Get the free Chapter 13 Plan and Motions 8-1-17

Show details

N.J. LBR 3015-1. A Certification of Service Notice of Chapter 13 Plan Transmittal and valuation must be filed with the Clerk of Court when the plan and transmittal notice are served. a. Motion to Avoid Liens Under 11. U.S.C. Section 522 f. NONE The Debtor moves to avoid the following liens that impair exemptions Nature of Type of Lien Lien Exemption Sum of All Other Liens Against the Property Lien to be Avoided Part 4 above Reclassified c. Motion to Partially Void Liens and Reclassify...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 plan and

Edit your chapter 13 plan and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 plan and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 13 plan and online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chapter 13 plan and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 plan and

How to fill out chapter 13 plan and

01

First, gather all necessary financial documentation, including income statements, expenses, debts, and assets.

02

Next, analyze your financial situation and determine whether Chapter 13 bankruptcy is the right option for you.

03

Consult with a bankruptcy attorney who specializes in Chapter 13 cases to ensure you meet the eligibility requirements and fully understand the process.

04

Create a repayment plan detailing how you will repay your debts over a period of three to five years.

05

File the necessary paperwork with the bankruptcy court, including the Chapter 13 petition, schedules, and your proposed repayment plan.

06

Attend a meeting of creditors, where the trustee and your creditors may ask you questions about your financial situation and proposed plan.

07

Make regular payments according to your repayment plan, either directly to the trustee or through payroll deductions.

08

Attend the confirmation hearing, where the bankruptcy judge will review your proposed plan and decide whether to approve it.

09

Once your plan is approved, continue making payments as outlined until all debts included in the plan are repaid.

10

Complete a debtor education course before receiving a discharge, which signifies the successful completion of your Chapter 13 plan.

11

Receive a discharge from the court, which releases you from any further liability on the debts included in your Chapter 13 plan.

Who needs chapter 13 plan and?

01

Individuals with a regular income who are unable to repay their debts in full may benefit from a Chapter 13 plan.

02

Those who want to protect valuable assets, such as their home or car, from being liquidated during bankruptcy proceedings may choose Chapter 13.

03

Chapter 13 may be suitable for individuals who have fallen behind on mortgage or car loan payments and want to catch up on missed payments.

04

People who want to avoid foreclosure or repossession and keep their property may opt for Chapter 13 bankruptcy.

05

Chapter 13 also provides an option for individuals who do not qualify for Chapter 7 bankruptcy due to income limitations.

06

Individuals who wish to create a manageable repayment plan to gradually pay off their debts over time may find Chapter 13 beneficial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify chapter 13 plan and without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including chapter 13 plan and, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send chapter 13 plan and for eSignature?

Once your chapter 13 plan and is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the chapter 13 plan and electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your chapter 13 plan and in minutes.

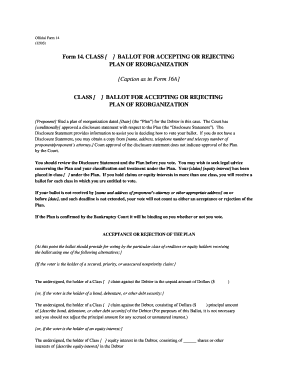

What is chapter 13 plan and?

Chapter 13 plan is a repayment plan outlined by an individual to pay off debts over a period of time.

Who is required to file chapter 13 plan and?

Individuals with regular income who have unsecured debts below a certain threshold are typically required to file a Chapter 13 plan.

How to fill out chapter 13 plan and?

To fill out a Chapter 13 plan, individuals must outline their income, expenses, and proposed repayment schedule for creditors.

What is the purpose of chapter 13 plan and?

The purpose of a Chapter 13 plan is to create a feasible repayment plan for individuals to pay off their debts over time while protecting their assets.

What information must be reported on chapter 13 plan and?

Chapter 13 plan must include details about the individual's income, expenses, assets, debts, and the proposed repayment plan for creditors.

Fill out your chapter 13 plan and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Plan And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.