Get the free VAT on property claims

Show details

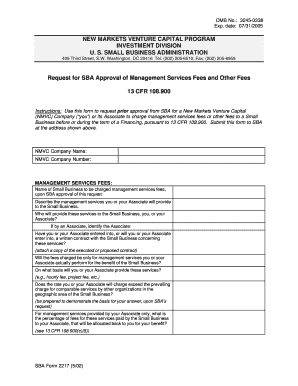

VAT on property claims By John Carey BSc MRICS ACILA Crawford Company CILA Property Special Interest Group June 2017 Introduction The purpose of this short paper is to give an insight into VAT as it affects property claims. The basic premise for input VAT to be recovered is that VAT is charged on outputs which are generated using the input on which VAT is sought to be recovered. HMRC VAT Registration Thresholds updated 1st April 2016 Where an entity has a mix of both taxable3 and exempted...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat on property claims

Edit your vat on property claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat on property claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat on property claims online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vat on property claims. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat on property claims

How to fill out vat on property claims

01

Start by gathering all the necessary documents related to your property claim.

02

Look for the VAT registration number of the property owner.

03

Calculate the VAT amount to be claimed on the property expenses.

04

Prepare the VAT claim form, providing all the required details.

05

Attach the supporting documents and receipts for the claimed VAT amount.

06

Double-check all the information and calculations in the claim form.

07

Submit the completed VAT claim form to the tax authority or relevant department.

08

Keep a copy of the submitted claim form and supporting documents for your records.

09

Await the response from the tax authority regarding the acceptance and processing of your VAT claim.

10

Follow up with any additional documentation or clarification if requested by the tax authority.

11

In case of approval, ensure the credited VAT amount is correctly reflected in your tax records.

12

If the VAT claim is denied, review the reasons for rejection and take appropriate action if necessary.

Who needs vat on property claims?

01

Individuals or businesses who have paid VAT on expenses related to the acquisition or improvement of a property.

02

Property owners who are registered for VAT and are eligible to claim VAT on their property expenses.

03

Contractors or builders who have incurred VAT on construction or renovation costs of a property.

04

Real estate developers or investors who have paid VAT on the purchase or development of properties.

05

Any person or entity involved in a property transaction where VAT has been incurred on related expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify vat on property claims without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including vat on property claims. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the vat on property claims in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your vat on property claims in seconds.

How do I edit vat on property claims on an Android device?

You can make any changes to PDF files, like vat on property claims, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is vat on property claims?

The VAT on property claims is a tax levied on certain property transactions in some countries.

Who is required to file vat on property claims?

Individuals or businesses involved in property transactions are required to file VAT on property claims.

How to fill out vat on property claims?

VAT on property claims can be filled out by providing specific information about the property transaction and the corresponding VAT amount.

What is the purpose of vat on property claims?

The purpose of VAT on property claims is to collect tax revenue from property transactions and to ensure compliance with tax laws.

What information must be reported on vat on property claims?

Information such as the property value, transaction amount, VAT rate, and seller/buyer details must be reported on VAT on property claims.

Fill out your vat on property claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat On Property Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.