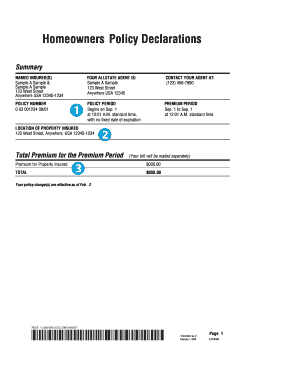

Get the free Installment tax notices are mailed on or before the 1st day of the

Show details

25987 S Tamiami Trl Cape Coral. 1039 SE 9th Ave Fort Myers 2480 Thompson St Lehigh Acres. 3114 Lee Blvd North Fort Myers. Www. facebook. com/LeeCountyTaxCollector Sign up for eNotify at www. leetc.com. DON T WAIT IN LINE PAY ONLINE. The installment application is available at www. leetc.com. WHO TO CONTACT 239. 533. 6000 www. leetc.com Prepares and mails tax notices tax bills Collects property tax payments based on certified rolls received from Property Appraiser and Levying Authority...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign installment tax notices are

Edit your installment tax notices are form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment tax notices are form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing installment tax notices are online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit installment tax notices are. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out installment tax notices are

How to fill out installment tax notices are

01

Collect all the necessary documentation, such as your tax return forms, income statements, and payment receipts.

02

Determine the type of installment tax notice you need to fill out. This can vary depending on your jurisdiction and the specific installment plan you are enrolled in.

03

Read the instructions provided with the installment tax notice carefully to understand the requirements and deadlines.

04

Fill in your personal information, including your name, address, and taxpayer identification number, as requested on the form.

05

Calculate the correct installment amount according to the instructions provided. This may involve dividing your total tax liability into equal payments over a specified period of time.

06

Attach any required supporting documents, such as proof of income or documentation related to deductions or credits claimed.

07

Review all the information you have entered to ensure accuracy and completeness.

08

Sign and date the installment tax notice as required.

09

Send the completed form and any accompanying documents to the appropriate tax authority by the specified deadline.

10

Keep a copy of the filled-out installment tax notice and supporting documents for your records.

Who needs installment tax notices are?

01

Anyone who has a tax liability and cannot pay it in full by the regular deadline may need an installment tax notice.

02

Individuals or businesses facing financial hardship or cash flow issues may choose to pay their taxes in installments.

03

Installment tax notices are particularly useful for self-employed individuals or those with variable income who may have difficulty budgeting for their tax obligations.

04

Some jurisdictions may require certain taxpayers, such as those with high tax liabilities or previous payment delinquencies, to use installment tax notices.

05

If you are unsure whether you need an installment tax notice, it is advisable to consult with a tax professional or contact your local tax authority for guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get installment tax notices are?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific installment tax notices are and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit installment tax notices are on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing installment tax notices are, you need to install and log in to the app.

Can I edit installment tax notices are on an iOS device?

You certainly can. You can quickly edit, distribute, and sign installment tax notices are on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

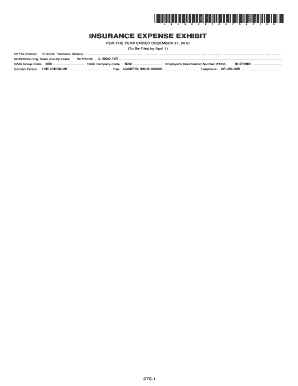

What is installment tax notices are?

Installment tax notices are notices sent to taxpayers informing them of the amount of taxes due and providing information on how the taxes can be paid in installments.

Who is required to file installment tax notices are?

Taxpayers who are unable to pay their taxes in full and wish to request a payment plan are required to file installment tax notices.

How to fill out installment tax notices are?

Installment tax notices can be filled out by providing personal information, details of tax owed, proposed payment plan, and any supporting documentation.

What is the purpose of installment tax notices are?

The purpose of installment tax notices is to help taxpayers who are unable to pay their taxes in full by providing them with a payment plan option.

What information must be reported on installment tax notices are?

Information such as taxpayer's personal details, amount of tax owed, proposed payment plan, and any supporting documentation must be reported on installment tax notices.

Fill out your installment tax notices are online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Installment Tax Notices Are is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.