Get the free Payroll ManagerPlease complete this section and enter data into your ADP Payroll sys...

Show details

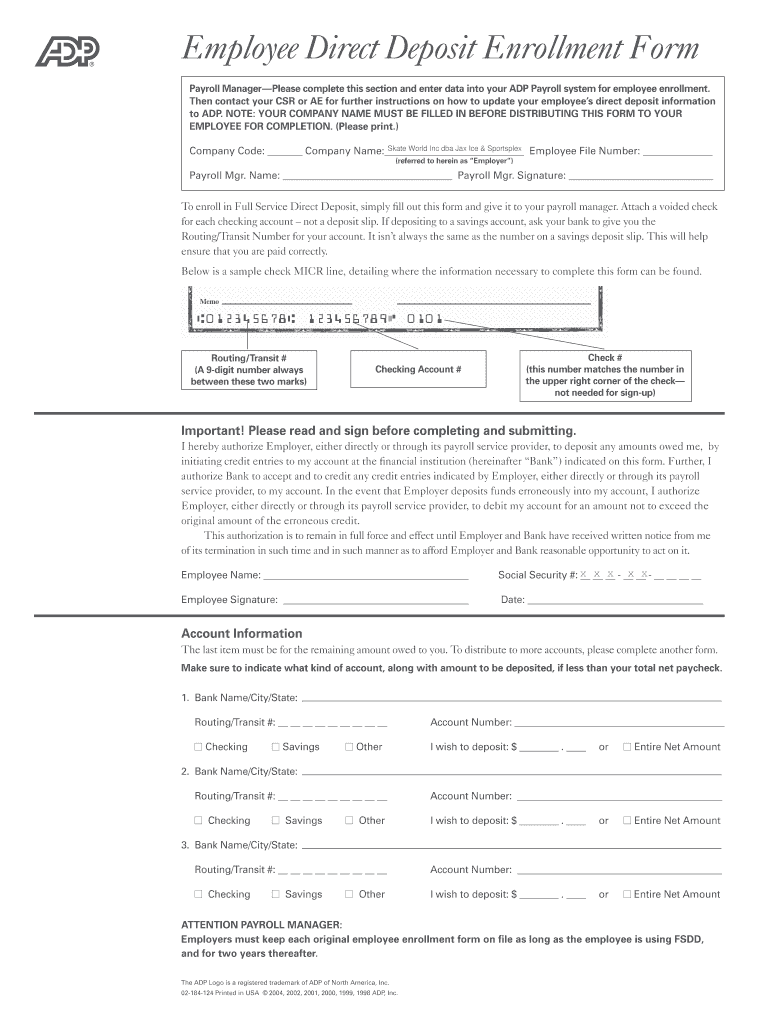

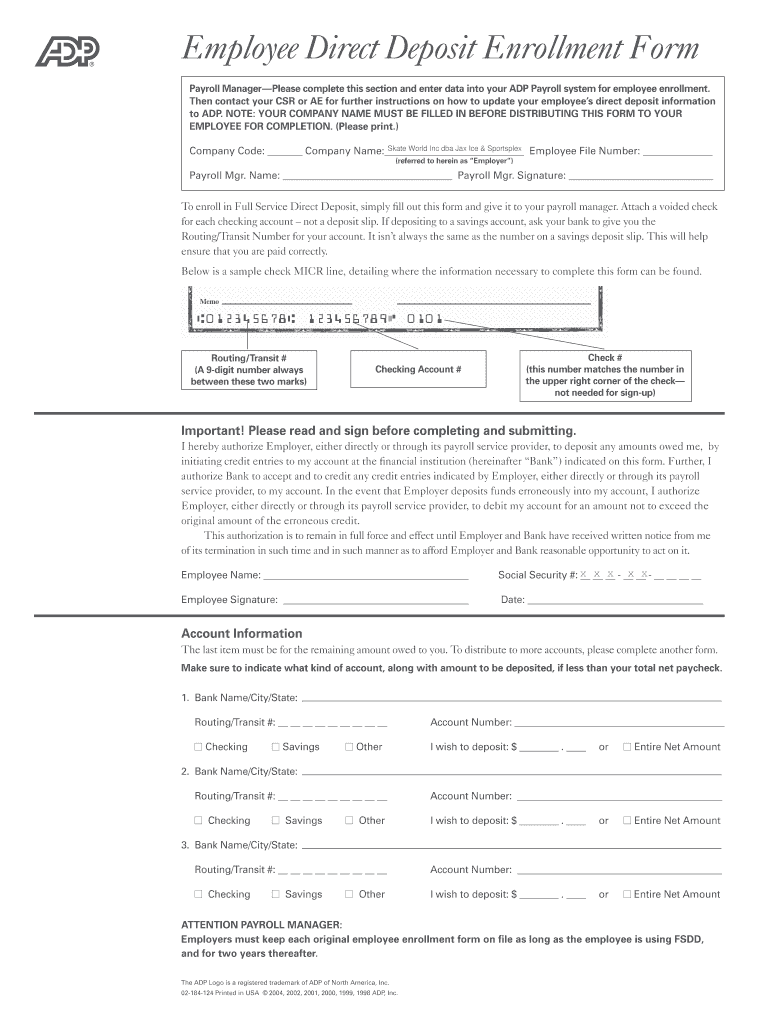

The ADP Logo is a registered trademark of ADP of North America Inc. 02-184-124 Printed in USA 2004 2002 2001 2000 1999 1998 ADP Inc.. In the event that Employer deposits funds erroneously into my account I authorize Employer either directly or through its payroll service provider to debit my account for an amount not to exceed the original amount of the erroneous credit. Memo 012345678 A 9-digit number always between these two marks Checking Account Check this number matches the number in the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll managerplease complete this

Edit your payroll managerplease complete this form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll managerplease complete this form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll managerplease complete this online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll managerplease complete this. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll managerplease complete this

How to fill out payroll managerplease complete this

01

To fill out the payroll manager form, follow these steps:

02

Start by entering the employee information such as name, employee ID, and job title.

03

Input the employee's hours worked, including regular hours, overtime hours, and any other applicable time off.

04

Calculate the employee's total earnings, which may include their base salary, bonuses, commissions, or other forms of compensation.

05

Deduct any applicable taxes, social security contributions, or other withholdings as required by law.

06

Determine any additional deductions or contributions that should be taken into account, such as health insurance premiums or retirement plan contributions.

07

Calculate the net pay by subtracting the total deductions from the total earnings.

08

Provide a breakdown of the employee's pay, including the gross pay, deductions, and net pay.

09

Double-check all the information entered for accuracy and make any necessary adjustments.

10

Once everything is accurate, submit the payroll manager form to the appropriate department or choose the desired method of payroll processing.

11

Keep a copy of the completed payroll manager form for your records. It is important to maintain accurate payroll documentation.

Who needs payroll managerplease complete this?

01

Payroll managers are needed by organizations that have employees and need to accurately process and manage their payroll.

02

Small businesses: Payroll managers are essential for small businesses that may not have the resources to outsource their payroll processing.

03

Medium to large companies: As the number of employees increases, the complexity of payroll management also increases. Payroll managers in medium to large companies streamline the payroll process, ensure compliance with laws and regulations, and provide valuable insights into labor costs.

04

Human resources departments: Payroll managers often work closely with HR departments as payroll is an integral part of employee compensation and benefits.

05

Accounting departments: Payroll managers ensure accurate financial reporting related to employee compensation and taxes.

06

Non-profit organizations: Even non-profit organizations with paid employees require payroll managers to handle payroll administration and ensure compliance.

07

Any organization that wants to avoid penalties, discrepancies, and legal issues related to payroll processing should consider having a payroll manager.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify payroll managerplease complete this without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your payroll managerplease complete this into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in payroll managerplease complete this without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit payroll managerplease complete this and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the payroll managerplease complete this in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your payroll managerplease complete this and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is payroll manager and how to complete this?

Payroll manager is a software or tool used to manage and process employee payrolls. It helps automate the calculation of wages, taxes, and deductions. To complete payroll manager, you need to input employee information, hours worked, wages, and any deductions or taxes.

Who is required to file payroll manager and how to complete this?

Employers or business owners are required to file payroll manager to ensure employees are paid accurately and on time. To complete payroll manager, employers need to input all necessary payroll information for each employee and verify the calculations are correct.

How to fill out payroll manager and complete this?

To fill out payroll manager, you need to input employee information such as name, address, social security number, hours worked, rate of pay, deductions, and any other relevant information. Once all data is inputted, the payroll manager will automatically calculate the employee's net pay.

What is the purpose of payroll manager and how to complete this?

The purpose of payroll manager is to streamline and automate the payroll process for businesses. It helps ensure employees are paid accurately and on time, as well as help with tax compliance and reporting requirements. To complete payroll manager, you need to input all necessary payroll data and review the calculations.

What information must be reported on payroll manager and how to complete this?

On payroll manager, you must report employee information, hours worked, wages, deductions, taxes, and any other relevant pay-related data. To complete this, you need to input all required information accurately and review the calculations before processing payroll.

Fill out your payroll managerplease complete this online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Managerplease Complete This is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.