Get the free 2017 Health Care FSA and or Dependent Care FSA Enrollment Form

Show details

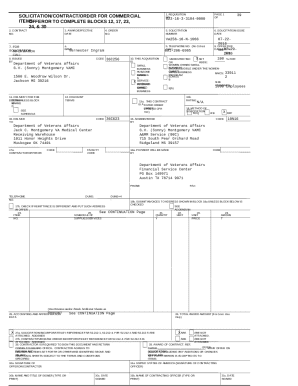

For information on contribution limits see hr. umich. edu/fsa-eligibility-enrollment Is your spouse also employed by U-M If yes spouse s name Spouse s SSN or UMID 3. Umich. edu. Only expenses incurred on or after your effective date through March 15 2018 are reimbursable. 7. A claim form for reimbursement from a Health Care Flexible Spending Account must be accompanied by an itemized receipt and/or an Explanation of Benefits EOB form. An EOB form is provided by the health insurance company...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2017 health care fsa

Edit your 2017 health care fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2017 health care fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2017 health care fsa online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2017 health care fsa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2017 health care fsa

How to fill out 2017 health care fsa

01

Step 1: Gather all necessary documents such as pay stubs, medical receipts, and insurance information.

02

Step 2: Determine the amount you want to contribute to your 2017 health care FSA. This can be done through careful budgeting and estimating your future medical expenses.

03

Step 3: Enroll in your employer's FSA program if you haven't already done so. This typically involves contacting your HR department and filling out the necessary enrollment forms.

04

Step 4: Familiarize yourself with the eligible expenses that can be paid for using your health care FSA. These expenses usually include medical and dental care, prescription medications, and certain over-the-counter items.

05

Step 5: Keep track of your expenses throughout the year by saving receipts and invoices. This will be important for reimbursement purposes.

06

Step 6: Submit reimbursement requests to your FSA administrator. This can usually be done online or by filling out a reimbursement form and providing the necessary documentation.

07

Step 7: Monitor your FSA balance and spending to ensure you don't exceed the allowed amount and to maximize your benefits before the end of the plan year.

08

Step 8: Remember to use up your FSA funds before the end of the plan year, as any remaining balance may be forfeited.

09

Step 9: Consult with a tax professional for any specific questions or concerns regarding your health care FSA.

Who needs 2017 health care fsa?

01

Employees who anticipate having significant out-of-pocket medical expenses in 2017 can benefit from having a health care FSA.

02

Individuals who have ongoing medical conditions or require regular prescription medications may find a health care FSA helpful in managing their expenses.

03

Families with dependents who have medical needs can also benefit from a health care FSA to cover their eligible expenses.

04

Self-employed individuals who are not covered by an employer-sponsored health care plan can use a health care FSA to offset their medical costs.

05

It is important to check with your employer or HR department to determine if you are eligible and if participating in a health care FSA aligns with your specific financial situation and medical needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2017 health care fsa from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 2017 health care fsa into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the 2017 health care fsa electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 2017 health care fsa in minutes.

How do I fill out 2017 health care fsa using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2017 health care fsa and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is health care fsa and?

A Healthcare Flexible Spending Account (FSA) is a pre-tax benefit account that can be used to pay for eligible medical, dental, and vision care expenses that are not covered by your health insurance plan.

Who is required to file health care fsa and?

Employees who want to use pre-tax dollars to pay for qualifying medical expenses are required to enroll in a health care FSA.

How to fill out health care fsa and?

To enroll in a health care FSA, employees must fill out the necessary enrollment forms provided by their employer during the open enrollment period.

What is the purpose of health care fsa and?

The purpose of a health care FSA is to help individuals save money on out-of-pocket medical expenses by allowing them to use pre-tax dollars to pay for these expenses.

What information must be reported on health care fsa and?

Information such as the amount of money contributed to the FSA, qualifying medical expenses incurred, and the account balance must be reported on a health care FSA.

Fill out your 2017 health care fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2017 Health Care Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.