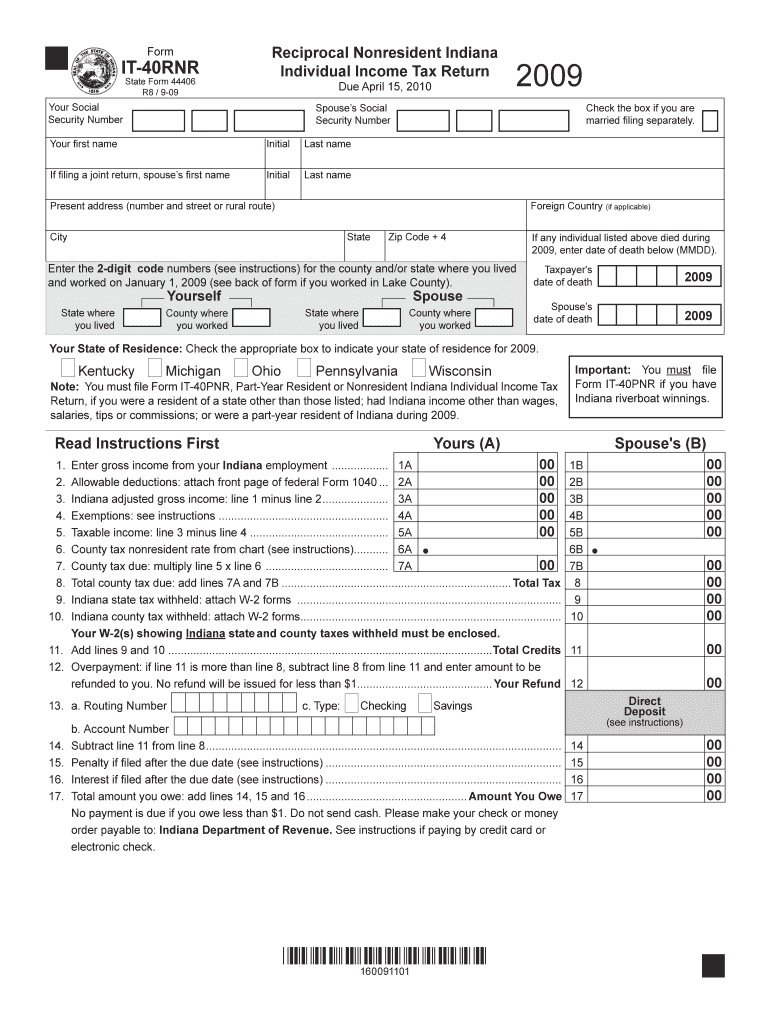

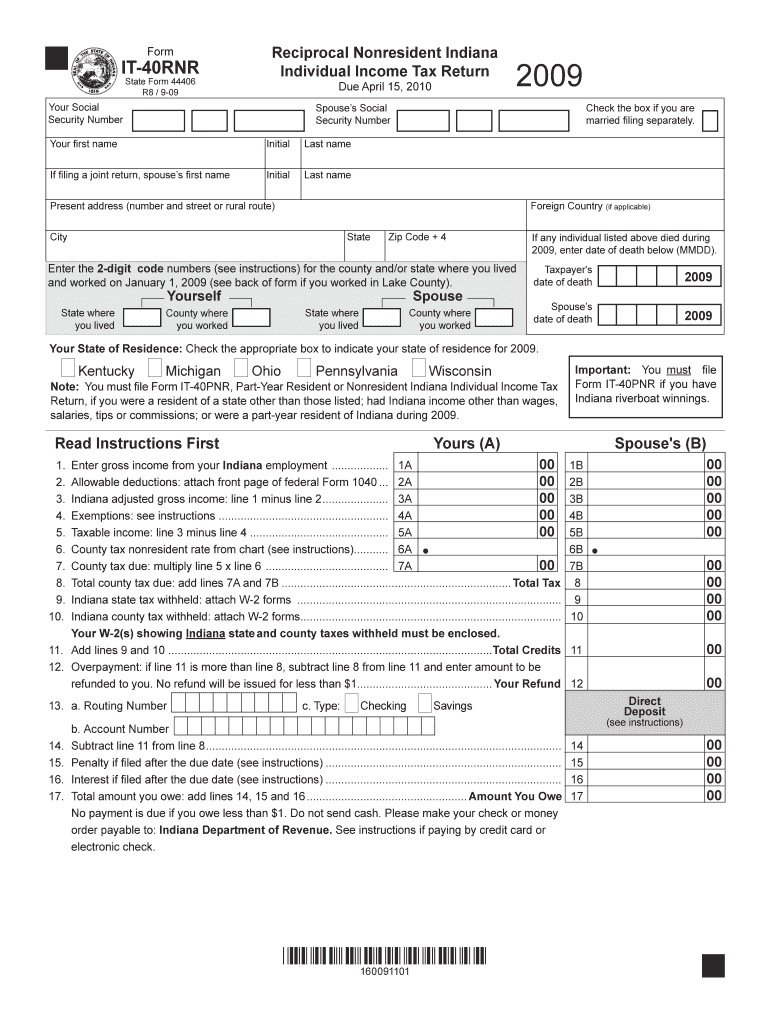

Get the free Foreign Country (if applicable)

Show details

R1 / 12-09 County Code 2009 Indiana Nonresident County Tax Rates PLUS the 2-digit code numbers Name Adams Allen Bartholomew Benton Blackford Boone Brown Carroll Cass Clark Clay Clinton Crawford Daviess Dearborn Decatur DeKalb Delaware Dubois Elkhart Fayette Floyd Fountain Franklin Fulton Gibson Grant Greene Hamilton Hancock Harrison Hendricks Henry Nonresident Rate. You may owe county tax if on Jan. 1 2009 you worked in an Indiana county that has adopted a county income tax. Changes in the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign country if applicable

Edit your foreign country if applicable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign country if applicable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign country if applicable online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit foreign country if applicable. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign country if applicable

How to fill out foreign country if applicable

01

Research the visa requirements for the specific foreign country you plan to visit.

02

Gather all necessary documents such as a valid passport, visa application forms, and supporting documents like invitation letters or travel itineraries.

03

Complete the visa application forms accurately and truthfully.

04

Prepare any additional documents required, such as proof of financial stability, travel insurance, or medical certificates.

05

Submit your visa application along with the necessary fees to the embassy or consulate of the foreign country.

06

Attend any scheduled interviews or biometric data collection appointments, if required.

07

Wait for the processing of your visa application and follow up if necessary.

08

Once your visa is approved, collect it from the embassy or consulate.

09

Make necessary travel arrangements and ensure you comply with any additional entry requirements like COVID-19 tests or quarantine regulations.

10

Keep your travel documents safe during your trip and comply with the immigration rules and regulations of the foreign country.

Who needs foreign country if applicable?

01

Individuals planning to travel to a foreign country for tourism or vacation purposes.

02

Business professionals attending conferences, meetings, or exploring business opportunities abroad.

03

Students pursuing education in a foreign country or participating in exchange programs.

04

Individuals visiting family or friends residing in a foreign country.

05

Researchers or professionals attending international conferences, seminars, or workshops.

06

Individuals seeking medical treatments or procedures in a foreign country.

07

Artists, performers, or athletes participating in international events or competitions.

08

Diplomats or government officials representing their country abroad.

09

Individuals seeking opportunities for work or employment in a foreign country.

10

Retirees or individuals planning to relocate to a foreign country for retirement purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign country if applicable?

Foreign country refers to any country outside the one in which the individual or entity is a resident or citizen.

Who is required to file foreign country if applicable?

Individuals or entities who have financial interests or signature authority over foreign financial accounts may be required to file a foreign country disclosure form.

How to fill out foreign country if applicable?

Foreign country disclosure forms can typically be filled out online through the appropriate government agency's website.

What is the purpose of foreign country if applicable?

The purpose of foreign country disclosure forms is to report any foreign financial accounts or interests to prevent tax evasion and money laundering.

What information must be reported on foreign country if applicable?

Information such as the account number, financial institution name, account balance, and any income generated from the account must be reported on the foreign country disclosure form.

How can I edit foreign country if applicable from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your foreign country if applicable into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I edit foreign country if applicable on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute foreign country if applicable from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out foreign country if applicable on an Android device?

On an Android device, use the pdfFiller mobile app to finish your foreign country if applicable. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your foreign country if applicable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Country If Applicable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.