Get the free I the - irs990 charityblossom

Show details

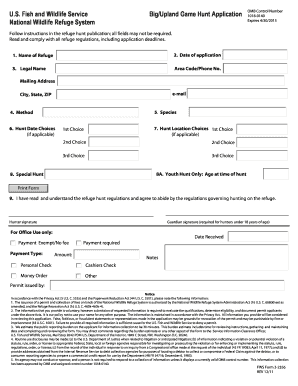

Aduiiiies1-3. 11i. O11ilfltl7-l.. 3. n.r 1/ 4 /Mi U4 lftf j f.l1ZQj/ll lqfml 5. 5 flf.57i3 5 The portion of total contributions by each. N shown on line 11 columno f Llrlg 00- D6 f JS L f/ LU D0 5 3 /Vol 151050- ti- C I Section B. Total Support y y 6 Puniic sugpo ri. Public Support 7 y 7 7 H Calendar year or fiscal year beginning in p 1 Y a 2004 b 2005 17 c 2006 1 d 2007 el 2008 1 f Total T 1 Gifts grants contributions and. - -. i. I. -- o l f r organization without charge jr/ E I-N I7-. 511...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i form - irs990

Edit your i form - irs990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i form - irs990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit i form - irs990 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit i form - irs990. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out i form - irs990

How to fill out i form

01

Read the instructions carefully before filling out the i form.

02

Provide accurate and complete information in each section of the form.

03

Start with personal information such as name, address, and contact details.

04

Include relevant identification numbers, such as social security or taxpayer identification number.

05

Specify your immigration status and provide supporting documents if required.

06

Fill in the details about your employment history, education, and any previous visits to the country.

07

Answer all the questions honestly and to the best of your knowledge.

08

Review the form thoroughly for any errors or omissions before submitting.

09

Make sure to sign and date the form as required.

10

Submit the completed i form to the appropriate authority as instructed.

Who needs i form?

01

Individuals applying for an immigrant visa or green card may need to fill out the i form.

02

Foreign nationals seeking temporary employment or study opportunities in a country may require the i form.

03

People who want to extend their stay or change their non-immigrant status may need to complete this form.

04

Certain permanent residents or citizens may also need to file the i form for various purposes.

05

It is advised to consult with an immigration attorney or check the official guidelines to determine if the i form is necessary in your specific case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my i form - irs990 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign i form - irs990 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send i form - irs990 for eSignature?

Once you are ready to share your i form - irs990, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the i form - irs990 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign i form - irs990 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your i form - irs990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

I Form - irs990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.