Get the free CC2017-02 PAYROLL SERVICES AND HUMAN RESOURCE INFORMATION SYSTEMS SERVICES FOR THE D...

Show details

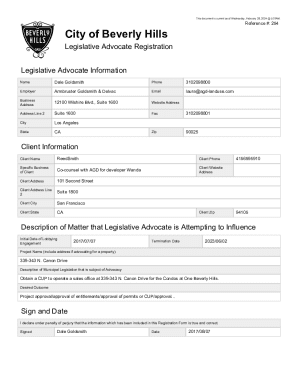

HOLLY NEW JERSEY 08060 FLORHAM PARK NEW JERSEY 07932 CHELMSFORD MA 01824 APLHARETTA GA 3005 DALLAS TX 75257 BRAIN BECKERT NEIL JESANI JERRY HAMPTON DAVID POTTER WELSEY WITHERINGTON PETER VAJTAY WINNIE CHU TELEPHONE 215-701-9400 1-800-972-8020 609-668-6452 609-308-0466 973-331-5465 732-343-2072 214-880-009 FAX 215-701-1922 732-508-3624 609298-6742 973-360-0699 N/A 214-880-9914 E-MAIL BBECKERT CLEARPAYR OLLSOLUTION.COM NEILJ PINEAPPLEHR.COM JHAMPTON PRIMEPOINT. CC2017-02 PAYROLL SERVICES AND...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cc2017-02 payroll services and

Edit your cc2017-02 payroll services and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cc2017-02 payroll services and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cc2017-02 payroll services and online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cc2017-02 payroll services and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cc2017-02 payroll services and

How to fill out cc2017-02 payroll services and

01

To fill out the cc2017-02 payroll services, follow these steps:

02

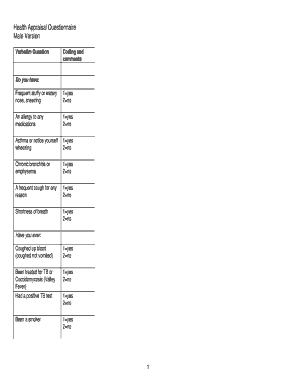

Begin by entering the employee's personal information, including their full name, address, and contact details.

03

Next, provide the employee's tax information, such as their Social Security Number or tax identification number.

04

Specify the employee's pay rate, hours worked, and any overtime or bonus payments they are entitled to.

05

Calculate the employee's gross pay by multiplying their hours worked by their pay rate and adding any additional payments.

06

Deduct any applicable taxes or withholdings from the employee's gross pay, such as federal income tax or Social Security contributions.

07

Subtract any voluntary deductions the employee has requested, such as health insurance premiums or retirement contributions.

08

Determine the employee's net pay by subtracting the total deductions from the gross pay.

09

Record the net pay amount in the appropriate field on the cc2017-02 payroll services form.

10

Finally, review the completed form for accuracy and ensure all necessary information is included before submitting it for processing.

Who needs cc2017-02 payroll services and?

01

cc2017-02 payroll services are beneficial for various entities, including:

02

- Small businesses with employees who need assistance in calculating payroll and ensuring compliance with tax regulations.

03

- Organizations that want to streamline their payroll processes and automate the calculation of wages and deductions.

04

- Accountants or payroll service providers who handle payroll responsibilities for multiple clients and require a standardized form.

05

- Individuals or households employing domestic help or caregivers who need a structured method for managing wages and tax obligations.

06

- Any entity seeking a comprehensive record of payroll information for accurate financial reporting and analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cc2017-02 payroll services and on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing cc2017-02 payroll services and, you can start right away.

How do I fill out the cc2017-02 payroll services and form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign cc2017-02 payroll services and. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete cc2017-02 payroll services and on an Android device?

Complete cc2017-02 payroll services and and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is cc2017-02 payroll services and?

cc2017-02 payroll services is a form used to report payroll information to the relevant authorities.

Who is required to file cc2017-02 payroll services and?

Employers are required to file cc2017-02 payroll services for their employees.

How to fill out cc2017-02 payroll services and?

cc2017-02 payroll services can be filled out online or on paper forms provided by the tax authorities.

What is the purpose of cc2017-02 payroll services and?

The purpose of cc2017-02 payroll services is to ensure accurate reporting and withholding of taxes related to employee wages.

What information must be reported on cc2017-02 payroll services and?

Information such as employee wages, taxes withheld, and other payroll-related data must be reported on cc2017-02 payroll services.

Fill out your cc2017-02 payroll services and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

cc2017-02 Payroll Services And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.