Get the free Section Return - irs990 charityblossom

Show details

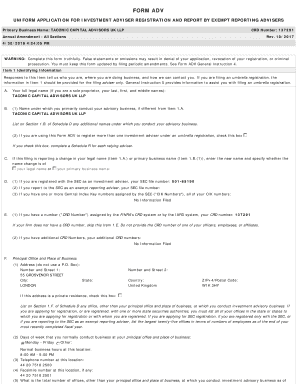

Form 990-PF 2009 16061111 752973 BNEI-MORDECH 2009. 040l0 BNEI MORDECHAI CHARITABLE F BNEI-MO1 r BNEI MORDECHAI CHARITABLE FOUNDATION rormoeo-Prmogef C/0 MARTIN REISMAN 81-0587770 Paoe2 Attached schedules and amounts ln the mscnpuon Begm mg 01 V937 End 0151937 man Shets B ce e ColumnShouldU 0 0 Va 0 V a Book Value b Book Value c Fair Market Value 80 237. IN IW Payroll Il Noncash lj Complete Part ll If there ls a noncash contribution. JACOB DWOIRA REISMAN FAMILY 2 IRREVOCABLE TRUST 13 500....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section return - irs990

Edit your section return - irs990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section return - irs990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section return - irs990 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section return - irs990. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section return - irs990

How to fill out section return

01

Read and understand the instructions provided for filling out the section return.

02

Gather all the relevant information and documents required for the section return.

03

Start by entering your personal details, such as your name, address, and contact information.

04

Follow the prompts and enter the necessary financial information, such as income, expenses, and deductions.

05

Double-check all the entered information for accuracy and completeness.

06

Submit the completed section return form by the designated deadline.

07

Keep a copy of the section return for your records.

Who needs section return?

01

Individuals who have earned income from various sources may need to fill out section return.

02

Business owners and self-employed individuals often need to include section return as part of their tax reporting.

03

Anyone who needs to claim deductions or credits on their tax return will need to fill out section return.

04

Those who have received income from sources that require reporting, such as rental income or investment gains, may be required to fill out section return.

05

Anyone who wants to ensure compliance with tax laws and avoid penalties should fill out section return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find section return - irs990?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific section return - irs990 and other forms. Find the template you need and change it using powerful tools.

How do I edit section return - irs990 online?

The editing procedure is simple with pdfFiller. Open your section return - irs990 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit section return - irs990 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign section return - irs990 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is section return?

Section return refers to the portion of a tax form that reports specific information related to a particular section of tax law or regulation.

Who is required to file section return?

Individuals or entities who meet the criteria outlined in the specific section of tax law or regulation are required to file a section return.

How to fill out section return?

To fill out a section return, individuals or entities must follow the instructions provided in the tax form, ensuring that all the required information is accurately reported.

What is the purpose of section return?

The purpose of a section return is to ensure compliance with the specific tax law or regulation referenced in that section, and to enable accurate assessment and collection of taxes.

What information must be reported on section return?

The specific information that must be reported on a section return will vary depending on the requirements outlined in the corresponding tax law or regulation.

Fill out your section return - irs990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section Return - irs990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.