Get the free Indian banks: performance benchmarking report - FY12 results

Show details

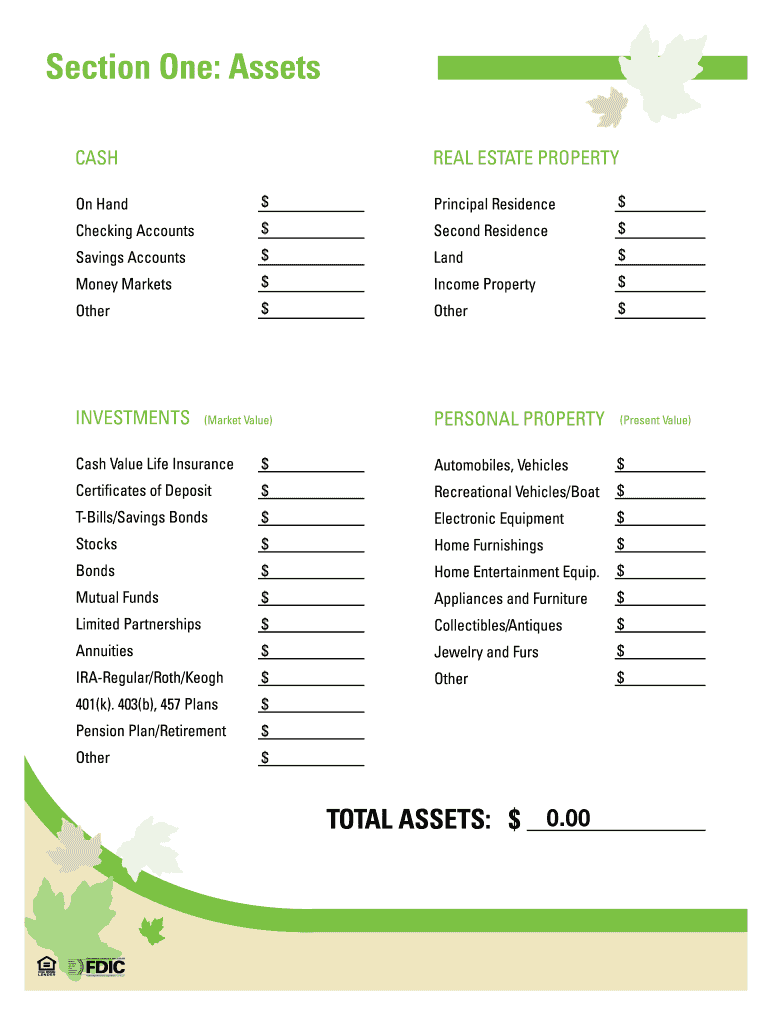

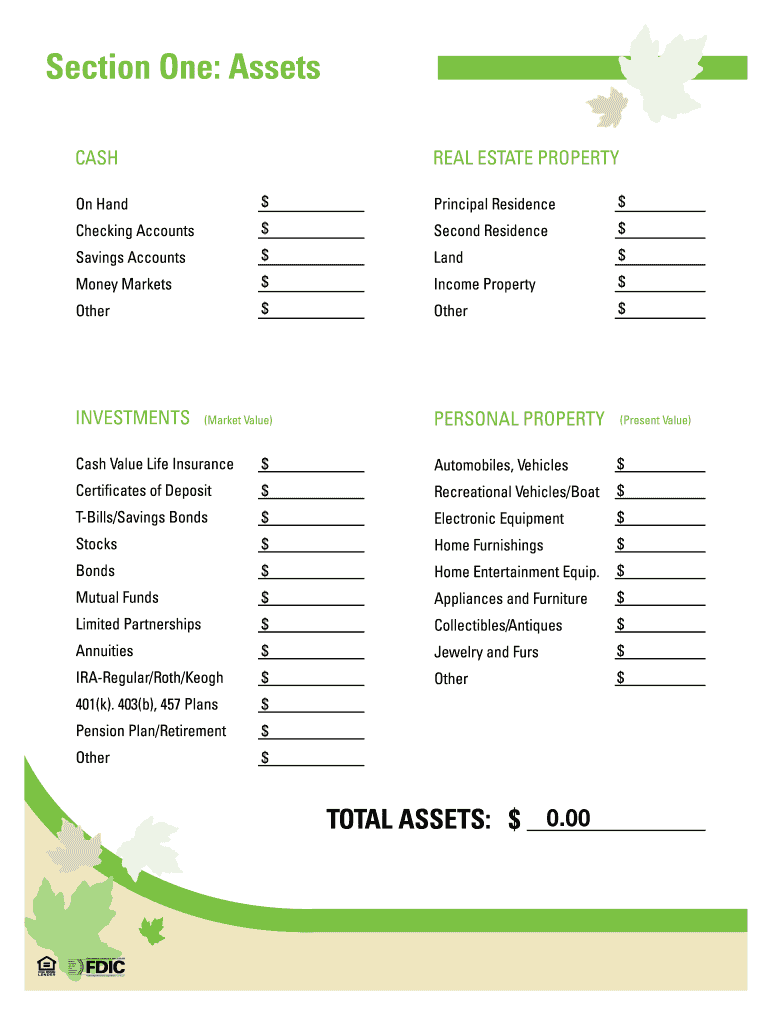

5 Minute Future Tool Welcome to the Gauge Savings Bank Interactive 5 Minute Future Tool. We hope you'll find that this worksheet makes visualizing your current financial picture a breeze. Once completed,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian banks performance benchmarking

Edit your indian banks performance benchmarking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian banks performance benchmarking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indian banks performance benchmarking online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indian banks performance benchmarking. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian banks performance benchmarking

How to fill out Indian banks performance benchmarking:

01

Start by gathering all the necessary financial data of the Indian bank you want to benchmark. This includes their income statement, balance sheet, and cash flow statement.

02

Analyze and compare these financial statements to the benchmarks set by other Indian banks in the industry. Look for key financial ratios such as return on assets, return on equity, and net interest margin.

03

Identify any strengths or weaknesses in the bank's performance compared to the benchmarks. This evaluation will help the bank identify areas for improvement and potential growth opportunities.

04

Create a comprehensive report summarizing the bank's performance compared to the benchmarks. Include all relevant financial ratios and analysis, along with any recommendations for improvement.

05

Present the report to the management team and stakeholders of the Indian bank, highlighting the key findings and actionable steps to enhance performance.

Who needs Indian banks performance benchmarking?

01

Banks: Indian banks themselves can benefit from performance benchmarking to evaluate their performance against industry standards and identify areas for improvement. This will help them stay competitive and make informed strategic decisions.

02

Investors: Investors who are considering investing in Indian banks can use performance benchmarking to assess the bank's financial health and potential returns. It provides them with a comparative analysis of different banks, helping them make informed investment decisions.

03

Regulators: Regulatory bodies in India can utilize performance benchmarking to monitor the overall health and stability of the banking sector. It allows them to identify banks that may require intervention or additional oversight.

04

Researchers and analysts: Academics, researchers, and industry analysts can utilize performance benchmarking to study and analyze the Indian banking sector. It provides them with valuable insights into financial trends, industry norms, and the overall health of the sector, aiding in their research and analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my indian banks performance benchmarking directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your indian banks performance benchmarking and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit indian banks performance benchmarking on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing indian banks performance benchmarking.

Can I edit indian banks performance benchmarking on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign indian banks performance benchmarking. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is indian banks performance benchmarking?

Indian banks performance benchmarking is a process of comparing the performance of different banks in India to assess their efficiency, profitability, and overall financial health.

Who is required to file indian banks performance benchmarking?

All banks operating in India are required to file indian banks performance benchmarking as part of regulatory and reporting requirements.

How to fill out indian banks performance benchmarking?

Indian banks performance benchmarking can be filled out by collecting relevant financial and operational data, analyzing key performance indicators, and submitting the required reports to regulatory authorities.

What is the purpose of indian banks performance benchmarking?

The purpose of indian banks performance benchmarking is to provide stakeholders with an objective assessment of the performance of banks in India, facilitate comparison between different banks, and identify areas for improvement.

What information must be reported on indian banks performance benchmarking?

Information such as financial statements, asset quality metrics, capital adequacy ratios, loan portfolio performance, and other key performance indicators must be reported on indian banks performance benchmarking.

Fill out your indian banks performance benchmarking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Banks Performance Benchmarking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.