Get the free (990-l5F Return of 4947(a)(1) Nonexempt Charitable Trust - irs990 charityblossom

Show details

Enter -0-i 11251027 794015 65-0965991 2009. 04050 The Michael M Eve K Ossof 65-09651 The Michael M Eve K Ossoff Foundation HWQWPFQWQ Martha O. See the Part VI instructions. 923521 oz-oz-io Form 990-PF 2009 Fofmeeo-Pri20U9i s Martha o. Blaxall and Robert H. Return See The Carlisle 6935 Carlisle Court C142 City town or post office state and ZIP code. For a foreign address see instructions. Blaxall Urustee 3960 Birdsville Road Davidsonville MD 21035 10. 00 0. 00Robert H. Ossoff 2014 Farnsworth...

We are not affiliated with any brand or entity on this form

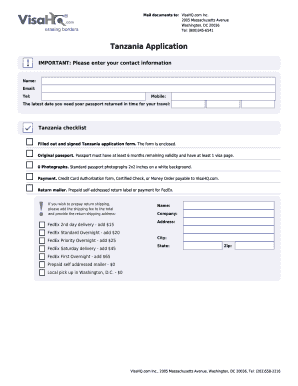

Get, Create, Make and Sign 990-l5f return of 4947a1

Edit your 990-l5f return of 4947a1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 990-l5f return of 4947a1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 990-l5f return of 4947a1 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 990-l5f return of 4947a1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 990-l5f return of 4947a1

How to fill out 990-l5f return of 4947a1

01

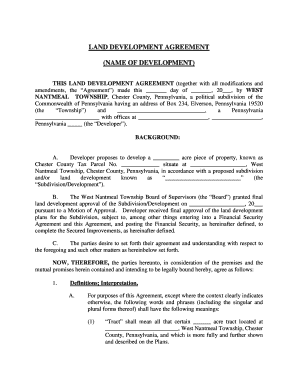

Step 1: Gather all the necessary information and documents required to fill out the 990-l5f return of 4947a1. This would include details about the organization, its activities, financial information, and any other relevant data.

02

Step 2: Complete Part I of Form 990-l5f, which involves providing basic information about the organization, such as its name, address, EIN, and accounting period.

03

Step 3: Proceed to Part II of the form and answer the specific questions related to the organization's activities, including descriptions of its program services, grants, contributions, investments, etc.

04

Step 4: Fill out Part III of the form, which requires detailed financial information such as revenue, expenses, assets, and liabilities. It is important to ensure accuracy and provide supporting documentation where required.

05

Step 5: Complete any additional schedules or attachments as necessary. These may include Schedule A (Public Charity Status and Public Support), Schedule B (Schedule of Contributors), Schedule C (Political Campaign and Lobbying Activities), and others.

06

Step 6: Review the completed form for any errors or missing information, and make necessary corrections.

07

Step 7: Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

08

Step 8: File the completed 990-l5f return of 4947a1 with the appropriate tax authority by the designated deadline. This may vary depending on the organization's accounting period.

Who needs 990-l5f return of 4947a1?

01

The 990-l5f return of 4947a1 is required to be filed by private foundations exempt from federal income tax under section 4947(a)(1) of the Internal Revenue Code. These organizations are generally created for charitable or educational purposes and do not qualify as public charities.

02

It is important for private foundations to file this return to provide transparency and accountability for their financial activities and ensure compliance with tax regulations.

03

Additionally, the information disclosed in the 990-l5f return is used by the IRS and other regulatory bodies to monitor and assess the activities of private foundations, including their eligibility for tax-exempt status and the proper use of funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 990-l5f return of 4947a1 for eSignature?

990-l5f return of 4947a1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the 990-l5f return of 4947a1 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 990-l5f return of 4947a1 and you'll be done in minutes.

How do I edit 990-l5f return of 4947a1 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 990-l5f return of 4947a1 right away.

What is 990-l5f return of 4947a1?

The 990-l5f return of 4947a1 is a tax return specifically for certain charitable trusts and private foundations under section 4947(a)(1) of the Internal Revenue Code.

Who is required to file 990-l5f return of 4947a1?

Charitable trusts and private foundations classified under section 4947(a)(1) of the Internal Revenue Code are required to file the 990-l5f return.

How to fill out 990-l5f return of 4947a1?

The 990-l5f return can be filled out using the official form provided by the IRS, which includes sections for reporting financial information, activities, and compliance with tax laws.

What is the purpose of 990-l5f return of 4947a1?

The purpose of the 990-l5f return is to report information about the activities, finances, and compliance of charitable trusts and private foundations in accordance with tax laws.

What information must be reported on 990-l5f return of 4947a1?

Information such as financial data, grants and contributions made, expenditures, activities, and compliance with tax regulations must be reported on the 990-l5f return.

Fill out your 990-l5f return of 4947a1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

990-l5f Return Of 4947A1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.