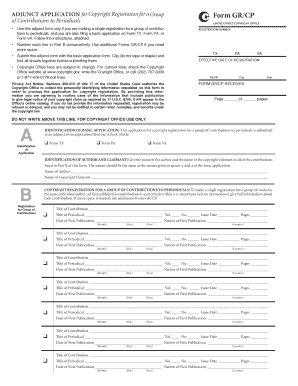

Get the free Bihar Value Added Tax Rules, 2005

Show details

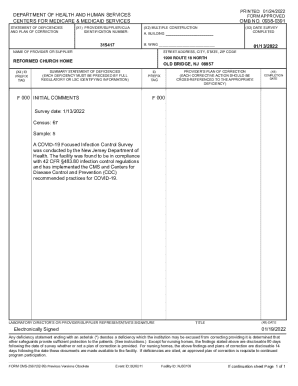

Page - 1 Bihar Value Added Tax Rules 2005 24th March 2005 S.O. 26 dated 24th March 2005 In exercise of the powers conferred by section 93 of the Bihar Value Added Tax Act 2005 the Governor of Bihar hereby makes the following rule Short title and commencement These rules may be called Bihar Value Added Tax Rules 2005. The portion of the challan marked Original shall be sent by the Treasury Officer to the concerned circle incharge. Name of the purchaser who is entitled for refund of tax under...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bihar value added tax

Edit your bihar value added tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bihar value added tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bihar value added tax online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bihar value added tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bihar value added tax

How to fill out bihar value added tax

01

Step 1: Collect all necessary information and documents such as business details, turnover, purchase details, sales details, etc.

02

Step 2: Register for Bihar Value Added Tax (VAT) by filling out the registration form and submitting it online or at the nearest VAT office.

03

Step 3: Obtain the required certificates/permits for VAT registration.

04

Step 4: Maintain proper books of accounts and records of all transactions related to VAT.

05

Step 5: Calculate the VAT liability by applying the prescribed rate on taxable turnover.

06

Step 6: Fill out the VAT return form with accurate details of sales, purchases, and other relevant information.

07

Step 7: Submit the completed VAT return form along with the necessary supporting documents to the relevant VAT office.

08

Step 8: Pay the VAT liability within the specified due dates.

09

Step 9: Keep track of any changes in VAT rates or regulations and comply with them accordingly.

10

Step 10: Regularly review and reconcile VAT returns to ensure accuracy and compliance.

11

Step 11: Seek professional guidance from a tax consultant or expert, if needed.

Who needs bihar value added tax?

01

Businesses registered in Bihar and engaged in buying, selling, or manufacturing goods are required to pay Bihar Value Added Tax (VAT).

02

Traders, manufacturers, retailers, wholesalers, and service providers fall under the purview of Bihar VAT.

03

Individuals or entities involved in inter-state sales or purchases of goods may also require Bihar VAT registration.

04

It is essential for businesses with an annual turnover above the threshold set by the Bihar government to register for and comply with Bihar Value Added Tax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bihar value added tax from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like bihar value added tax, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in bihar value added tax?

The editing procedure is simple with pdfFiller. Open your bihar value added tax in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the bihar value added tax electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your bihar value added tax.

What is bihar value added tax?

Bihar Value Added Tax (VAT) is a tax levied on the sale of goods in the state of Bihar.

Who is required to file bihar value added tax?

Businesses selling goods in Bihar are required to file Bihar Value Added Tax.

How to fill out bihar value added tax?

To file Bihar Value Added Tax, businesses need to collect details of their sales and purchases, calculate the tax liability, and submit the tax return online or offline.

What is the purpose of bihar value added tax?

The purpose of Bihar Value Added Tax is to generate revenue for the state government and to tax consumption of goods.

What information must be reported on bihar value added tax?

Businesses must report details of their sales, purchases, tax liability, and any exemptions or deductions claimed.

Fill out your bihar value added tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bihar Value Added Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.