Get the free Fiscal code -VAT nr

Show details

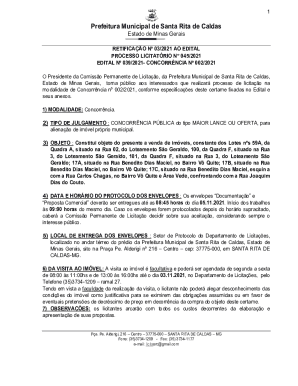

Bank address Piazza Durante 11 20131 Milano MI ABI 03015 CAB 03200 CIN L Account number 000003443106 IBAN code IT27L0301503200000003443106 BIC Receiver UNCRITMM BIC Beneficiary FEBIITM1 N.B. Please note that for a successful bank transaction you must enter both BIC Code the BIC receiver and the BIC beneficiary. Quality Consult Srl Authorized capital 10. 000 00 f.p. Legal and administrative seat Via del Velodromo 77 - 00179 - Rome Italy Fiscal code -VAT nr. IT06927791001 R.E.A C. C. I. A....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal code -vat nr

Edit your fiscal code -vat nr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal code -vat nr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal code -vat nr online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal code -vat nr. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal code -vat nr

How to fill out fiscal code -vat nr

01

To fill out the fiscal code (vat nr), follow these steps:

02

Start by gathering the necessary information, including the individual's personal details (name, date of birth, gender) or company details (company name, address, tax registration number).

03

Once you have the required information, visit the official website of your country's tax authority.

04

Look for the section or form specifically designated for registering and obtaining a fiscal code (vat nr).

05

Fill out the form or provide the necessary details as requested. Ensure the information is accurate and up-to-date.

06

Submit the completed form or application electronically or via mail, as instructed.

07

Wait for the confirmation or approval of your fiscal code (vat nr) application. This usually takes a certain period of time depending on the country's administrative processes.

08

Once approved, you will receive your fiscal code (vat nr), which can be used for tax-related transactions and identification purposes.

Who needs fiscal code -vat nr?

01

A fiscal code (vat nr) is needed by:

02

- Individuals who need to engage in various financial activities, such as opening a bank account, purchasing property, or registering for employment.

03

- Companies or businesses that need to issue invoices, pay taxes, or engage in financial transactions within their country or internationally.

04

- Foreign individuals or companies who conduct business or have financial affairs in a particular country and are required to comply with local tax regulations.

05

- Professionals or freelancers who provide services and need to bill clients or report income for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fiscal code -vat nr?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the fiscal code -vat nr in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete fiscal code -vat nr online?

With pdfFiller, you may easily complete and sign fiscal code -vat nr online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the fiscal code -vat nr electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your fiscal code -vat nr and you'll be done in minutes.

What is fiscal code -vat nr?

The fiscal code, also known as VAT number, is an identification number used for tax purposes by businesses.

Who is required to file fiscal code -vat nr?

Businesses that engage in taxable activities are required to file a fiscal code (VAT number).

How to fill out fiscal code -vat nr?

To fill out a fiscal code (VAT number), businesses need to provide information such as their legal name, address, and taxable activities.

What is the purpose of fiscal code -vat nr?

The purpose of the fiscal code (VAT number) is to track and monitor the tax transactions of businesses.

What information must be reported on fiscal code -vat nr?

Businesses must report their taxable activities, sales revenue, and taxes owed on their fiscal code (VAT number).

Fill out your fiscal code -vat nr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Code -Vat Nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.