Get the free 2016 Especially for You Team Captain Kick-Off Open House

Show details

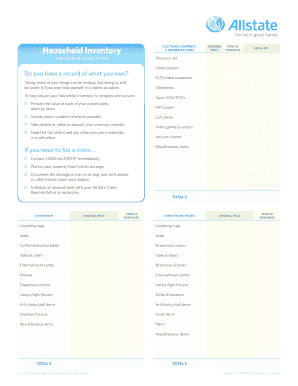

Especiallyforyourace. org Email questions Contact Jacki Knight at jknight mercycare. org or 319-221-8889 or Christina Djerf at cdjerf mercycare. Com NOTE File should be EPS AI or PDF format with simple name no spaces in file name Also save logo as exact team name email to Garment Designs as soon as possible Chip timing 5K Runners only Multiple registrations can be put on one form Post-race activities at NewBo EFY Merchandise new items for 2016 Critical Dates and Deadlines Website www....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016 especially for you

Edit your 2016 especially for you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 especially for you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2016 especially for you online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2016 especially for you. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2016 especially for you

How to fill out 2016 especially for you

01

Gather all the necessary documents, such as your W-2 forms and any other income-related documents.

02

Obtain the 2016 tax forms and publications, which can be found on the official IRS website or obtained from a local tax office.

03

Read the instructions on the tax forms carefully to understand what information is required in each section.

04

Start by filling out your personal information correctly, including your name, address, and Social Security number.

05

Proceed to report your income by entering the appropriate figures from your W-2 forms and any other sources of income.

06

Calculate your deductions and enter them in the appropriate section. Common deductions include mortgage interest, medical expenses, and charitable contributions.

07

Complete any additional sections or schedules that are relevant to your specific tax situation. This may include reporting self-employment income, rental income, or claiming education credits.

08

Review your completed tax return for any errors or missing information. Make sure all calculations are accurate.

09

Sign and date your tax return before submitting it to the IRS. Keep a copy for your records.

10

Consider filing your tax return electronically for faster processing and to ensure accuracy.

11

If you are unsure about any part of the process, seek assistance from a tax professional or utilize IRS resources for guidance.

Who needs 2016 especially for you?

01

Anyone who earned income in the year 2016 is required to fill out a tax return, including individuals, married couples, and dependents.

02

Business owners, freelancers, and self-employed individuals who received income exceeding the filing threshold must also complete a tax return.

03

People who had taxes withheld from their earnings and are eligible for a refund should file a tax return to claim their refund.

04

Individuals who had any significant life events in 2016, such as getting married, having a child, or buying a home, may need to file a tax return to take advantage of certain deductions or credits.

05

Even if you are not legally obligated to file a tax return, it may still be beneficial to do so in order to qualify for certain government assistance programs, obtain loans, or establish a verifiable income history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2016 especially for you in Gmail?

2016 especially for you and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in 2016 especially for you without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2016 especially for you and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out 2016 especially for you using my mobile device?

Use the pdfFiller mobile app to complete and sign 2016 especially for you on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is especially for you team?

Especially for you team is a personalized team created to meet specific needs or requirements.

Who is required to file especially for you team?

Anyone who needs a specialized team to address their unique needs or preferences.

How to fill out especially for you team?

To fill out especially for you team, you would need to provide details on the specific requirements, preferences, and any relevant information.

What is the purpose of especially for you team?

The purpose of especially for you team is to provide a tailored solution to meet individual needs and preferences.

What information must be reported on especially for you team?

The information reported on especially for you team would depend on the specific needs and requirements of the individual or team.

Fill out your 2016 especially for you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016 Especially For You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.