Get the free Receipt / Invoice No

Show details

Edu Title IX/Equity and ADA/Section 504 Coordinator Flint River Campus and Taylor County Center Adrienne Kendall 1533 Highway 19 South Thomaston GA 30286 706 646-6224 akendall sctech. Edu. Any complaints filed against the Title IX/ Equity Coordinator or ADA/Section 504 Coordinator on any campus/center shall be handled by Xenia Johns 501 Varsity Road Griffin GA 30223 770 228-7348 xjohns sctech. Edu ADA/Section 504 Coordinator Griffin Campus Butts County Center and the Jasper County Center...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receipt invoice no

Edit your receipt invoice no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receipt invoice no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit receipt invoice no online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit receipt invoice no. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receipt invoice no

How to fill out receipt invoice no

01

Start by gathering all the necessary information such as the company name, address, and contact details.

02

Make sure you have the invoice number that needs to be filled out. This number is usually provided by the company or organization issuing the invoice.

03

Write the invoice number in the designated field on the receipt invoice. This field is typically labeled as 'Invoice Number' or 'Invoice No.'

04

Double-check the accuracy of the invoice number before proceeding.

05

If there are any additional details required for the invoice, such as purchase order numbers or project references, ensure that you include them in the appropriate fields on the receipt invoice.

06

Once you have completed filling out the receipt invoice, review all the information entered to make sure it is accurate and complete.

07

Sign and date the receipt invoice, if necessary, to validate its authenticity.

08

Keep a copy of the filled-out receipt invoice for your records.

09

Submit the receipt invoice to the relevant party as instructed, whether it is an employer, client, or organization.

10

If you have any doubts or questions about filling out the receipt invoice, don't hesitate to seek assistance from the issuing company or consult relevant guidelines or resources.

Who needs receipt invoice no?

01

Businesses: Businesses of all sizes need receipt invoice numbers to keep track of financial transactions and for accounting purposes.

02

Customers: Customers who make purchases or receive services from companies or individuals may require receipt invoice numbers for record-keeping, reimbursement, or tax purposes.

03

Self-employed individuals: Freelancers, independent contractors, and self-employed professionals often need receipt invoice numbers to bill their clients and keep track of income.

04

Organizations: Non-profit organizations, government agencies, and other entities may require receipt invoice numbers for budgeting, auditing, and financial reporting purposes.

05

Accountants and bookkeepers: Professionals in the accounting and bookkeeping industry need receipt invoice numbers to maintain accurate financial records for their clients.

06

Legal and regulatory authorities: Authorities responsible for enforcing tax regulations, financial compliance, or legal proceedings may request receipt invoice numbers as part of their processes.

07

Insurance companies: Insurance providers may require receipt invoice numbers to process claims and verify policyholder payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the receipt invoice no in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your receipt invoice no in seconds.

Can I create an electronic signature for signing my receipt invoice no in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your receipt invoice no right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit receipt invoice no on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share receipt invoice no from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

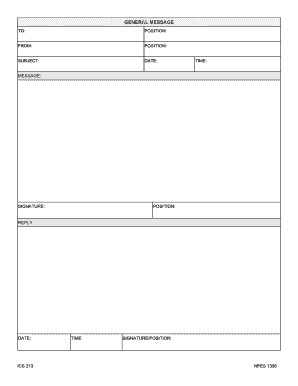

What is receipt invoice no?

Receipt invoice no is a unique number assigned to a documented transaction that serves as proof of payment.

Who is required to file receipt invoice no?

Businesses or individuals who issue invoices or receipts for goods or services provided are required to file receipt invoice no.

How to fill out receipt invoice no?

Receipt invoice no should be filled out with the necessary information including the date of transaction, description of goods or services, amount paid, and any applicable taxes.

What is the purpose of receipt invoice no?

The purpose of receipt invoice no is to track and record financial transactions for accounting and tax purposes.

What information must be reported on receipt invoice no?

Information required on receipt invoice no includes the names and addresses of the seller and buyer, description of goods or services, quantity, price, and total amount.

Fill out your receipt invoice no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receipt Invoice No is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.