US and Canada F-30 2016 free printable template

Show details

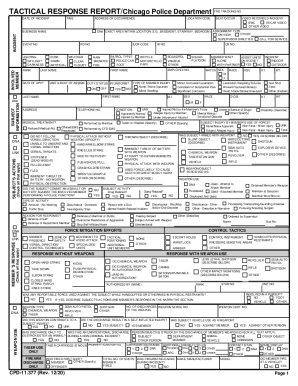

Handbook contents are available on the Group Life page at www. aa.org. FOR G.S.O. RECORDS DEPT. USE ONLY DELEGATE AREA NUMBER F-30 - Revised 8 -16 DISTRICT NUMBER GROUP SERVICE NUMBER ASSIGN BY G.S.O. A LCOHOLICS A NONYMOUS NEW GROUP FORM U.S. and Canada Our membership ought to include all who suffer from alcoholism. Hence we may refuse none who wish to recover. Nor ought A. A. Membership ever depend upon money or conformity. Any two or three alcoholics gathered together for sobriety may call...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign US and Canada F-30

Edit your US and Canada F-30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your US and Canada F-30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit US and Canada F-30 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit US and Canada F-30. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

US and Canada F-30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out US and Canada F-30

How to fill out US and Canada F-30

01

Obtain the F-30 form from the official IRS website or relevant Canadian authority.

02

Carefully read the instructions provided with the F-30 form.

03

Fill in your personal information, including your name, address, and taxpayer identification number.

04

Indicate your filing status and provide any required financial information accurately.

05

Ensure you include all necessary supplementary documentation as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting it.

Who needs US and Canada F-30?

01

Individuals and businesses who have cross-border tax obligations between the US and Canada.

02

Residents of the US and Canada who have income, assets, or investments in the other country.

03

Taxpayers who need to report specific information to comply with the tax regulations of both countries.

Fill

form

: Try Risk Free

People Also Ask about

What is the group conscience format AA?

The group conscience is the collective conscience of the group membership and this represents substantial unanimity on one issue before definitive action is taken. This is achieved by the group members through the sharing of full information, individual points of view, and the practice of A.A.'s principles.

How do I run an AA Group conscience meeting?

Suggested Format for a Group Conscience Meeting 1.Introduction. Serenity Prayer. Reading of the Steps, Traditions, and Concepts if appropriate. Establishing Ground Rules. Minutes from Previous Meeting. Setting Up the Agenda. Making Decisions. Closing.

How do I set up an AA?

Group membership requires no formal application. As stated in Tradition Three, “The only requirement for A.A. membership is a desire to stop drinking." Just as we are members of A.A. if we say we are, so are we members of a group if we say we are.

How do you run a group conscience in AA?

Suggested Format for a Group Conscience Meeting 1.Introduction. Serenity Prayer. Reading of the Steps, Traditions, and Concepts if appropriate. Establishing Ground Rules. Minutes from Previous Meeting. Setting Up the Agenda. Making Decisions. Closing.

Can you join AA online?

You can attend AA meetings in person if you prefer face-to-face interaction or you can join the meetings online. This article provides an overview of AA, describes what to expect at an online AA meeting, the types of AA meetings, and the effectiveness of online AA meetings.

What is the group conscience in AA?

The group conscience is the collective conscience of the group membership and this represents substantial unanimity on one issue before definitive action is taken. This is achieved by the group members through the sharing of full information, individual points of view, and the practice of A.A.'s principles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in US and Canada F-30?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your US and Canada F-30 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in US and Canada F-30 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing US and Canada F-30 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the US and Canada F-30 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your US and Canada F-30 in minutes.

What is US and Canada F-30?

The US and Canada F-30 is a tax form used by individuals and entities to report certain types of income, typically related to cross-border transactions and tax obligations between the United States and Canada.

Who is required to file US and Canada F-30?

Individuals and entities that have cross-border income or transactions between the US and Canada, and are subject to tax reporting requirements in either country, are required to file the F-30 form.

How to fill out US and Canada F-30?

To fill out the US and Canada F-30, one must gather necessary financial information, accurately complete the form following the provided instructions, and submit it by the specified deadline, ensuring that all income and deductions are reported correctly.

What is the purpose of US and Canada F-30?

The purpose of the US and Canada F-30 is to ensure compliance with tax laws in both countries, enabling the authorities to monitor and collect taxes on income earned across borders.

What information must be reported on US and Canada F-30?

The information that must be reported on the US and Canada F-30 includes details of income earned, deductions claimed, relevant identification numbers, and specifics of any cross-border financial transactions.

Fill out your US and Canada F-30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

US And Canada F-30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.