Get the free : T-1099 - mht maryland

Show details

- g- ppwater oint. t 1 l. i. Fairview Pt -. / U -- / t r ti - - II. J. QUAD ST. MLCHAELS MD II. 1r I/ Point O Pmes Mulberrv Point ol P. Return to DHCP/DHCD 100 COMMUNITY PLACE CROWNSVILLE MD 21032 301-514-7600 SKETCH MAP - NOT TO SCALE drawn by Rachel Mancini John Milner Associates Inc. August. Major Bibliographical Reference 10. Geographical Data 5 500 square feet Acreage of nomiated property Quadrangle name UTM Refernces ll Zone I do NOT complete UTM references B iJ Easting Northing lij...

We are not affiliated with any brand or entity on this form

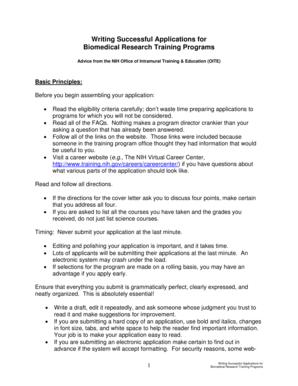

Get, Create, Make and Sign t-1099 - mht maryland

Edit your t-1099 - mht maryland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-1099 - mht maryland form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t-1099 - mht maryland online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t-1099 - mht maryland. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t-1099 - mht maryland

How to fill out t-1099

01

Gather all the necessary information and forms required to complete t-1099. This may include the recipient's name, address, social security number, and the amount of income they received.

02

Make sure you have the correct version of the t-1099 form as per the IRS guidelines.

03

Carefully read the instructions provided with the form to understand how to fill out each section correctly.

04

Start filling out the form by entering the recipient's identification information, such as their name, address, and social security number.

05

Next, report the type of income being reported on the form. This could be interest, dividends, royalties, or other types of income.

06

Include the total amount of income the recipient earned in the appropriate box on the form.

07

If applicable, provide any additional details or explanations required for certain types of income, such as details on real estate transactions.

08

Double-check all the information you entered to ensure accuracy and correctness.

09

Sign and date the form before submitting it to the IRS and keep a copy for your own records.

Who needs t-1099?

01

Individuals who paid income to someone else must fill out t-1099 form.

02

Businesses or entities that made payments to freelancers, independent contractors, or vendors in the course of their trade or business need to file t-1099.

03

Anyone who has received at least $10 in interest or dividends, or $600 or more in rent, prizes, awards, or compensation for services rendered, may also need to complete t-1099.

04

It is important to consult the official IRS guidelines or a tax professional to determine if you specifically need to file t-1099.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the t-1099 - mht maryland in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your t-1099 - mht maryland in seconds.

How do I edit t-1099 - mht maryland on an Android device?

The pdfFiller app for Android allows you to edit PDF files like t-1099 - mht maryland. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out t-1099 - mht maryland on an Android device?

Use the pdfFiller app for Android to finish your t-1099 - mht maryland. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is t-1099?

T-1099 is a tax form used to report various types of income received by an individual or a business.

Who is required to file t-1099?

Individuals or businesses who make payments of $600 or more for services performed by non-employees, such as independent contractors, are required to file t-1099.

How to fill out t-1099?

To fill out t-1099, you need to provide information about the recipient of the income, the amount paid, and the purpose of the payment.

What is the purpose of t-1099?

The purpose of t-1099 is to report income payments made to non-employees, which helps the IRS track income that may need to be reported on the recipient's tax return.

What information must be reported on t-1099?

The information that must be reported on t-1099 includes the recipient's name, address, tax identification number, the amount of income paid, and the purpose of the payment.

Fill out your t-1099 - mht maryland online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-1099 - Mht Maryland is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.