India Form for Entry for GST Manual Transactions of Receipt 2017-2025 free printable template

Show details

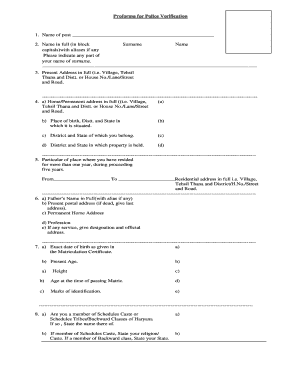

Version 1. 4. 2 dated 30/06/2017 Form for Entry for GST Manual Transactions of Receipt Part A. To be filled by Representative of Vendor / Contractor Recipient 1. Transaction Type 2. Old Invoice No* 3. Station / Office 4. Division 6. Railway Department 5. Zone 7. State 8. Goods and Services Transaction Description e*g* Parcel EFT Sale of Scrap Loco etc* 9. Recipient s Details 9. 1 Name 9. 2 Registered with GSTIN Y/N 9. 3 GSTIN 9. 4 Is Tax Payable on Reverse Charge Basis Y/N 9. 5 State 9. 6...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst manual transaction form

Edit your railway gst form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your entry gst manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form entry gst manual online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit goods services tax manual form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out entry gst manual form

How to fill out India Form for Entry for GST Manual Transactions of Receipt

01

Obtain the India Form for Entry for GST Manual Transactions of Receipt.

02

Fill in the details of the supplier, including name, address, and GSTIN.

03

Enter the date of the transaction and the receipt number.

04

Provide details of the goods or services received, including description and quantity.

05

Input the applicable GST rates and calculate the total GST amount.

06

Include any additional charges, if applicable.

07

Sign and date the form to certify the information provided.

Who needs India Form for Entry for GST Manual Transactions of Receipt?

01

Businesses and professionals registered for GST in India.

02

Entities that perform manual transactions requiring GST documentation.

03

Individuals who need to maintain record of receipts for compliance purposes.

Video instructions and help with filling out and completing form gst manual

Instructions and Help about form for entry for gst manual transaction of receipt

NOW ONLINE UTILITY AVAILABLE, WATCH HOW to FILL ONLINE TRAN-1 https://youtu.be/kAgNEQfShK4 NOW ONLINE UTILITY AVAILABLE, WATCH HOW to FILL ONLINE TRAN-1 https://youtu.be/kAgNEQfShK4 NOW ONLINE UTILITY AVAILABLE, WATCH HOW to FILL ONLINE TRAN-1 https://youtu.be/kAgNEQfShK4 NOW ONLINE UTILITY AVAILABLE, WATCH HOW to FILL ONLINE TRAN-1 https://youtu.be/kAgNEQfShK4

Fill

gst manual receipt form

: Try Risk Free

People Also Ask about gst manual transactions

How does GST filing work?

GST return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

Who signs gift tax return for deceased donor?

The donor is responsible for paying the gift tax. However, if the donor does not pay the tax, the person receiving the gift may have to pay the tax. If a donor dies before filing a return, the donor's executor must file the return.

What is the form of GST?

Goods and Services Tax (GST)

What is GST on estate tax return?

The generation-skipping tax (GST), also referred to as the generation-skipping transfer tax, prevents you from deliberately skipping your children in your estate plan in favor of younger generations to bypass potential estate taxes due upon your children's deaths.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form manual transactions?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the gst manual transaction of receipt in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in gst form for railway parcel without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit form gst manual and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the form gst manual electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form gst manual.

What is India Form for Entry for GST Manual Transactions of Receipt?

India Form for Entry for GST Manual Transactions of Receipt is a prescribed format to document manual transactions related to Goods and Services Tax (GST) receipts in India. It is used to ensure proper record-keeping and compliance with GST regulations.

Who is required to file India Form for Entry for GST Manual Transactions of Receipt?

Businesses and individuals who engage in manual transactions subject to GST requirements are required to file the India Form for Entry. This includes registered taxpayers who issue receipts that are not recorded electronically.

How to fill out India Form for Entry for GST Manual Transactions of Receipt?

To fill out the form, gather details such as transaction date, recipient information, description of goods/services, GST amount, and any applicable invoice numbers. Ensure all sections are completed accurately before submission.

What is the purpose of India Form for Entry for GST Manual Transactions of Receipt?

The purpose of the form is to provide a clear, standardized method for documenting manual transactions subject to GST, facilitating easier audits and compliance monitoring by tax authorities.

What information must be reported on India Form for Entry for GST Manual Transactions of Receipt?

The information required includes transaction date, taxpayer details, nature of goods/services, taxable value, GST amount, and any relevant invoice or receipt numbers.

Fill out your form gst manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Gst Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.