Get the free r d tax credit questionnaire

Show details

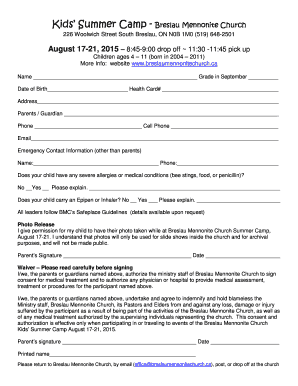

R D Tax Credits Questionnaire R D by Industry sector Name Company Group University Products Processes Plans Indicate sources of other data/information Address Country Post Code Yes No Do you build Models/Prototypes Telephone Fax Do you carry out testing analysis and research Do you write and/or adapt software Email Do you use subcontractors Website Do you use Consultants Do you use Test Facilities Do you use Agency Workers Role/Position Do you use Graduates/PhDs Do you use...

We are not affiliated with any brand or entity on this form

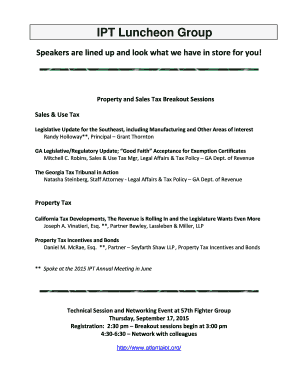

Get, Create, Make and Sign r d tax credit

Edit your r d tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r d tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit r d tax credit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit r d tax credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r d tax credit

How to fill out r d tax credit

01

Step 1: Gather all relevant information about your research and development activities, including project details, expenses, and supporting documents.

02

Step 2: Determine if your company is eligible for the R&D tax credit. Typically, companies engaged in innovative activities, such as product development, process improvement, or software engineering, are eligible.

03

Step 3: Consult with a tax professional or advisor who is well-versed in R&D tax credits to ensure you understand the requirements and to maximize your potential benefits.

04

Step 4: Fill out the necessary forms, such as IRS Form 6765. Provide accurate and detailed information about your R&D activities, expenses, and any other required documentation.

05

Step 5: Submit your completed forms and supporting documents to the appropriate tax authority, usually the Internal Revenue Service (IRS), along with your regular tax filing or as specified by your jurisdiction.

06

Step 6: Monitor the progress of your tax credit claim and be prepared to address any follow-up questions or requests for additional information from the tax authority.

07

Step 7: If approved, the R&D tax credit will be applied to your tax liability, reducing the amount of taxes you owe or providing a tax refund.

Who needs r d tax credit?

01

Companies engaged in research and development activities are the primary beneficiaries of the R&D tax credit.

02

Startups and small businesses investing in innovation and technology often qualify for R&D tax credits that can help offset their research expenses and improve their cash flow.

03

Established businesses that actively engage in developing new products, processes, or software, or those seeking to improve existing ones, can benefit from R&D tax credits to reduce their tax liability and reinvest in further research and development.

04

Various industries, including technology, manufacturing, pharmaceuticals, aerospace, and software development, commonly benefit from R&D tax credits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send r d tax credit for eSignature?

Once you are ready to share your r d tax credit, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete r d tax credit online?

Easy online r d tax credit completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out r d tax credit on an Android device?

Use the pdfFiller app for Android to finish your r d tax credit. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is r d tax credit?

Research and Development (R&D) tax credit is a tax incentive offered by governments to encourage companies to invest in research and development activities.

Who is required to file r d tax credit?

Companies that engage in qualified research activities and meet certain criteria as defined by tax laws are required to file for R&D tax credit.

How to fill out r d tax credit?

To fill out R&D tax credit, companies need to document all qualified research activities, expenses incurred, and other relevant information as required by tax regulations.

What is the purpose of r d tax credit?

The purpose of R&D tax credit is to incentivize companies to invest in innovation and technological advancement, leading to economic growth and competitiveness.

What information must be reported on r d tax credit?

Companies must report qualified research activities, expenses related to research and development, and other relevant financial and operational data on R&D tax credit.

Fill out your r d tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R D Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.