Get the free 401k Loan Application - Roebbelen Benefits

Show details

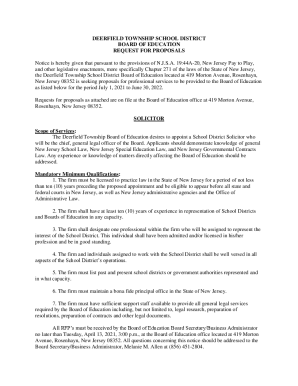

LOAN AUTHORIZATION FORM Goebbels Management Inc., 401(k) Profit Sharing Plan Name: Plan #: 201166 SS#: Address: City: State: Zip: I request to borrow the following amount from my account balance:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k loan application

Edit your 401k loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k loan application online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 401k loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k loan application

How to fill out a 401k loan application:

01

Provide personal information: Start by filling out your personal information such as your full name, address, social security number, and contact information. This is necessary for the loan application process.

02

Specify the loan amount: Indicate the amount of money you would like to borrow from your 401k account. Make sure to consider any restrictions or limitations set by your employer or the plan administrator regarding the maximum loan amount.

03

State the purpose of the loan: Explain the purpose of the loan, whether it is for home improvement, education, medical expenses, or any other qualifying reasons allowed by your 401k plan. Some plans may require you to provide additional documentation supporting your loan purpose.

04

Select a repayment term: Choose the desired repayment term for your loan. This can typically range from 1 to 5 years, but it may vary depending on your plan's guidelines. Keep in mind that shorter repayment terms often result in higher monthly payments, while longer terms may incur more interest charges.

05

Review the interest rate and fees: Familiarize yourself with the interest rate and any applicable fees associated with the 401k loan. These costs can vary between plans, so it's important to understand the financial implications before proceeding. It's worth noting that the interest you pay on a 401k loan is typically paid back to your own retirement account.

06

Sign and date the application: Once you have completed all the necessary sections of the loan application, carefully read through the terms and conditions provided. If you agree to the terms, sign and date the application document accordingly.

Who needs a 401k loan application:

01

Employees facing financial need: Individuals who are experiencing financial hardships or unexpected expenses may opt for a 401k loan as a way to access their retirement savings temporarily. This can be a solution to avoid high-interest loans or credit card debt.

02

Individuals with a well-funded 401k: For those who have built a substantial balance in their 401k account, a loan can be an attractive option since the money is borrowed from oneself rather than external lenders. This approach may be preferred when compared to borrowing from traditional lenders with potentially higher interest rates.

03

Individuals who meet their plan requirements: Each 401k plan may have specific guidelines regarding loan eligibility and requirements. If an individual meets the criteria set by their plan administrator, they may proceed with applying for a 401k loan.

It's important to note that borrowing from your 401k should be carefully considered, as it can affect your retirement savings and there may be tax implications. It's advisable to consult with a financial advisor or plan administrator to fully understand the impact of taking a 401k loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 401k loan application to be eSigned by others?

To distribute your 401k loan application, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find 401k loan application?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 401k loan application in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit 401k loan application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 401k loan application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is 401k loan application?

A 401k loan application is a request to borrow money from a 401k retirement account.

Who is required to file 401k loan application?

Any individual who has a 401k retirement account and wishes to borrow money from it is required to file a 401k loan application.

How to fill out 401k loan application?

To fill out a 401k loan application, an individual must contact their plan administrator and follow the specific instructions provided by the 401k provider.

What is the purpose of 401k loan application?

The purpose of a 401k loan application is to access funds from a 401k retirement account for personal or financial needs.

What information must be reported on 401k loan application?

The information required on a 401k loan application typically includes personal identification details, loan amount requested, repayment terms, and any other relevant financial information.

Fill out your 401k loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.