any errors.

05

Specify the transfer method: Decide how you want the transfer to be made – you can choose either a direct transfer or a rollover. In a direct transfer, the funds move directly from one financial institution to another without you ever having possession of the money. A rollover, on the other hand, involves receiving the funds and then depositing them into your new Roth IRA account within a specific time frame.

06

Review and submit the form: Double-check the completed transfer request form for accuracy and make any necessary corrections. Ensure you have signed and dated the form where required. Submit the form electronically or via mail, following the instructions provided by the receiving institution.

07

Follow up with the transfer: After submitting the transfer request form, follow up with the receiving institution to confirm receipt and to track the progress of the transfer. They will provide updates and notify you when the transfer process is completed.

Who needs a Roth IRA account transfer?

01

Individuals looking for better investment options: If your current Roth IRA account does not offer the investment options you desire or if you want to take advantage of different investment strategies and opportunities, a transfer can allow you to move your funds to a financial institution that better suits your needs.

02

Relocating or changing financial institutions: If you are moving or changing banks, it might be more convenient to transfer your Roth IRA account to a new institution. This allows you to consolidate your financial accounts in one place and simplifies managing your investments.

03

Dissatisfied with current account services or fees: If you are unhappy with the services provided by your current Roth IRA account provider, such as customer support or access to online tools, or if you find the fees to be excessively high, a transfer offers the opportunity to switch to a different institution that meets your requirements.

04

Life events such as divorce or inheritance: Significant life events, like divorce or receiving an inheritance that includes a Roth IRA account, might necessitate a transfer to reposition the funds or consolidate them with your existing retirement savings.

Remember, it is always recommended to consult with a financial advisor or tax professional before making any decisions related to your Roth IRA account transfer to ensure you fully understand the implications and potential tax consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find roth ira account transfer?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the roth ira account transfer in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in roth ira account transfer?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your roth ira account transfer to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit roth ira account transfer on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share roth ira account transfer from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your roth ira account transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Account Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.