Get the free Return Method: Email

Show details

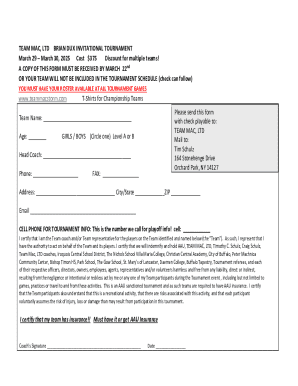

Return Method Email March 22 2017 ALICIA AYERS PO BOX 2326 GREAT FALLS MT 59403 CERTIFICATION LETTER I COREY STAPLETON Secretary of State for the State of Montana do hereby certify that RDI FINANCIAL INC. Corey Stapleton Montana Secretary of State Montana State Capitol. PO Box 202801. Helena Montana 59620-2801 tel 406 444-4195. Filed its Annual Report 2017 with this office and has fulfilled the applicable requirements set forth in law. Certified File Number D212324 - 10828579 Effective Date...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign return method email

Edit your return method email form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your return method email form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing return method email online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit return method email. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out return method email

How to fill out return method email

01

Start by opening your email application or website.

02

Click on the button to compose a new email.

03

In the recipient field, enter the email address of the person or company you are sending the return method email to.

04

Write a concise and clear subject line that indicates the purpose of the email, such as 'Return Method for Product XYZ'.

05

In the body of the email, begin by politely addressing the recipient.

06

Explain the reason for the email, which is to provide them with the return method for a product or service.

07

Clearly and step-by-step, describe the return method that needs to be followed. Use bullet points or numbered lists to make it easy to read and understand.

08

Include any important deadlines or instructions that need to be followed for the return method.

09

Conclude the email by thanking the recipient for their attention and providing any necessary contact information for further assistance.

10

Proofread the email for any errors or inconsistencies before sending it.

11

Click on the 'Send' button to deliver the return method email to the recipient.

Who needs return method email?

01

Customers who want to return a product or service they have purchased.

02

Companies or organizations that have a return policy and require customers to follow a specific method for returning items.

03

Online retailers or e-commerce platforms that need to provide return instructions to their customers.

04

Individuals or businesses that have received a faulty or incorrect item and need to communicate the return method to the sender.

05

Any situation where the return of a product or service needs to be facilitated through email communication.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit return method email from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your return method email into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the return method email in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your return method email in seconds.

Can I edit return method email on an iOS device?

Create, edit, and share return method email from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is return method email?

Return method email is a way to submit your tax return electronically via email.

Who is required to file return method email?

Anyone who is required to file a tax return is eligible to file via return method email.

How to fill out return method email?

You can fill out your tax return using the necessary forms and then submit it via email to the designated address.

What is the purpose of return method email?

The purpose of return method email is to provide a secure and convenient way to file your tax return electronically.

What information must be reported on return method email?

You must report all income, deductions, and credits on your tax return when using return method email.

Fill out your return method email online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Return Method Email is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.