Get the free Ao contributivo a corregirse/

Show details

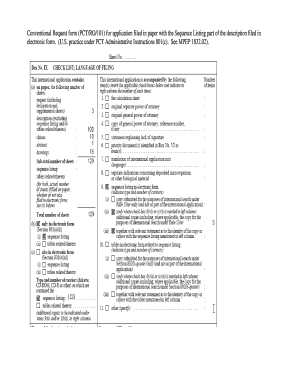

Anote todos los cuatro d gitos del a o contributivo del de los Formulario s 499R-2/W-2PR o 499R-2c/W-2cPR o W-3PR que desea corregir. Si va a corregir su EIN anote el EIN incorrecto en el encasillado h. Encasillado f Clase de patrono. Encasillado c Total de Formularios 499R-2c/W-2cPR. Anote el n mero de Formularios 499R-2c/W-2cPR individuales que radica con este Formulario W-3c PR o anote -0- si corrige nicamente un solo Formulario W-3PR radicado anteriormente. Cu ndo se debe radicar la...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ao contributivo a corregirse

Edit your ao contributivo a corregirse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ao contributivo a corregirse form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ao contributivo a corregirse online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ao contributivo a corregirse. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ao contributivo a corregirse

How to fill out ao contributivo a corregirse

01

First, gather all required documentation such as identification, proof of income, and medical history.

02

Visit your local social security office or healthcare center to request the appropriate application form.

03

Fill out the application form with accurate and complete information.

04

Attach all necessary documentation to the application form.

05

Submit the filled-out application form and supporting documents to the designated authority.

06

Wait for the application to be processed and reviewed by the relevant authorities.

07

If any corrections or additional information are required, respond promptly and provide the necessary updates.

08

Once approved, follow any further instructions provided by the authorities.

09

Maintain regular communication with the social security office or healthcare center to stay updated on the progress of your application.

10

Once successfully enrolled, make sure to keep your information up to date and adhere to any renewal requirements.

Who needs ao contributivo a corregirse?

01

Individuals who are eligible for the contributory healthcare system and require corrections or updates to their information.

02

People who have recently experienced changes in their personal details or circumstances that need to be reflected in their contributory healthcare records.

03

Those who have identified errors or inaccuracies in their existing contributory healthcare records and want to rectify them.

04

Any individual who wants to ensure their contributory healthcare records are up to date and accurately reflect their current situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ao contributivo a corregirse in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ao contributivo a corregirse as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit ao contributivo a corregirse online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ao contributivo a corregirse and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit ao contributivo a corregirse on an iOS device?

Create, modify, and share ao contributivo a corregirse using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is ao contributivo a corregirse?

Ao contributivo a corregirse is a tax return form that needs to be corrected.

Who is required to file ao contributivo a corregirse?

Individuals who need to correct errors or update information on their tax return are required to file ao contributivo a corregirse.

How to fill out ao contributivo a corregirse?

To fill out ao contributivo a corregirse, individuals need to review their original tax return, identify the errors or updates needed, and provide the corrected information.

What is the purpose of ao contributivo a corregirse?

The purpose of ao contributivo a corregirse is to ensure accurate reporting of income, deductions, and credits on tax returns.

What information must be reported on ao contributivo a corregirse?

Information such as corrected income amounts, updated deductions, and any additional tax credits must be reported on ao contributivo a corregirse.

Fill out your ao contributivo a corregirse online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ao Contributivo A Corregirse is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.