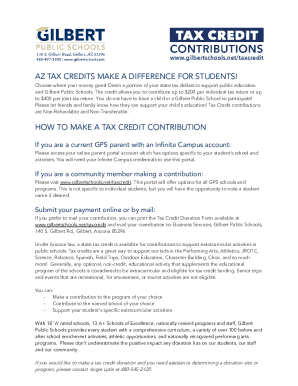

AZ Gilbert Public Schools Tax Credit Contribution Form 2014 free printable template

Show details

Gilbert Public School District No. 41 2014 Arizona State Tax Credit Contribution Form I am enclosing a (Check, Money Order) payable to Gilbert Public School District No. 41 for $ as a total contribution

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Gilbert Public Schools Tax Credit

Edit your AZ Gilbert Public Schools Tax Credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Gilbert Public Schools Tax Credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ Gilbert Public Schools Tax Credit online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AZ Gilbert Public Schools Tax Credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ Gilbert Public Schools Tax Credit Contribution Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ Gilbert Public Schools Tax Credit

How to fill out AZ Gilbert Public Schools Tax Credit Contribution

01

Step 1: Obtain the AZ Gilbert Public Schools Tax Credit Contribution form from the school's website or administrative office.

02

Step 2: Fill in your personal information, including your name, address, and contact details.

03

Step 3: Specify the amount you wish to contribute, ensuring it does not exceed the allowable tax credit limit.

04

Step 4: Designate the specific school or program you want your contribution to support.

05

Step 5: Review the form for accuracy and ensure all required sections are completed.

06

Step 6: Submit the form with your payment, either online, by mail, or in person at the school.

Who needs AZ Gilbert Public Schools Tax Credit Contribution?

01

Families with children enrolled in Gilbert Public Schools who want to support school programs and activities.

02

Taxpayers looking for a tax credit opportunity to reduce their state tax liability.

03

Community members who wish to contribute to the betterment of local education and resources.

Fill

form

: Try Risk Free

People Also Ask about

What is an ECA contribution?

Extracurricular activities, also known as ECA, are school sponsored optional activities that require enrolled students to pay a fee in order to participate that supplement a school's education program. ECA contributions may be claimed for sports, music, and fabulous field experiences.

Who qualifies for the Arizona property tax credit?

As for the property tax credit, individuals may qualify for a credit if they were residents of Arizona the entire year and meet all of the following criteria: Paid property taxes or rent on a main home in Arizona during the tax year.

How does the Arizona private school tax credit work?

The Arizona Private School Tuition Tax Credit allows Arizona taxpayers to give to AZTO and receive a dollar-for-dollar tax credit against your Arizona Income Taxes. AZTO then issues tuition awards to eligible students attending one of AZTO's participating schools.

What is the ECA tax credit in Arizona?

Arizona law provides a tax credit for contributions to public schools to support extracurricular activities or character education. Additional support areas include: standardized testing fees for college credit or readiness, such as PSAT, AP and IB tests. career and technical education industry certification assessment.

What is the maximum AZ school tax credit?

Two Credits for Arizona Individual Taxpayers Tuition Tax Credits2023 Original Credit Maximum2023 PLUS Credit MaximumMarried Jointly$1,308$1,301Individual$655$652Tax Forms323/301348/301

How does the Arizona charitable tax credit work?

The Arizona Charitable Tax Credit allows taxpayers to make a charitable contribution to an eligible nonprofit and receive a dollar-for- dollar tax credit against their AZ state taxes. You can take advantage of this credit to help those most in need in our community, and it won't even cost you a penny.

How do tax credits work Arizona?

The Arizona Tax Credit reduces your Arizona state tax liability independently from any tax that you may have withheld during the year. If you withheld an amount equal to or greater than your tax liability, the credit will increase your state tax refund. And, you may carry the credit forward for five consecutive years.

How much can I donate for AZ tax credit?

The tax credit is claimed on Form 321. The maximum QCO credit donation amount for 2022: $400 single, married filing separate or head of household; $800 married filing joint.

What is the charitable giving tax credit in Arizona?

To receive a dollar-for-dollar tax credit on your Arizona state taxes, donors can give a maximum of $421* for single taxpayers or heads of household and $841* for couples filing jointly. * Please note that max amounts have changed for 2023 Arizona state filings.

What is the Arizona state aid to education tax credit?

State Aid Credit This "Homeowner Rebate" appears automatically on the tax bills of property classified as Legal Class 3 on a line titled "STATE AID TO EDUCATION" and is up to 40% or $600 as defined in Arizona law (A.R.S § 15-972 ).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AZ Gilbert Public Schools Tax Credit?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific AZ Gilbert Public Schools Tax Credit and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the AZ Gilbert Public Schools Tax Credit in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your AZ Gilbert Public Schools Tax Credit and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out AZ Gilbert Public Schools Tax Credit on an Android device?

Complete your AZ Gilbert Public Schools Tax Credit and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is AZ Gilbert Public Schools Tax Credit Contribution?

The AZ Gilbert Public Schools Tax Credit Contribution allows taxpayers to make contributions to support extracurricular activities and character development programs in Gilbert Public Schools, which can be claimed as a tax credit on their Arizona state income tax return.

Who is required to file AZ Gilbert Public Schools Tax Credit Contribution?

Any Arizona taxpayer who wishes to claim a tax credit for contributions made to AZ Gilbert Public Schools for extracurricular activities must file the AZ Gilbert Public Schools Tax Credit Contribution form. This typically includes individuals or couples who file taxes in Arizona.

How to fill out AZ Gilbert Public Schools Tax Credit Contribution?

To fill out the AZ Gilbert Public Schools Tax Credit Contribution form, you need to provide your personal information, including your name, address, and Social Security number, along with the amount of your contribution and the date of the contribution. Follow the specific instructions provided with the form to ensure accuracy.

What is the purpose of AZ Gilbert Public Schools Tax Credit Contribution?

The purpose of the AZ Gilbert Public Schools Tax Credit Contribution is to provide additional funding for extracurricular activities, programs, and services that enhance student education, which may not be funded by regular school budgets.

What information must be reported on AZ Gilbert Public Schools Tax Credit Contribution?

The information that must be reported on the AZ Gilbert Public Schools Tax Credit Contribution includes your full name, the amount contributed, the date of the contribution, the type of program your contribution supports, and your Social Security number to verify your eligibility for the tax credit.

Fill out your AZ Gilbert Public Schools Tax Credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Gilbert Public Schools Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.