Get the free BEstimated Tax Vouchersb - City of Kenton

Show details

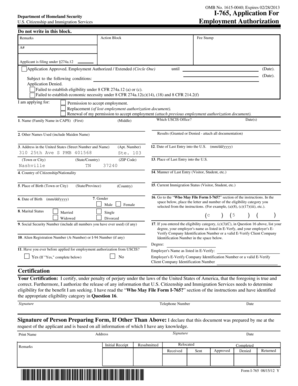

TAX YEAR for office use only FORM XQ1 CITY OF KENTON ESTIMATED TAX PAYMENT PO Box 220 2nd Quarter Due on or before June 30 Kenton, OH 433260220 4196731355 DATE RECEIVED Payment Enclosed $ PAYMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bestimated tax vouchersb

Edit your bestimated tax vouchersb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bestimated tax vouchersb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bestimated tax vouchersb online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bestimated tax vouchersb. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bestimated tax vouchersb

How to fill out estimated tax vouchers:

Gather necessary information:

01

Determine your estimated taxable income for the year.

02

Calculate any tax deductions or credits you anticipate.

03

Determine your estimated tax liability.

Obtain the correct form:

01

The IRS provides Form 1040-ES for individuals or Form 1120-W for businesses.

02

These forms can be downloaded from the IRS website or obtained from a local tax office.

Fill out your personal information:

01

Provide your name, address, and Social Security Number or Employer Identification Number.

02

Ensure accuracy and legibility to avoid any processing issues.

Estimate your income:

01

Enter your estimated income from different sources (e.g., wages, self-employment, investments).

02

Consider any changes in income compared to the previous year.

Calculate exemptions and deductions:

01

Determine your filing status and claim the appropriate exemptions.

02

Calculate any deductions or credits you expect to qualify for.

Determine your estimated tax liability:

01

Use the IRS tax tables or tax calculation worksheets provided with the form to calculate your tax liability.

02

Consider any alternative minimum tax or self-employment tax requirements.

Calculate your estimated tax payments:

01

Subtract any withholding tax or tax credits you expect to receive.

02

Divide the remaining tax liability by the number of payment periods for the year (usually four).

Fill out the payment vouchers:

01

Transfer the calculated payment amounts to the payment vouchers included with the form.

02

Ensure accuracy and legibility to avoid any issues with payment processing.

Submit the vouchers and payments:

01

Mail the completed vouchers and payments to the address provided on the form.

02

Keep copies of the vouchers and payment receipts for your records.

Who needs estimated tax vouchers:

01

Self-employed individuals: Those who receive income but do not have taxes withheld from their payments.

02

Independent contractors: Individuals who receive income from contractual work or freelance jobs.

03

Salaried employees with additional income: Those who have a primary source of income but also earn money from side jobs, investments, or business activities.

04

Individuals with significant investment income: Those who earn income from stocks, dividends, rental properties, or other investments.

05

Business owners: Those who operate sole proprietorships, partnerships, corporations, or other types of businesses.

Note: It is always recommended to consult with a tax professional or use tax software to ensure accuracy when filling out estimated tax vouchers and making payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bestimated tax vouchersb to be eSigned by others?

To distribute your bestimated tax vouchersb, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find bestimated tax vouchersb?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the bestimated tax vouchersb in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in bestimated tax vouchersb?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your bestimated tax vouchersb to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is bestimated tax vouchersb?

Estimated tax vouchers are used to pay income tax on income that is not subject to withholding, such as self-employment income or interest and dividends.

Who is required to file bestimated tax vouchersb?

Individuals, sole proprietors, partners, and S corporation shareholders are required to file estimated tax vouchers if they expect to owe at least $1,000 in taxes after subtracting withholding and credits.

How to fill out bestimated tax vouchersb?

Estimated tax vouchers can be filled out by providing estimates of income, deductions, and credits for the tax year. The vouchers can be filed quarterly using Form 1040-ES.

What is the purpose of bestimated tax vouchersb?

The purpose of estimated tax vouchers is to ensure that taxpayers pay their tax liabilities throughout the year, rather than waiting until the end of the year to settle their tax obligations.

What information must be reported on bestimated tax vouchersb?

The estimated tax vouchers require taxpayers to report their estimated income, deductions, credits, and tax liability for the year.

Fill out your bestimated tax vouchersb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bestimated Tax Vouchersb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.