Get the free Philippine Retail Sales Receipt

Show details

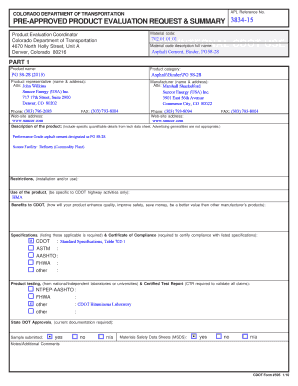

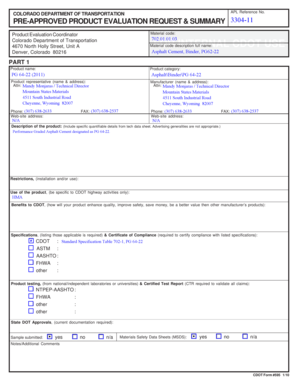

Independent Distributor Philippine Retail Sales Receipt UHS Essential Health Philippines Inc. 24th Floor Tower 1 The Enterprise Center 6766 Ayala Avenue corner Paseo de Roxas Makati City Philippines 1200 distserv ph. A repurchase of a USANA product will establish your satisfaction with previous purchases of that product. Usana.com Customer Service 632 858-4500 Phone Order Line 632 858-4599 Fax Order Line Distributor Name and Address Distributor Phone Method of Payment S O Customer Name L D...

We are not affiliated with any brand or entity on this form

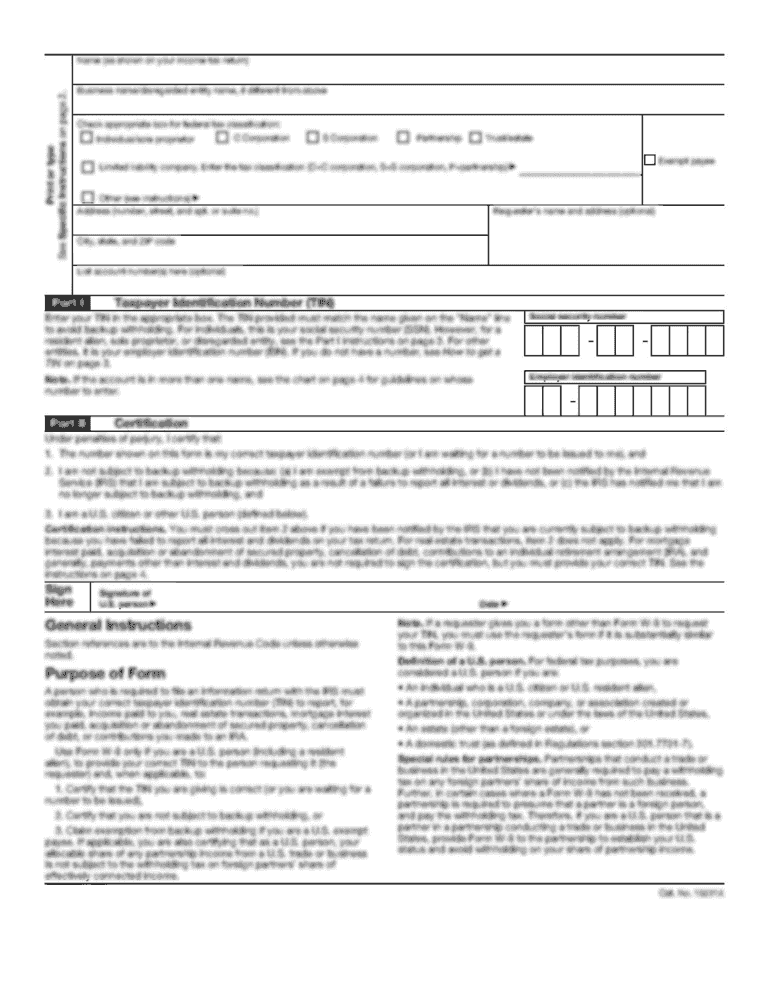

Get, Create, Make and Sign philippine retail sales receipt

Edit your philippine retail sales receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your philippine retail sales receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing philippine retail sales receipt online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit philippine retail sales receipt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out philippine retail sales receipt

How to fill out philippine retail sales receipt:

01

Start by writing the name and address of your business at the top of the receipt.

02

Include the date and time of the transaction.

03

Write the customer's name and address below the business information.

04

Indicate the payment method used (cash, credit card, etc.).

05

List the items purchased, including their description, quantity, and price.

06

Calculate the total amount paid by the customer, including any taxes or discounts.

07

Provide a detailed breakdown of the taxes applied, if applicable.

08

Optionally, include any additional notes or terms of sale.

09

Sign and date the receipt to validate it.

Who needs philippine retail sales receipt:

01

All businesses in the Philippines that engage in retail sales need to issue sales receipts.

02

Individuals or organizations purchasing goods or services from retail establishments in the Philippines require a retail sales receipt as proof of purchase.

03

The Bureau of Internal Revenue (BIR) in the Philippines requires businesses to issue sales receipts for tax purposes. These receipts are necessary for proper record-keeping and compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between sales invoice and official receipt in the Philippines?

Sales invoices are for the sale of goods or property, while official receipts are for the sale of services or leases of property. Both are considered principal evidence for these transactions. In other words, they're definitive proof that they happened.

What is an official receipt in the Philippines?

An official receipt (OR) is proof that a customer has purchased a service over ₱25 from your company. In the Philippines, the law mandates the issuance of OR, as specified in Section 237 of the Tax Code.

How do I issue an official receipt in the Philippines?

How to Fill Out an Official Receipt Calculate and collect the sale. Write down the specifics of the sale. Classify and compute the amount collected. Review all details and sign. List the client's information. Give a unique invoice number. Itemize products sold. Breakdown the total amount due.

How do I make a sales receipt?

What to include on a receipt. Your business name, address, and phone number. Sale date and time. Transaction number. Product or service description. Cost. Tax, if required.

How do I issue a receipt in the Philippines?

How to Get Official Receipt from BIR? Register and get a BIR Form 2303 – Certificate of Registration in BIR RDO. File and pay BIR Form 0605 – Annual Registration Fee. Fill-out BIR Form 1906 – Application for Authority to Print (ATP) Receipts and Invoices. Prepare sample format of the Official Receipt.

How do you issue a receipt?

What information must I put on a receipt? your company's details including name, address, phone number and/or email address. the date of transaction showing date, month and year. a list of products or services showing a brief description of the product and quantity sold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my philippine retail sales receipt in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your philippine retail sales receipt right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit philippine retail sales receipt on an iOS device?

Create, edit, and share philippine retail sales receipt from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out philippine retail sales receipt on an Android device?

Complete philippine retail sales receipt and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is philippine retail sales receipt?

A Philippine retail sales receipt is a document issued by sellers to customers as proof of purchase, detailing the items bought, their prices, and the total amount paid.

Who is required to file philippine retail sales receipt?

Retailers and businesses engaged in selling goods and services in the Philippines are required to issue and file retail sales receipts.

How to fill out philippine retail sales receipt?

To fill out a Philippine retail sales receipt, include the seller's name, business address, Tax Identification Number (TIN), date of sale, description of items sold, quantity, unit price, total amount, and any applicable taxes.

What is the purpose of philippine retail sales receipt?

The purpose of the Philippine retail sales receipt is to provide proof of transaction, facilitate tax reporting, and ensure compliance with tax regulations.

What information must be reported on philippine retail sales receipt?

The information that must be reported on a Philippine retail sales receipt includes the seller's name, TIN, business address, date of sale, item descriptions, quantities, pricing, total amount, and applicable taxes.

Fill out your philippine retail sales receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Philippine Retail Sales Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.