LPL Financial CM105 2015-2025 free printable template

Get, Create, Make and Sign lpl cm105 form

Editing lpl cm105 move address online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lpl financial cm105 address form

How to fill out LPL Financial CM105

Who needs LPL Financial CM105?

Video instructions and help with filling out and completing financial cm105 check printable

Instructions and Help about financial cm105 check printable

Hello and thank you for attending today's webcast on retirement counseling tips My name is Joy Fisher and I'm Patricia Sapol and we are from OPM's benefit officer development and outreach team We have an allotted time of one hour and a half for today's presentation And there will be an opportunity to submit your questions for any questions that you may have You may email Benefits at opmgov and the subject line please add Retirement counseling tips so that we may address your question during today's presentation Our objectives today are counseling and retirement planning tips common causes of retirement delays and retirement resources We will explore key times in the federal career that are significant and optimal times to maximize opportunities to educate our employees on their benefits and retirement planning tools We will also discuss the most common items that contribute to retirement delays and how to reduce or eliminate those errors and Finally we will share some of the many resources available for retirement planning As we will touch on a variety of topics during today's webcast we want you to have the references that are available from the CSRs and FERS handbook The Code of Federal Regulations and we will talk about a few of our benefit administration letters specifically submitting a healthy retirement application package as you know the handbook the code of federal regulation and BLS will cover everything from coverage Determining retirement coverage credible service how to plan and apply for retirement and everything in between Retirement counseling is so important throughout the federal career We find optimal times to retire to to teach our choice about retirement from the very start of their employment So from your new hire orientation planning to key times such as Mid-career pre retirement and the retirement eligible we continue to educate our employees on their benefits and retirement Educating employees about their benefits is a career long process which provides them the Poison needful to set and reach their retirement goals this approach ensures that as life changes Throughout their federal career employees will be equipped with the knowledge and tools they need to make sound decisions Employees should be aware of the agents service requirements for retire the options to enroll and change their benefits and their insurances as life changes and how to navigate those tools and the resources that are available to help them plan financially By identifying addressing these educational needs during key points throughout their federal career We are equipping them and greatly reducing the anxieties that may come as they near retirement When retirement planning is a part of the career planning process Employees would know how to build a solid retirement base to which they can contribute Their throughout their years of their government service The agency is responsible for providing that ploy and all inclusive presentation covering all of...

People Also Ask about

Does LPL Financial have IRA accounts?

Is an early distribution from a Roth IRA taxable?

What is the penalty for early withdrawal from LPL?

Can you make an IRA distribution to a third party?

Can I withdraw from my Roth IRA early without penalty?

How much tax do I pay on Roth early distribution?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial cm105 check printable?

How do I edit financial cm105 check printable in Chrome?

How do I complete financial cm105 check printable on an iOS device?

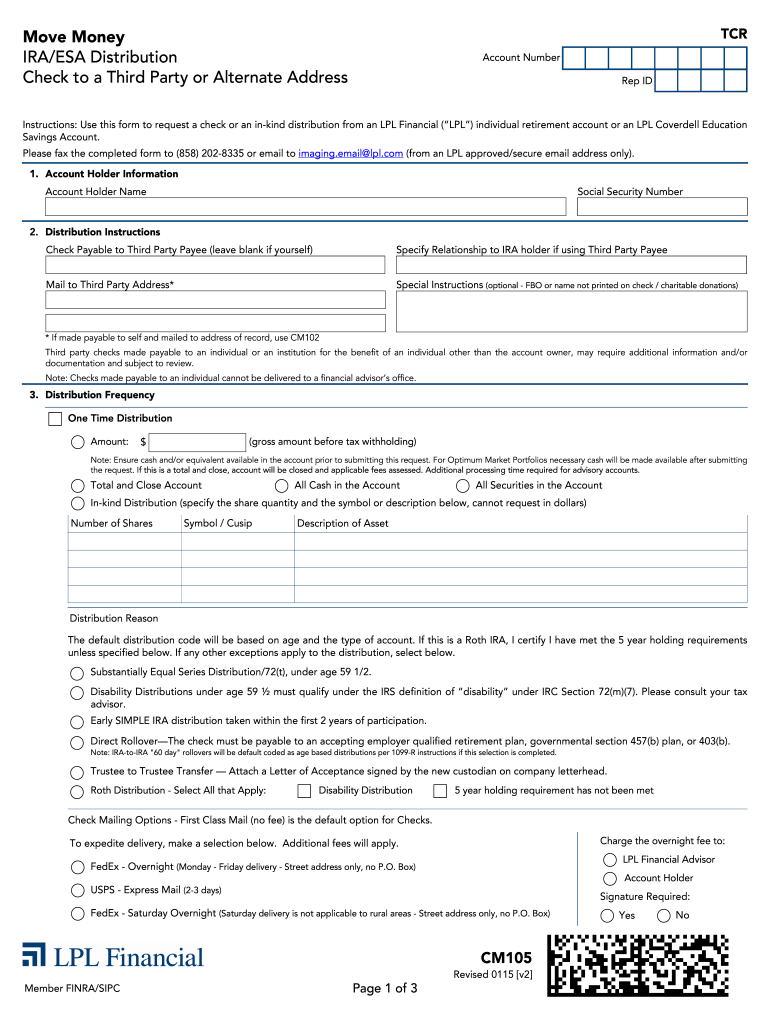

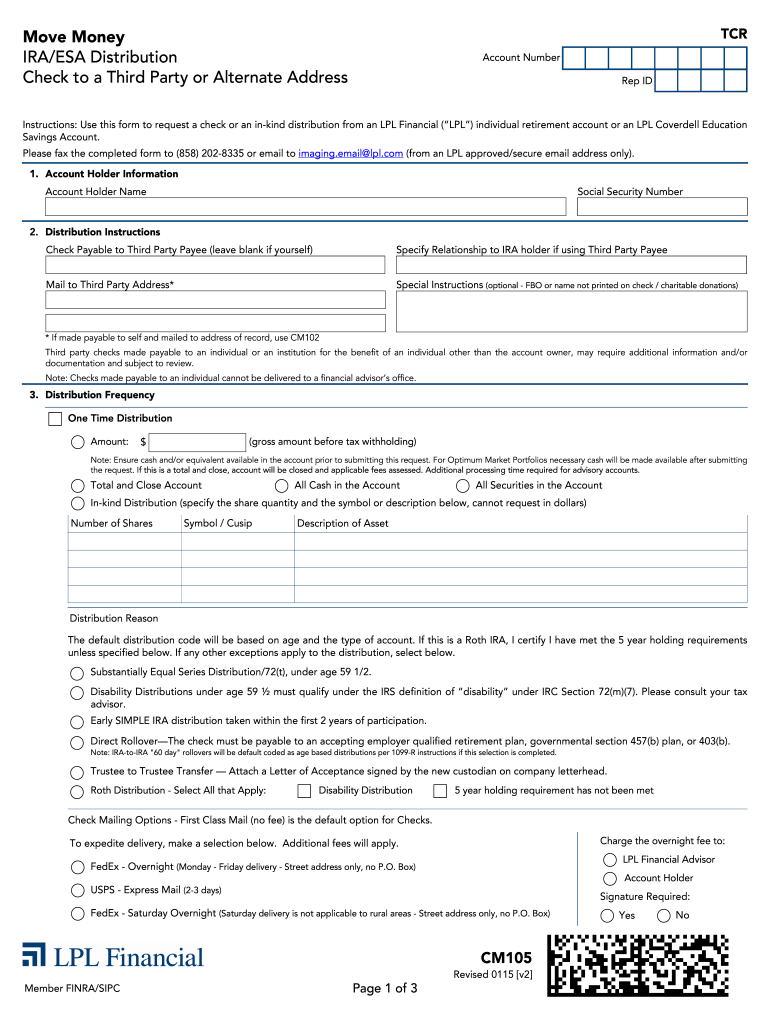

What is LPL Financial CM105?

Who is required to file LPL Financial CM105?

How to fill out LPL Financial CM105?

What is the purpose of LPL Financial CM105?

What information must be reported on LPL Financial CM105?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.