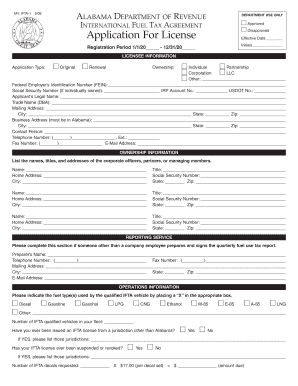

AL MV IFTA-1 2017-2025 free printable template

Get, Create, Make and Sign al application license form

Editing alabama international fuel tax agreement fillable online

Uncompromising security for your PDF editing and eSignature needs

AL MV IFTA-1 Form Versions

How to fill out mv ifta 1 form

How to fill out AL MV IFTA-1

Who needs AL MV IFTA-1?

Video instructions and help with filling out and completing alabama international fuel tax

Instructions and Help about al application license online

The contractor State License Board orCSLBreceives thousands of applications each year but nearly 45 percent of them are rejected because of incomplete or incorrect information we don't want this to happen to youths application tutorial is designed to help you fill out the license application and point out common mistakes and oversights to avoid, so your application won#39’t be rejected or delayed review any section of this video as many times as you need to and make sure thread the directions carefully and while the first few pages may look scarythey'’re not really read them before you start it#39’ll save you a lot of time and headaches later plus the application is only five pages not so bad right, but before you begin filling this out thereat some things you need to remember you#39’re a limited liability company that wants to apply for a California contractor license use the specific LLC application that#39’s available on our website while some LLC application information is different this video will be able to help you through the basic application process while filling out this applicationyou'’ll see the terms qualifying individual and qualifier a lot on this application the qualifier is the person who is responsible for the licenses' construction operations the license qualifier must within the last ten-year shave four years of journeyman level experience in the classification that#39;reapplying for this is a requirement for all licenses issued by CSL what qualifies as a journeyman well it#39’s inexperienced worker who is fully trained and able to perform the trade without supervision as opposed to a trainee helper labor assistant or apprentice parts of journey level experience can earn by completing an accredited apprenticeship program or earning college degree in a related major like engineering or landscape architecture okay this is important an u.s. social security number is required for you and everyone you're including on the license other forms of identification like Canadian Social Insurance numbers or individual taxpayer identification numbers cannot be substituted the bottom line is if you're done#39’t have a US SocialSecurity number you can#39’t be included on the application also important if you get to a point where a certain sectiondoesn'’t apply to you write the letters/a for not applicable done#39’t leave any space blank or ignore any of the sections seriously we'd rather not reject to return your application for correction and keep in mind that you can only submit one application at a time, and before you start remember to type ruse blue or black ink when filling this out when CSL receives your application it is scanned into a computer system and anything other than blue or black Incan#39’t be read okay now that we've gotten those basics out of the way let#39’s getstartedhere is the beginning of the application new license applicants must include a$300 non-refundable fee with the application CSL accepts money...

People Also Ask about alabama international fuel tax agreement

How do I get my IFTA stickers for Alabama?

How do I get an IFTA sticker in Alabama?

What is the tax on motor fuel in Alabama?

How do I register for IRP in Alabama?

How much is IFTA in Alabama?

How do I file my IFTA tax in Alabama?

How do I get my IFTA stickers in Alabama?

Do I need a IFTA sticker Alabama?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2017 al ifta 1 international search directly from Gmail?

How do I make changes in alabama international fuel tax?

Can I create an electronic signature for signing my alabama international fuel tax in Gmail?

What is AL MV IFTA-1?

Who is required to file AL MV IFTA-1?

How to fill out AL MV IFTA-1?

What is the purpose of AL MV IFTA-1?

What information must be reported on AL MV IFTA-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.