IN State Form 4008 2017 free printable template

Show details

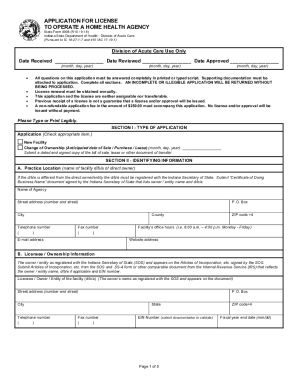

O. Box 7236 INDIANAPOLIS INDIANA 46207 Home Health Statute IC 16-27-1-7 The state department shall adopt rules under IC 4-22-2 to do the following 1 Protect the health safety and welfare of patients. 2 Govern the qualifications of applicants for licenses. 3 Govern the operating policies supervision and maintenance of service records of home health agencies. A or V. A. of this application an affidavit must be submitted with the application affirming that said person s has/have been given the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN State Form 4008

Edit your IN State Form 4008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN State Form 4008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN State Form 4008 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IN State Form 4008. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN State Form 4008 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN State Form 4008

How to fill out IN State Form 4008

01

Obtain IN State Form 4008 from the official state website or local government office.

02

Read the form instructions carefully to understand each section.

03

Fill out your personal information in the designated fields, including name, address, and contact information.

04

Provide the necessary financial information as required by the form.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate state agency as per the instructions provided.

Who needs IN State Form 4008?

01

Individuals who are applying for a specific state benefit or financial assistance.

02

Residents of Indiana who meet the eligibility criteria set forth by the program associated with Form 4008.

03

Those who are required to report income, expenses, or other financial details for state programs.

Fill

form

: Try Risk Free

People Also Ask about

Where to find Indiana state tax forms?

Find forms online at our Indiana tax forms website, order by phone, at 317-615-2581 (leave your order on voice mail, available 24 hours a day).

Can I view my tax forms online?

Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

Does Indiana have a state tax form?

Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state and/or county income tax. Print or type your full name, Social Security number or ITIN and home address.

Does Indiana have a state W 4?

WH-4 Indiana State Tax Withholding Form (pdf) - All employees should complete Form WH-4 to ensure that the correct State income tax is withheld from your pay. Depending on the county in which you reside, you may have also have county tax withheld from your pay.

Where can I find Indiana state tax forms?

Find forms online at our Indiana tax forms website, order by phone, at 317-615-2581 (leave your order on voice mail, available 24 hours a day).

What is a wh 4 form for indiana?

WH-4 Indiana State Tax Withholding Form (pdf) - All employees should complete Form WH-4 to ensure that the correct State income tax is withheld from your pay. Depending on the county in which you reside, you may have also have county tax withheld from your pay.

What is A or 40 tax form?

2022 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

How much should I withhold for taxes Indiana?

Overview of Indiana Taxes Indiana has a flat tax rate, meaning you're taxed at the same 3.23% rate regardless of your income level or filing status.

Are employers required to withhold Indiana county taxes?

Indiana employers are required to withhold both state and county taxes from employees' wages, generally. Employers have to register to withhold tax in Indiana and must have an Employer Identification Number issued by the federal government.

Where do I file my IT 40 in Indiana?

Go to the Indiana Department of Revenue site to submit your payment. Make sure you choose "Individual Tax Return (IT-40)", and then select the correct tax year and filing status.

Where do I get Indiana state tax forms?

Find forms online at our Indiana tax forms website, order by phone, at 317-615-2581 (leave your order on voice mail, available 24 hours a day).

What is a it40?

Full-year residents must file Form IT-40, Indiana Full-Year Resident Individual Income Tax Return or Form IT-40EZ for Full-Year Indiana Resident Filers with No Dependents.

Does Indiana have State income tax form?

Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state and/or county income tax. Print or type your full name, Social Security number or ITIN and home address.

What is a wh 3 form for Indiana?

What's a WH-3? The WH-3 (Annual Withholding Reconciliation Form) is a reconciliation form for the amount of state and county income taxes withheld throughout the year. All employers must file the WH-3 by January 31 each year.

What is a wh 1 form for Indiana?

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. When completed correctly, this form ensures that a business's withholding taxes by county are reported accurately and timely.

How do I file my Indiana state taxes?

You have the option to file and pay your tax return online. If you prefer to pay by mail, you can mail a copy of your official tax documents and your completed tax forms to Indianapolis. Low income individuals may request filing assistance from their local Department of Revenue location.

Does Indiana have a state tax return?

If you were a full-year resident of Indiana and your gross income (the total of all your income before deductions) was more than your total exemptions claimed, then you must file an Indiana tax return. A general rule of thumb is to file Indiana state taxes if your income is $1,000 or more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IN State Form 4008 online?

The editing procedure is simple with pdfFiller. Open your IN State Form 4008 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete IN State Form 4008 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IN State Form 4008 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit IN State Form 4008 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share IN State Form 4008 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is IN State Form 4008?

IN State Form 4008 is a form used in the state of Indiana for reporting and remitting sales tax for certain businesses. It is primarily used for income tax withholding for employers.

Who is required to file IN State Form 4008?

Employers in Indiana that are required to withhold state income tax from employees' wages must file IN State Form 4008.

How to fill out IN State Form 4008?

To fill out IN State Form 4008, gather necessary information such as your Employer Identification Number (EIN), total wages paid, and total state income tax withheld. Then, accurately enter this information into the form according to the provided instructions.

What is the purpose of IN State Form 4008?

The purpose of IN State Form 4008 is to report the amount of state income tax withheld from employee wages and to remit that amount to the Indiana Department of Revenue.

What information must be reported on IN State Form 4008?

IN State Form 4008 requires reporting the business's name, address, EIN, total wages paid during the reporting period, and the total amount of state income tax withheld from employees' wages.

Fill out your IN State Form 4008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN State Form 4008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.