Get the free Form Under section 501(c), 527, or 4947(a)(1) ofthe internal Revenue Code - irs990 c...

Show details

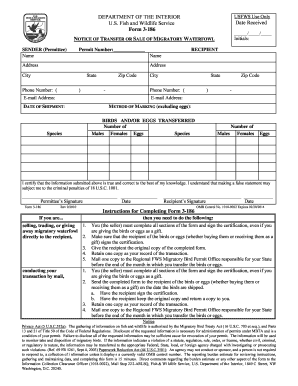

Ax - 45 Typ or print and title Q preparers 7 ar Setmfeck Identifying Number Paid signature IV Y M41 ifPreparefs I emlsloyed lj See Instructions Prepareris Firms name -E-E I d F -. P LXiYes LJNo address. andIP 4 622 TIRD f- E NEW YORK NY7 100 Phone no b212 819-sooo aE1o311ooo FORM 990EZ PART I - OTHER EXPENSES SUPPLIES 10 699. H use omy if self-employ AND - 7 Ein v13-2891505 Y P. c. May the IRS discuss this return with the - par shown5above7 See instructions. 50 521. aE100a1000 I 97704G 7601...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form under section 501c

Edit your form under section 501c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form under section 501c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form under section 501c online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form under section 501c. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form under section 501c

How to fill out form under section 501c

01

Obtain the necessary forms: To fill out the form under section 501c, you need to start by obtaining the appropriate forms from the Internal Revenue Service (IRS) website or by visiting their local office.

02

Read the instructions: Carefully read the instructions provided with the form to ensure you understand the requirements and any supporting documents that may be needed.

03

Provide organizational details: Fill in the required sections of the form with accurate information about your organization, including its name, address, and contact details.

04

State the purpose and activities: Clearly explain the purpose of your organization and provide details about the activities it will undertake to meet its objectives.

05

Provide financial information: Include detailed information about the organization's sources of income and how funds will be used for charitable or social welfare purposes.

06

Attach necessary documents: Attach any required supporting documents, such as financial statements, articles of incorporation, or bylaws, as specified in the instructions.

07

Review and double-check: Carefully review the completed form and all attached documents to ensure accuracy and compliance with IRS regulations.

08

Submit the form: Once you are confident that all information is accurate and complete, submit the form and any required fees to the address specified in the instructions.

09

Follow up: After submission, follow up with the IRS to track the status of your application and address any additional requirements or inquiries they may have.

10

Seek professional advice if needed: If you are unsure about any aspects of filling out the form under section 501c, it is wise to seek professional advice from an attorney or a tax specialist.

Who needs form under section 501c?

01

Nonprofit organizations: Nonprofit organizations, such as charitable, religious, educational, scientific, or literary organizations, often need to file the form under section 501c to obtain tax-exempt status.

02

Social welfare organizations: Social welfare organizations that are engaged in activities to promote the common good and general welfare of a community may also need to file the form under section 501c.

03

Labor and agricultural organizations: Labor unions and agricultural organizations involved in fraternal, educational, or cooperative activities may require the form under section 501c for tax-exempt status.

04

Business leagues and chambers of commerce: Business leagues and chambers of commerce involved in promoting business interests or enhancing the community's economic well-being may need to file the form under section 501c.

05

Veterans organizations: Veterans organizations, including those providing assistance and support to veterans and their families, often need to file the form under section 501c to be recognized as tax-exempt.

06

Other eligible organizations: Various other organizations, such as amateur sports clubs, homeowners associations, and cemetery companies, may also need to file the form under section 501c for tax-exempt status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form under section 501c in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form under section 501c.

How do I edit form under section 501c straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form under section 501c, you can start right away.

How do I complete form under section 501c on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your form under section 501c, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is form under section 501c?

Form under section 501c is Form 990.

Who is required to file form under section 501c?

Nonprofit organizations with tax-exempt status under section 501c of the Internal Revenue Code are required to file Form 990.

How to fill out form under section 501c?

Form 990 can be filled out online or by paper and must include detailed information about the organization's finances, activities, and governance.

What is the purpose of form under section 501c?

The purpose of Form 990 is to provide the public with transparency and accountability regarding the finances and activities of nonprofit organizations.

What information must be reported on form under section 501c?

Form 990 must include information about the organization's revenue, expenses, assets, liabilities, program activities, and key staff members.

Fill out your form under section 501c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Under Section 501c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.