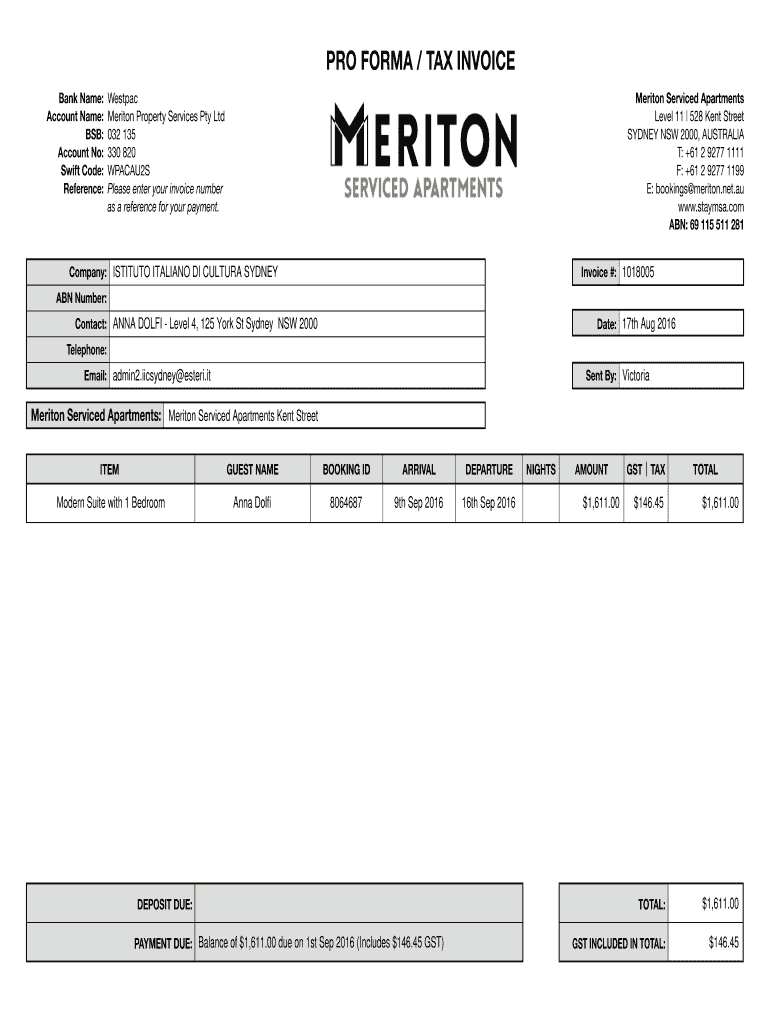

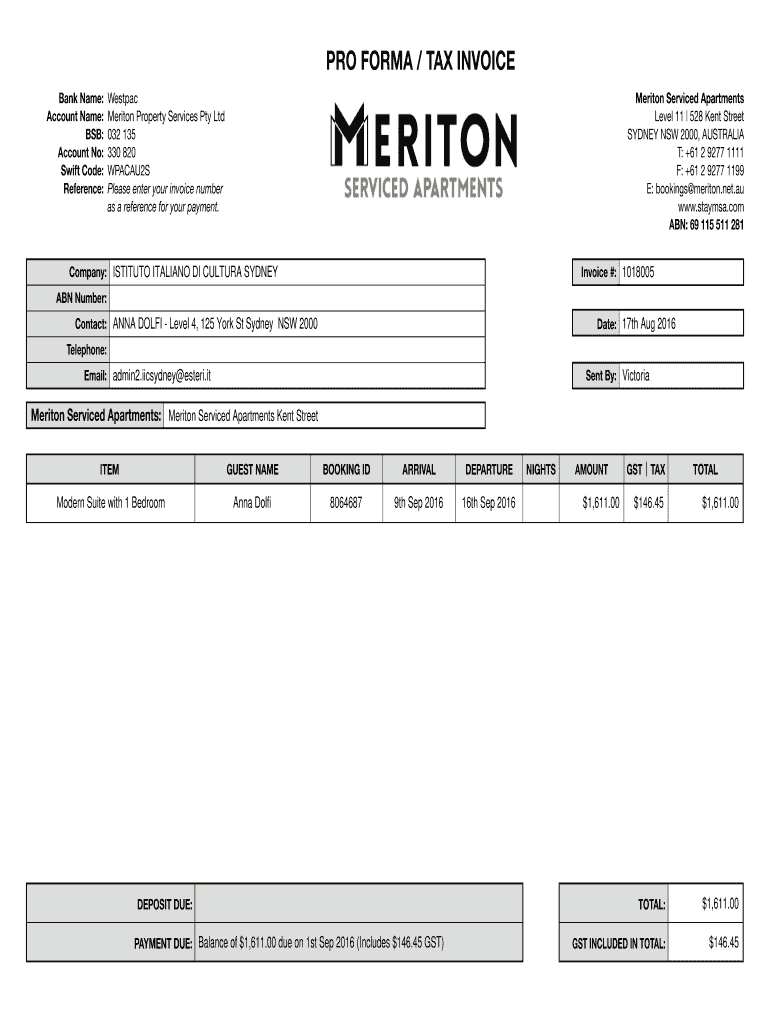

Get the free PRO FORMA / TAX INVOICE

Show details

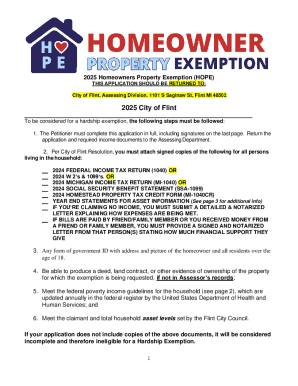

Au www. staymsa.com ABN 69 115 511 281 Company ISTITUTO ITALIANO DI CULTURA SYDNEY Invoice 1018005 ABN Number Contact ANNA DOLFI - Level 4 125 York St Sydney NSW 2000 Date 17th Aug 2016 Telephone Email admin2. 00 due on 1st Sep 2016 Includes 146. 45 GST Powered by TCPDF www. tcpdf.org NIGHTS AMOUNT 1 611. 00 GST TAX TOTAL 146. PRO FORMA / TAX INVOICE Bank Name Westpac Account Name Meriton Property Services Pty Ltd BSB 032 135 Account No 330 820 Swift Code WPACAU2S Reference Please enter your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pro forma tax invoice

Edit your pro forma tax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pro forma tax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pro forma tax invoice online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pro forma tax invoice. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pro forma tax invoice

How to fill out pro forma tax invoice

01

Step 1: Start by filling out your business and customer information at the top of the pro forma tax invoice form.

02

Step 2: Include the details of the goods or services being provided, such as descriptions, quantities, and unit prices.

03

Step 3: Calculate the total amount for each item and include it in the respective column.

04

Step 4: Add any applicable taxes, such as GST or VAT, to the invoice total.

05

Step 5: Provide payment terms and instructions for the customer, including accepted payment methods and due dates.

06

Step 6: Include your business contact information, including address, phone number, and email.

07

Step 7: Double-check all the information filled in the pro forma tax invoice for accuracy and completeness.

08

Step 8: Save a copy of the pro forma tax invoice for your records and send a copy to the customer.

Who needs pro forma tax invoice?

01

Any registered business or individual engaged in the sale of goods or provision of services may need a pro forma tax invoice.

02

Pro forma tax invoices are commonly used in international trade to provide a detailed breakdown of costs and taxes.

03

They are useful for businesses that need to provide invoice estimates before finalizing a sale or shipment.

04

Some countries, such as India, require pro forma tax invoices for specific transactions, such as exports or imports.

05

Individuals or businesses dealing with tax-exempt entities may also use pro forma tax invoices to outline the transaction details without including applicable taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pro forma tax invoice?

The editing procedure is simple with pdfFiller. Open your pro forma tax invoice in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit pro forma tax invoice on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing pro forma tax invoice.

How do I fill out the pro forma tax invoice form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign pro forma tax invoice and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is pro forma tax invoice?

A pro forma tax invoice is a preliminary bill of sale sent to buyers before the actual invoice is issued.

Who is required to file pro forma tax invoice?

Individuals or businesses who engage in taxable transactions are required to file a pro forma tax invoice.

How to fill out pro forma tax invoice?

To fill out a pro forma tax invoice, you need to include details such as seller and buyer information, description of goods or services, quantities, prices, and any applicable taxes.

What is the purpose of pro forma tax invoice?

The purpose of a pro forma tax invoice is to provide a preview of the final invoice before the actual transaction takes place, helping both the seller and buyer to understand the terms of the sale.

What information must be reported on pro forma tax invoice?

Information such as seller and buyer details, description of goods or services, quantities, prices, taxes, and any discounts or offers must be reported on a pro forma tax invoice.

Fill out your pro forma tax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pro Forma Tax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.