Get the free Manager, Payroll Services

Show details

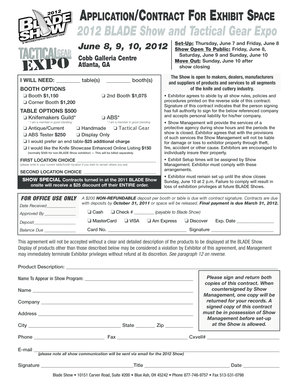

School district payroll experience is highly desirable and Oracle/PeopleSoft experience is preferred. Required Testing Certificates Continuing Educ./Training Clearances FLSA State Exempt Salary Range Classified Management Grade 44 Personnel Commission Approved October 19 2016. Interprets and analyzes State and Federal laws regulations and established policies for the purpose of assuring compliance with all payroll related matters. Supervises and evaluates assigned staff for the purpose of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manager payroll services

Edit your manager payroll services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manager payroll services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manager payroll services online

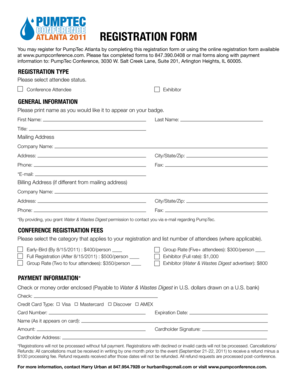

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit manager payroll services. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manager payroll services

How to fill out manager payroll services

01

Gather all relevant employee information, such as names, addresses, social security numbers, and tax withholdings.

02

Determine the pay period for which you are filling out the payroll services.

03

Calculate the wages and deductions for each employee based on their hours worked, salary, and any applicable tax or benefit calculations.

04

Input the employee information and corresponding wages into the payroll software or system.

05

Verify the accuracy of the payroll data before finalizing and submitting it.

06

Generate payroll reports, such as pay stubs or summary reports, for record-keeping purposes.

07

Distribute employee salaries through direct deposit or by printing physical paychecks.

08

Ensure compliance with federal and state tax laws by withholding and remitting payroll taxes.

09

Keep thorough documentation of all payroll records for future reference or audits.

10

Periodically review and update payroll services to accommodate any changes in employees, wages, or regulations.

Who needs manager payroll services?

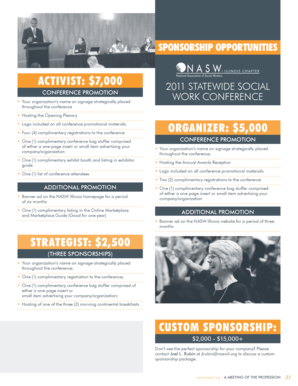

01

Small and medium-sized businesses that have employees and want to ensure accurate and timely payment of wages.

02

Companies that want to streamline their payroll processes and reduce manual paperwork.

03

Business owners who prefer to outsource payroll tasks to specialized manager payroll service providers.

04

Employers who want to comply with all relevant tax regulations and avoid penalties or fines.

05

Organizations that require detailed and reliable payroll reports for financial analysis and planning.

06

Entrepreneurs who want to focus on core business activities and delegate payroll responsibilities to professionals.

07

Companies aiming to maintain employee satisfaction by ensuring on-time and accurate payroll services.

08

Businesses looking to enhance data security and confidentiality related to payroll information.

09

Employers working with a diverse workforce and needing assistance with handling different tax withholdings and benefit plans.

10

Companies wishing to stay updated with current payroll laws and regulations without investing significant time and resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my manager payroll services in Gmail?

manager payroll services and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get manager payroll services?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific manager payroll services and other forms. Find the template you need and change it using powerful tools.

How do I edit manager payroll services straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing manager payroll services, you need to install and log in to the app.

What is manager payroll services?

Manager payroll services involve managing and processing employee payroll, including calculating wages, deductions, and issuing paychecks.

Who is required to file manager payroll services?

Employers who have employees and pay them wages are required to file manager payroll services.

How to fill out manager payroll services?

To fill out manager payroll services, employers need to collect employee payroll information, calculate wages and deductions, and ensure accurate payment distribution.

What is the purpose of manager payroll services?

The purpose of manager payroll services is to ensure that employees are paid accurately and timely, and that all payroll taxes and deductions are handled properly.

What information must be reported on manager payroll services?

Information such as employee names, hours worked, wages earned, deductions, and taxes withheld must be reported on manager payroll services.

Fill out your manager payroll services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manager Payroll Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.