Get the free Multi-Family Lending

Show details

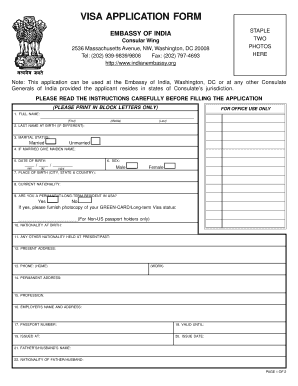

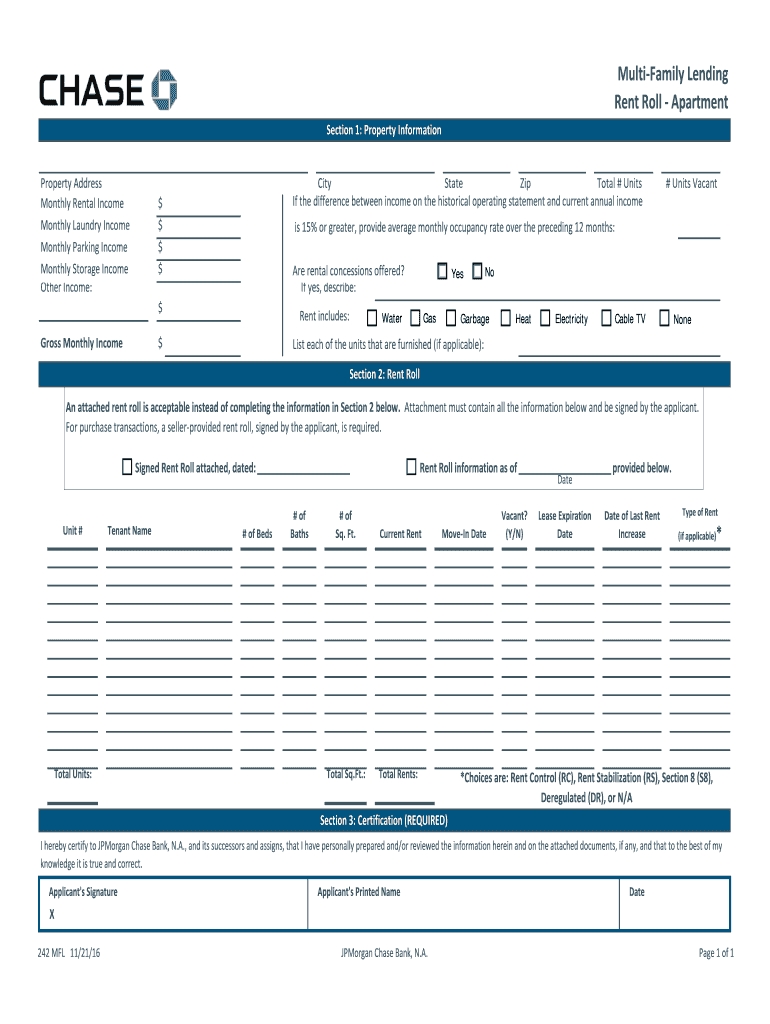

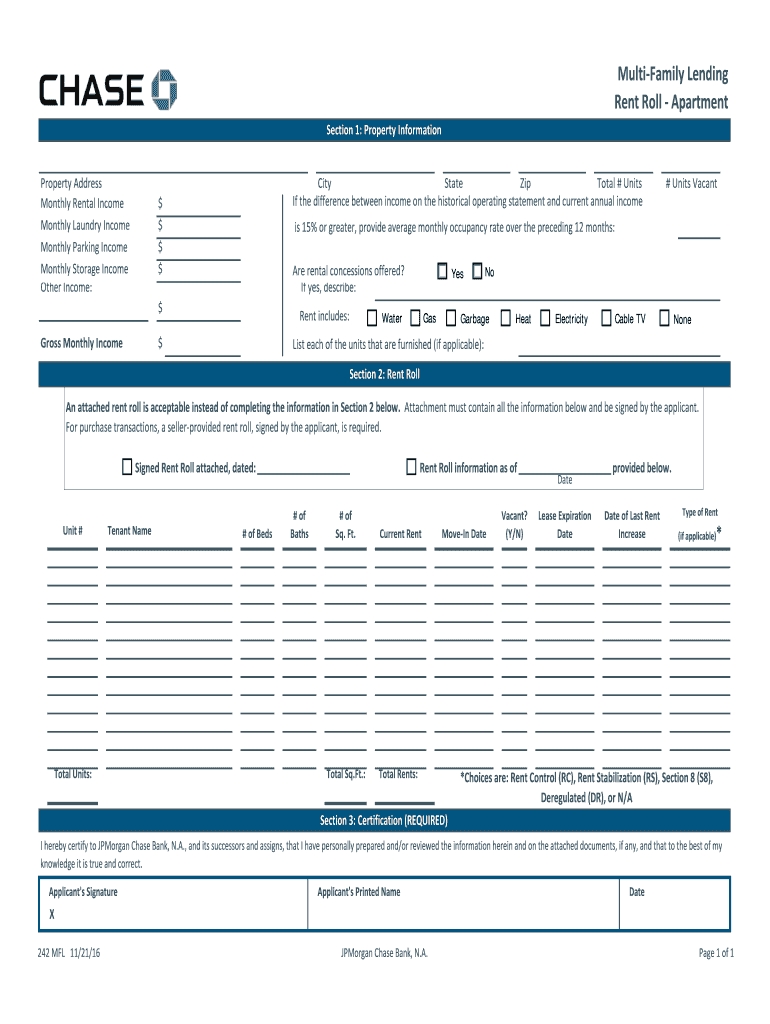

MultiFamily LendingRent Roll ApartmentSection 1: Property Information Property Address Monthly Rental Income Monthly Laundry Income Monthly Parking Income Monthly Storage Income Other Income:$ $ $

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multi-family lending

Edit your multi-family lending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multi-family lending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing multi-family lending online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit multi-family lending. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multi-family lending

How to Fill Out Multi-Family Lending:

01

Gather all necessary financial documents such as tax returns, bank statements, and income statements related to the multi-family property you are seeking lending for.

02

Research and choose a suitable lender or financial institution that specializes in multi-family lending. Consider factors such as interest rates, loan terms, and reputation.

03

Complete the loan application provided by the lender. Be sure to provide accurate and up-to-date information about the property, your personal finances, and any co-borrowers if applicable.

04

Submit all required documentation and supporting materials as requested by the lender. This may include property appraisal, rent rolls, and any other relevant financial information.

05

Await the lender's decision on your loan application. They may request further information or clarification during the underwriting process.

06

If approved, carefully review and sign all loan documents, including the terms and conditions, loan agreement, and any associated fees.

07

In some cases, the lender may conduct an inspection of the property to ensure its condition aligns with the loan requirements.

08

Proceed with the necessary steps to close the loan, which may involve coordinating with the lender, title company, and any other involved parties.

09

Once the loan has closed, ensure timely repayment of the loan installments as agreed upon in the loan agreement.

Who Needs Multi-Family Lending:

01

Real estate investors looking to purchase or refinance multi-family properties, such as apartment buildings, duplexes, or condominium complexes, may utilize multi-family lending.

02

Developers or construction companies undertaking the construction or renovation of multi-family residential properties may require multi-family lending to finance their projects.

03

Individuals or companies seeking to expand their existing multi-family property portfolio or acquire additional properties may seek multi-family lending as a financing option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my multi-family lending in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your multi-family lending and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send multi-family lending to be eSigned by others?

Once you are ready to share your multi-family lending, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit multi-family lending on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit multi-family lending.

What is multi-family lending?

Multi-family lending refers to the process of providing loans for properties that contain multiple residential units, such as apartment buildings or townhouses.

Who is required to file multi-family lending?

Banks, financial institutions, and lending organizations are required to file multi-family lending information with regulatory authorities.

How to fill out multi-family lending?

Multi-family lending information can be filled out electronically through the designated regulatory portals or platforms provided by the authorities.

What is the purpose of multi-family lending?

The purpose of multi-family lending is to provide financial support for the construction, purchase, or refinancing of properties with multiple residential units.

What information must be reported on multi-family lending?

Information such as loan amounts, interest rates, borrower details, property addresses, and other relevant financial data must be reported on multi-family lending.

Fill out your multi-family lending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multi-Family Lending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.