Get the free Nonprofit Accounting

Show details

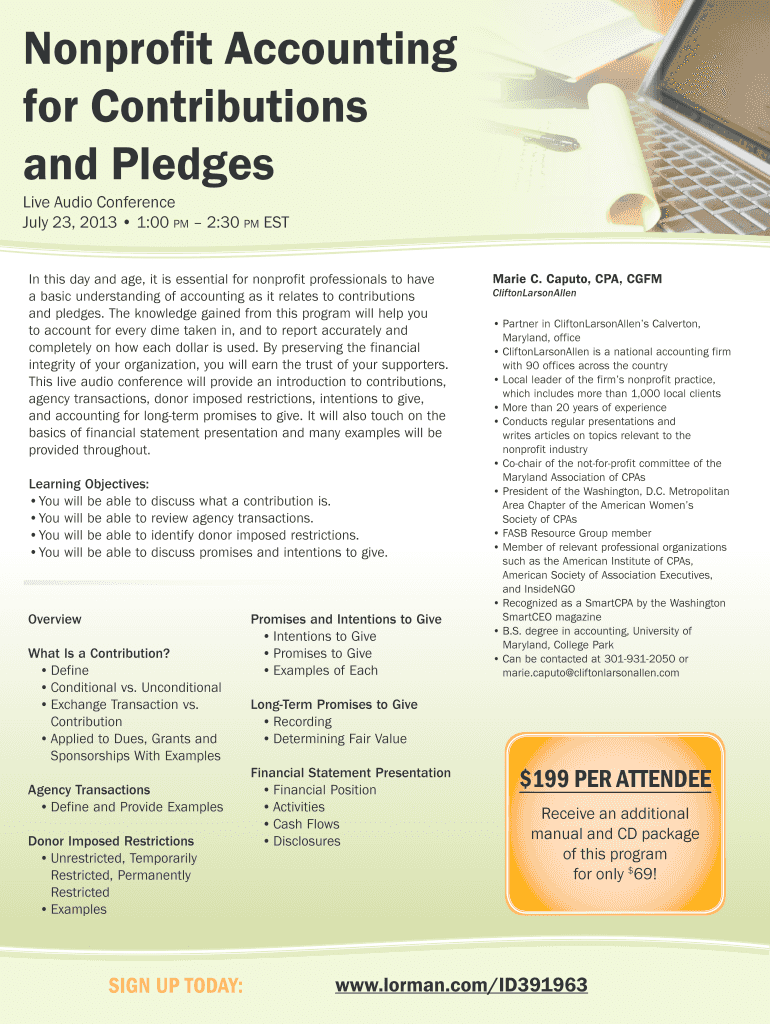

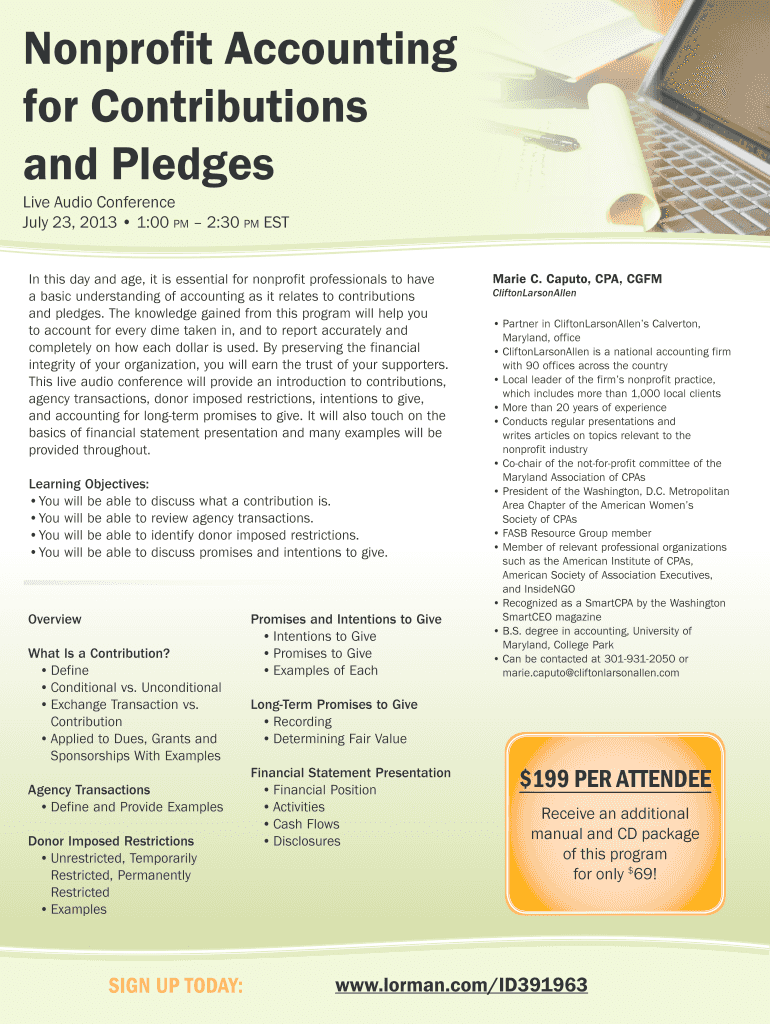

Nonprofit Accounting for Contributions and Pledges Live Audio Conference July 23, 2013 1:00 pm 2:30 pm EST In this day and age, it is essential for nonprofit professionals to have a basic understanding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit accounting

Edit your nonprofit accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit accounting online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nonprofit accounting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit accounting

How to fill out nonprofit accounting?

01

Start by organizing all financial documents related to your nonprofit organization, such as bank statements, invoices, receipts, and financial reports.

02

Create separate accounts for income and expenses to track the sources of funds and how they are being utilized.

03

Record all financial transactions accurately in the accounting system or software of your choice. This includes income, expenses, payroll, and any other financial activities.

04

Implement a system of checks and balances to ensure accuracy and prevent fraud. This can include having multiple individuals involved in the accounting process, conducting regular audits, and establishing clear financial policies and procedures.

05

Reconcile your bank statements with your accounting records on a regular basis, ideally monthly. This will help identify any discrepancies or errors that need to be corrected.

06

Generate financial reports regularly to track the financial health and performance of your nonprofit. These reports can include balance sheets, income statements, and cash flow statements.

07

Ensure compliance with applicable accounting standards and regulations for nonprofit organizations, such as Generally Accepted Accounting Principles (GAAP) or the Financial Accounting Standards Board (FASB) guidelines.

Who needs nonprofit accounting?

01

Nonprofit organizations of all sizes and types require nonprofit accounting to effectively manage their financial resources and fulfill their missions.

02

Donors and stakeholders who contribute funds to nonprofit organizations need transparent and accurate accounting records to ensure their donations are being used appropriately and efficiently.

03

Regulatory bodies, such as the IRS (Internal Revenue Service) in the United States, require nonprofit organizations to maintain proper accounting records to qualify for tax-exempt status and to comply with reporting requirements.

04

Board members and leadership teams of nonprofit organizations need nonprofit accounting to make informed financial decisions and monitor the organization's financial stability and sustainability.

05

Grant-making organizations and foundations often require nonprofits to submit financial reports and demonstrate sound accounting practices to be eligible for funding.

In summary, nonprofit accounting is crucial for maintaining accurate financial records, ensuring transparency and accountability, and meeting legal and regulatory requirements. It is essential for nonprofit organizations, donors, stakeholders, regulatory bodies, and grant-making organizations. By following proper accounting procedures and practices, nonprofits can effectively manage their finances and fulfill their missions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nonprofit accounting without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your nonprofit accounting into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send nonprofit accounting to be eSigned by others?

Once you are ready to share your nonprofit accounting, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the nonprofit accounting in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your nonprofit accounting and you'll be done in minutes.

What is nonprofit accounting?

Nonprofit accounting is a specialized form of accounting that focuses on tracking and reporting financial information for nonprofit organizations.

Who is required to file nonprofit accounting?

Nonprofit organizations are required to file nonprofit accounting in order to comply with regulatory requirements and to provide transparency to stakeholders.

How to fill out nonprofit accounting?

Nonprofit accounting can be filled out by following standard accounting principles and guidelines specifically tailored for nonprofit organizations.

What is the purpose of nonprofit accounting?

The purpose of nonprofit accounting is to accurately track and report financial information in order to demonstrate accountability, transparency, and compliance with regulations.

What information must be reported on nonprofit accounting?

Nonprofit accounting must include details about revenue, expenses, assets, liabilities, and any other financial transactions of the organization.

Fill out your nonprofit accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.