Get the free Being a Self Employed Personal Assistant

Show details

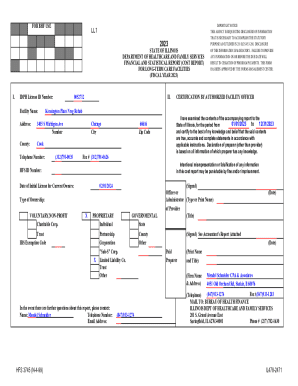

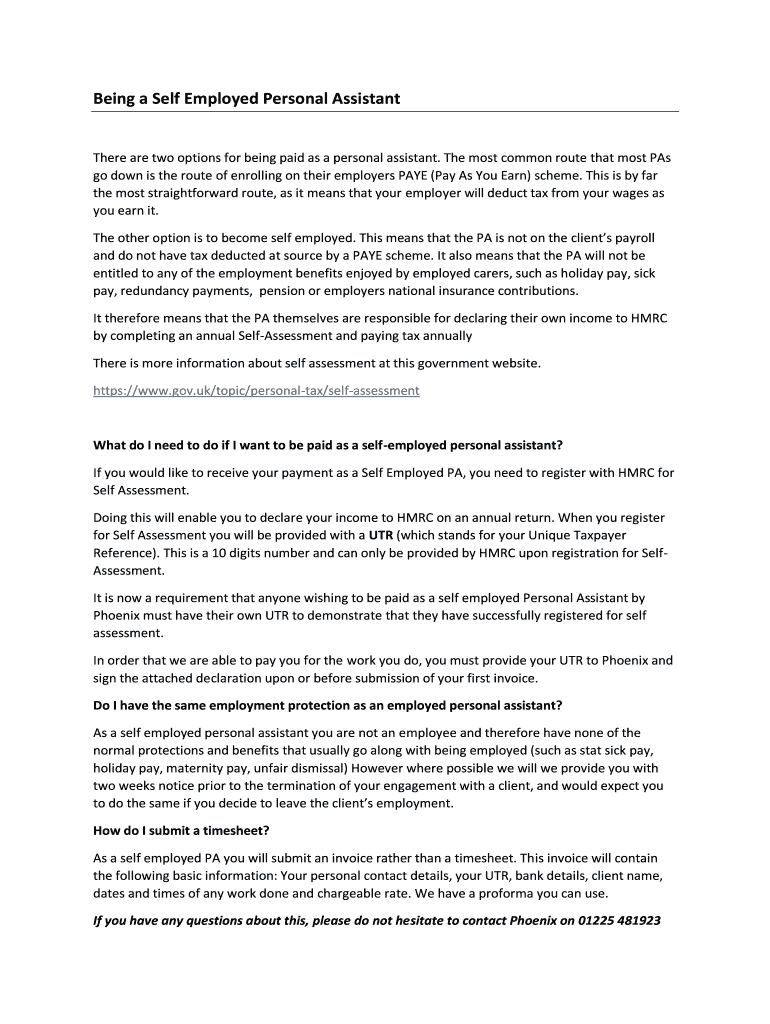

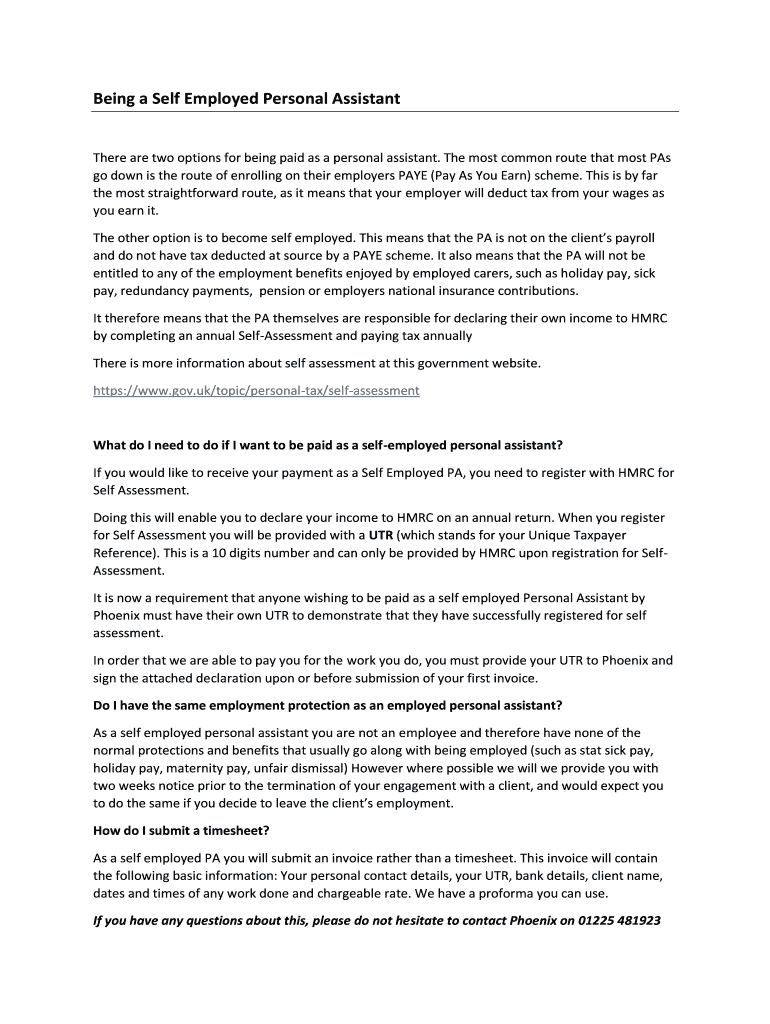

The most common route that most PAs go down is the route of enrolling on their employers PAYE Pay As You Earn scheme. In order that we are able to pay you for the work you do you must provide your UTR to Phoenix and sign the attached declaration upon or before submission of your first invoice. It therefore means that the PA themselves are responsible for declaring their own income to HMRC by completing an annual Self-Assessment and paying tax annually There is more information about self...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign being a self employed

Edit your being a self employed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your being a self employed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit being a self employed online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit being a self employed. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out being a self employed

How to fill out being a self employed

01

To fill out being a self-employed, follow these steps:

02

Determine your business structure: Decide whether you want to operate as a sole proprietor, partnership, or limited liability company (LLC).

03

Register your business: Visit your local government office or website to register your business name, obtain an employer identification number (EIN), and acquire any necessary permits or licenses.

04

Set up a separate business bank account: Keeping your personal and business finances separate is crucial for proper accounting.

05

Track your income and expenses: Use accounting software or a spreadsheet to keep track of your earnings and expenses. This will help with accurate tax filing.

06

Pay estimated taxes: As a self-employed individual, you are responsible for paying your own taxes. Estimate your tax liability and make quarterly payments to avoid penalties.

07

File your tax returns: Complete and file your annual tax returns, including Schedule C or other applicable forms to report your self-employment income and deductions.

08

Keep thorough records: Maintain organized records of all your business activities, invoices, receipts, and any other relevant documents.

09

Consider hiring a professional: If you find the process overwhelming, consider hiring a tax professional or accountant who specializes in self-employment to assist you in managing your taxes and finances.

Who needs being a self employed?

01

Being self-employed is suitable for various individuals including:

02

- Freelancers and independent contractors: Those who offer services or work on a project basis.

03

- Small business owners: Individuals who own and operate their own small businesses.

04

- Consultants and professionals: Experts in a particular field who provide consulting or professional services.

05

- Artists and creatives: Individuals involved in artistic endeavors, such as writers, musicians, photographers, etc.

06

- Digital nomads and remote workers: People who work remotely and have location-independent careers.

07

- Individuals seeking flexibility and autonomy: Those who prefer having control over their work schedules and choosing their projects.

08

- Those looking for additional income: Being self-employed can be a way to supplement one's regular employment and earn extra money.

09

- Entrepreneurs: Individuals starting their own businesses and ventures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit being a self employed from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including being a self employed, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete being a self employed online?

With pdfFiller, you may easily complete and sign being a self employed online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit being a self employed straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing being a self employed.

What is being a self employed?

Being self-employed means working for yourself rather than an employer.

Who is required to file being a self employed?

Those who work for themselves and earn income from their business activities are required to file as self-employed.

How to fill out being a self employed?

To fill out being self-employed, you will need to report your income, expenses, and deductions related to your business.

What is the purpose of being a self employed?

The purpose of being self-employed is to accurately report your income and expenses for tax purposes.

What information must be reported on being a self employed?

You must report all income earned from self-employment, as well as any deductible business expenses.

Fill out your being a self employed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Being A Self Employed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.