Canada GST189 E 2014 free printable template

Show details

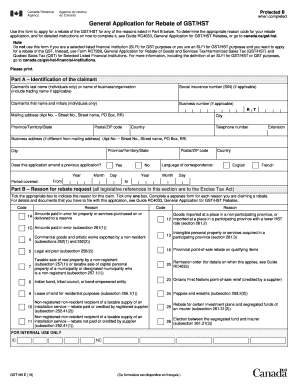

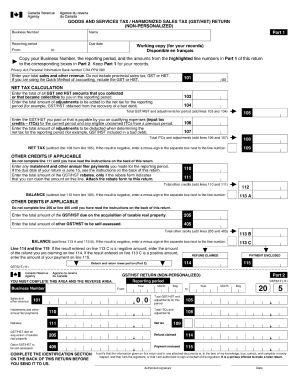

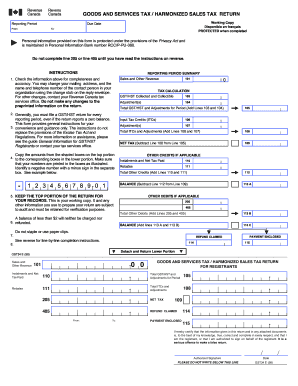

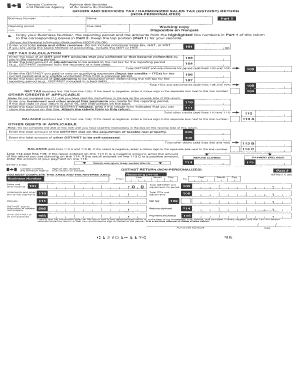

Instead use Form RC7289 General Application for Rebate of Goods and Services Tax/ Harmonized Sales Tax GST/HST and Quebec Sales Tax QST for Selected Listed Financial Institutions. GST189 E 14 Protected B when completed General Application for Rebate of GST/HST NOTE In this form the text inserted between square brackets represents the regular print information. Use this form to apply for a rebate of the GST/HST for any of the reasons listed in Part B on page 5 below. To determine the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada GST189 E

Edit your Canada GST189 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST189 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada GST189 E online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada GST189 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST189 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST189 E

How to fill out Canada GST189 E

01

Obtain the GST189 E form from the official Canada Revenue Agency (CRA) website or through their local office.

02

Provide your business number at the top of the form.

03

Indicate the reason for applying for a rebate in the appropriate section.

04

Fill out your name and contact information accurately.

05

Specify the period for which you are applying for the rebate.

06

Complete the details regarding your eligible expenses, including amounts and descriptions.

07

Attach any required documentation or receipts that support your claim.

08

Review all information for accuracy before submission.

09

Submit the completed form to the CRA either electronically or by mail as instructed.

Who needs Canada GST189 E?

01

Individuals or businesses that have paid Goods and Services Tax (GST) or Harmonized Sales Tax (HST) on certain expenses and are eligible for a rebate.

02

Non-residents of Canada who have paid GST/HST on eligible expenses while visiting or doing business in Canada.

03

Registered charities and non-profit organizations seeking a rebate on the GST/HST they paid.

Fill

form

: Try Risk Free

People Also Ask about

Can visitors to Canada get tax refund?

Use this form to claim a refund of goods and services tax / harmonized sales tax (GST/HST) if: • you are an individual and a non-resident of Canada; and • the total of your eligible purchases, before taxes, is CAN$200 or more.

How do I claim my GST refund Canada?

To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

What is the GST rebate for a new home buyer in BC?

The GST is a Federal tax of 5% on the purchase price of a new home or a substantially renovated home. New home buyers can apply for a rebate of up to a maximum of 36% of the tax if the purchase price is $350,000 or less. A partial GST rebate is available for new homes costing between $350,000 and $450,000.

Who qualifies for HST rebate in Ontario?

To receive the GST/HST credit you have to be a resident of Canada for tax purposes, and at least 1 of the following applies, you: Are 19 years of age or older; Have (or previously had) a spouse or common-law partner; or. Are (or previously were) a parent and live (or previously lived) with your child.

Can you claim GST back when leaving Canada?

Place of final departure from Canada If yes, send us your original validated receipts. Use this form to claim a refund of goods and services tax / harmonized sales tax (GST/HST) if: • you are an individual and a non-resident of Canada; and • the total of your eligible purchases, before taxes, is CAN$200 or more.

What is the GST refund for tourists in Canada?

You can claim up to 50% of the amount of GST/HST you paid for the eligible tour package. The refund calculation is based on the number of nights of short-term accommodation in Canada included in the package.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the Canada GST189 E in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your Canada GST189 E and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit Canada GST189 E on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing Canada GST189 E, you can start right away.

How do I fill out the Canada GST189 E form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Canada GST189 E and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Canada GST189 E?

Canada GST189 E is a form used for applying for a refund of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on eligible expenses.

Who is required to file Canada GST189 E?

Individuals or businesses that have paid GST/HST on eligible expenses and wish to claim a refund are required to file Canada GST189 E.

How to fill out Canada GST189 E?

To fill out Canada GST189 E, provide your contact information, specify the type of refund you are claiming, detail the eligible expenses, and include any necessary supporting documentation.

What is the purpose of Canada GST189 E?

The purpose of Canada GST189 E is to facilitate the refund process for individuals or businesses who have overpaid GST/HST on eligible purchases and expenses.

What information must be reported on Canada GST189 E?

Information required on Canada GST189 E includes the applicant's identification details, GST/HST registration number (if applicable), a detailed description of the expenses, the amount of GST/HST paid, and any supporting documents.

Fill out your Canada GST189 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst189 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.