Get the free Motor Insurance in India to 2016 Market Databook

Show details

Brochure More information from http://www.researchandmarkets.com/reports/2190325/ Motor Insurance in India to 2016: Market Datebook Description: Synopsis Ti metric s 'Motor Insurance in India to 2016:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor insurance in india

Edit your motor insurance in india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor insurance in india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

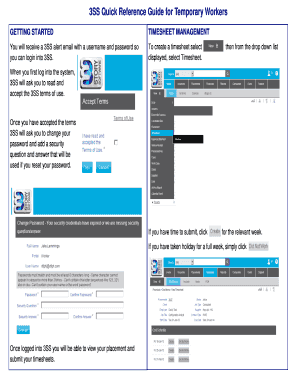

How to edit motor insurance in india online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor insurance in india. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor insurance in india

How to fill out motor insurance in India?

01

Firstly, gather all the necessary documents such as vehicle registration certificate, driving license, previous insurance policy documents, and any other relevant documents required by the insurance company.

02

Choose the type of motor insurance you require. In India, there are two types of motor insurance - third-party liability insurance and comprehensive insurance. Third-party liability insurance is mandatory by law, whereas comprehensive insurance provides coverage for both third-party liability and damages to your own vehicle.

03

Research and compare insurance policies from different insurance companies. Consider factors such as premium rates, coverage options, claim settlement ratio, and customer reviews. Choose the insurance policy that best suits your requirements.

04

Fill out the motor insurance application form accurately. Provide all the necessary details about yourself, your vehicle, and any additional drivers. Make sure to disclose all relevant information about the vehicle's usage, modifications, and any previous accidents.

05

Choose the desired coverage options and add-ons. Additional coverage options like personal accident cover, zero depreciation cover, and engine protection cover can be selected based on your preferences and requirements. Carefully read the policy terms and conditions to understand the coverage and exclusions.

06

Calculate the premium amount payable for the chosen motor insurance policy. Premium is calculated based on factors like the age of the vehicle, your age and driving experience, location, and usage patterns. Some insurance companies also offer discounts for installing anti-theft devices or being a member of automobile associations.

07

Make the payment for the insurance premium. Insurance companies provide various payment options such as online payment, NEFT transfer, credit/debit card payment, or through authorized agents. Ensure that you receive a valid premium payment receipt for future reference.

Who needs motor insurance in India?

01

Anyone who owns a motor vehicle in India is legally required to have third-party liability insurance. This is mandated by the Motor Vehicles Act, 1988. Whether it is a two-wheeler, car, commercial vehicle, or any other vehicle, having third-party liability insurance is mandatory.

02

Apart from the legal obligation, motor insurance is crucial for financial protection. Accidents can happen at any time, and having comprehensive motor insurance gives you coverage against damages caused by accidents, natural disasters, theft, and other unforeseen events. It provides financial assistance for repairs, medical expenses, and compensation for third-party damages.

03

Motor insurance is not only for vehicle owners but also for anyone who drives a vehicle. If you frequently borrow or use someone else's vehicle, it is advisable to have personal motor insurance to protect yourself and the vehicle in case of an accident.

In conclusion, filling out motor insurance in India involves gathering the necessary documents, choosing the right type of insurance, comparing policies, filling out the application form accurately, selecting coverage options, calculating the premium, and making the payment. Motor insurance is essential for vehicle owners and drivers to meet legal requirements and ensure financial protection in case of accidents or damages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is motor insurance in India?

Motor insurance in India provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could arise from accidents.

Who is required to file motor insurance in India?

All vehicle owners in India are required to have motor insurance.

How to fill out motor insurance in India?

To fill out motor insurance in India, one must provide personal details, vehicle information, and choose the type of coverage required.

What is the purpose of motor insurance in India?

The purpose of motor insurance in India is to provide financial protection in case of accidents involving vehicles.

What information must be reported on motor insurance in India?

Information such as personal details, vehicle registration number, make and model of vehicle, coverage type, and premium amount must be reported on motor insurance in India.

How do I complete motor insurance in india online?

pdfFiller has made it simple to fill out and eSign motor insurance in india. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit motor insurance in india straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing motor insurance in india right away.

Can I edit motor insurance in india on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign motor insurance in india on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your motor insurance in india online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Insurance In India is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.