Get the free Accounting Endowments of Not-for-Profit Organizations After UPMIFA

Show details

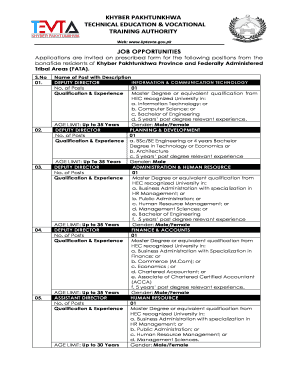

Accounting Endowments of Not-for-Profit Organizations After UPLIFT Live Audio Conference October 25, 2011 1:00 pm 2:30 pm EST EXPRESS REGISTRATION Sign up at www.lorman.com/ID388546 Live Audio Conference

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting endowments of not-for-profit

Edit your accounting endowments of not-for-profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting endowments of not-for-profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting endowments of not-for-profit online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounting endowments of not-for-profit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting endowments of not-for-profit

Point by point, here's how to fill out accounting endowments of not-for-profit:

01

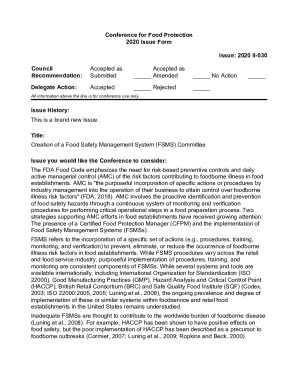

Understand the purpose of accounting endowments: Accounting endowments in a not-for-profit organization are funds that are restricted for specific purposes, such as scholarships, research grants, or building maintenance. It is important to have a clear understanding of the purpose of the endowments before proceeding with the accounting process.

02

Review legal and regulatory requirements: Familiarize yourself with any legal or regulatory requirements that govern how accounting endowments should be managed and reported. This may include guidelines from the Financial Accounting Standards Board (FASB) or specific laws applicable to not-for-profit organizations in your country.

03

Establish a separate accounting system: It is recommended to maintain a separate accounting system for tracking and managing accounting endowments. This will help ensure accurate reporting and compliance with regulations. Set up separate accounts or designate specific codes in your financial software to track the inflows and outflows related to endowments.

04

Document the purpose and restrictions: Each accounting endowment should have clear documentation outlining its purpose and any restrictions imposed on its use. Ensure that the terms are well-documented, including any restrictions on principal or income, investment guidelines, and spending policies.

05

Track and report on investments: Endowments are often invested to generate income for the organization's operations. It is important to track the performance of these investments and report them accurately. Monitor the investments regularly, and ensure that the reporting complies with accounting standards and any legal requirements.

06

Record inflows and outflows: As contributions are received and expenses are incurred related to the accounting endowments, ensure that they are properly recorded in the accounting system. Contributions should be distinguished based on restriction types, such as temporary or permanent restrictions, to accurately reflect the financial position of the organization.

07

Prepare financial statements and reports: Regularly prepare financial statements and reports specifically for accounting endowments. This will provide transparency and accountability to stakeholders, enabling them to evaluate the organization's stewardship over the endowment funds. These reports should include information on the balances, investment gains or losses, and any changes in restrictions.

Who needs accounting endowments of not-for-profit?

01

Not-for-profit organizations: Any not-for-profit organization that receives and manages endowment funds will need accounting endowments. This includes charities, educational institutions, healthcare organizations, and religious organizations that rely on endowments to support their missions and activities.

02

Donors and Funding organizations: Donors who contribute to not-for-profit organizations are interested in ensuring that their funds are managed properly and used for the intended purposes. Accounting endowments provide a transparent and accountable way to track and report on these funds. Funding organizations, such as foundations or government agencies, may also require proper accounting of endowments as a condition for funding.

03

Board of Directors and Auditors: The board of directors of a not-for-profit organization has the fiduciary responsibility to oversee the management of endowment funds. They rely on accurate accounting endowment reports to make informed decisions about investments and spending policies. Auditors also require proper documentation and reporting of accounting endowments to ensure compliance with accounting standards and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the accounting endowments of not-for-profit in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your accounting endowments of not-for-profit and you'll be done in minutes.

How can I fill out accounting endowments of not-for-profit on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your accounting endowments of not-for-profit. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out accounting endowments of not-for-profit on an Android device?

Complete your accounting endowments of not-for-profit and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is accounting endowments of not-for-profit?

Accounting endowments of not-for-profit refer to the financial resources set aside for the long-term sustainability of the organization.

Who is required to file accounting endowments of not-for-profit?

Not-for-profit organizations that have endowments are required to file accounting endowments.

How to fill out accounting endowments of not-for-profit?

Accounting endowments of not-for-profit are typically filled out by the organization's finance department or external auditors.

What is the purpose of accounting endowments of not-for-profit?

The purpose of accounting endowments is to provide transparency on how the organization manages its financial resources.

What information must be reported on accounting endowments of not-for-profit?

Information such as the value of the endowment, investment strategy, and any restrictions on the use of funds must be reported.

Fill out your accounting endowments of not-for-profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Endowments Of Not-For-Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.