Get the free Credit /Reimbursement for

Show details

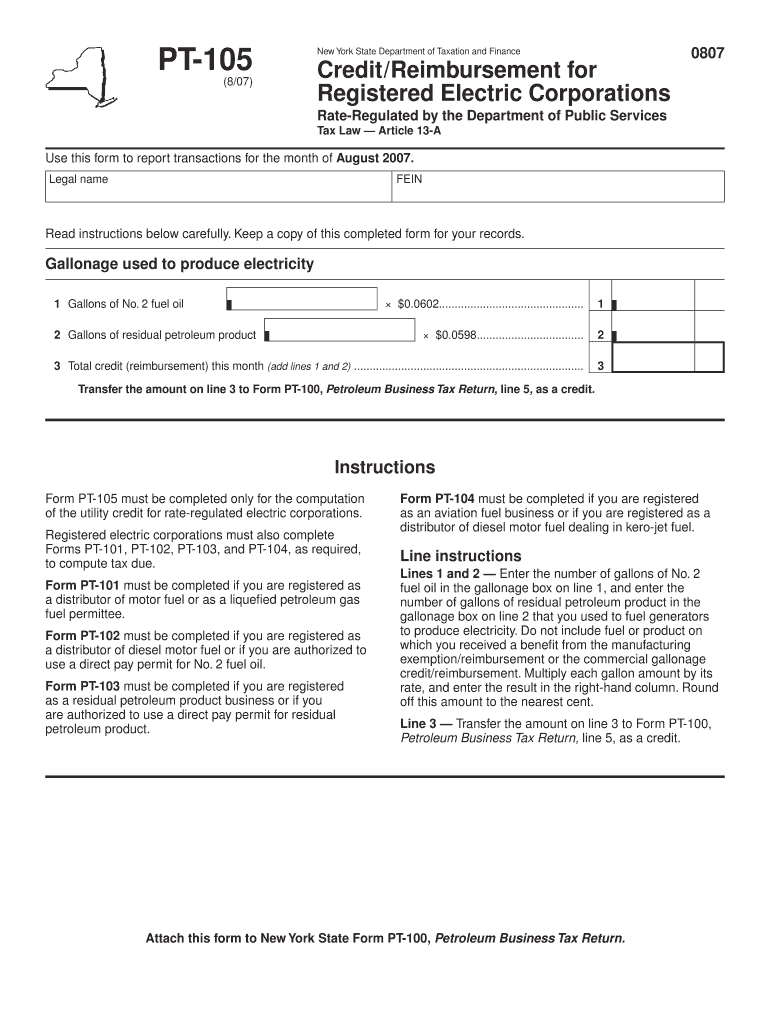

Forms PT-101 PT-102 PT-103 and PT-104 as required to compute tax due. a distributor of motor fuel or as a liquefied petroleum gas fuel permittee. Use a direct pay permit for No. 2 fuel oil. as a residual petroleum product business or if you are authorized to use a direct pay permit for residual petroleum product. PT-105 8/07 New York State Department of Taxation and Finance Credit /Reimbursement for Registered Electric Corporations Rate-Regulated by the Department of Public Services Tax Law...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit reimbursement for

Edit your credit reimbursement for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit reimbursement for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit reimbursement for online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit reimbursement for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit reimbursement for

How to fill out credit reimbursement for

01

Step 1: Gather all your credit reimbursement documents such as receipts, invoices, and any other relevant paperwork.

02

Step 2: Review your credit reimbursement policy to understand the eligibility criteria and the items that can be reimbursed.

03

Step 3: Fill out the credit reimbursement form accurately, providing all the required information such as your name, employee ID, and contact details.

04

Step 4: Attach all the necessary documents to support your reimbursement claim. Make sure they are legible and organized.

05

Step 5: Double-check your completed form and attached documents for any errors or omissions.

06

Step 6: Submit your credit reimbursement form along with the supporting documents to the appropriate department or authority.

07

Step 7: Keep a copy of your submitted form and documents for your records.

08

Step 8: Wait for the approval process to be completed. It may take some time, so be patient.

09

Step 9: If your credit reimbursement claim is approved, you will receive the reimbursement amount through the specified payment method.

10

Step 10: If your credit reimbursement claim is rejected or requires further clarification, follow up with the concerned department to address any issues.

Who needs credit reimbursement for?

01

Employees who have made eligible credit-related expenses may need credit reimbursement.

02

Business travelers who have paid for their travel expenses using personal funds may need credit reimbursement.

03

Individuals who have purchased items on behalf of their organization and need to be reimbursed for those expenses may need credit reimbursement.

04

Anyone who has incurred expenses that are covered under a credit reimbursement policy may need to submit a reimbursement claim.

05

Credit card holders who have been wrongly charged or have experienced fraudulent activity on their credit card may need credit reimbursement.

06

Freelancers or contractors who have been asked to cover certain expenses by their clients may need credit reimbursement for those expenses.

07

Company executives or managers who have used their personal funds for business-related expenses may need credit reimbursement.

08

Students who have paid for eligible educational expenses out-of-pocket may need credit reimbursement from their educational institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit reimbursement for for eSignature?

Once your credit reimbursement for is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find credit reimbursement for?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the credit reimbursement for in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit credit reimbursement for on an Android device?

You can make any changes to PDF files, like credit reimbursement for, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is credit reimbursement for?

Credit reimbursement is for providing reimbursement or repayment for previously charged credits or expenses.

Who is required to file credit reimbursement for?

Anyone who has incurred expenses or credits that are eligible for reimbursement must file for credit reimbursement.

How to fill out credit reimbursement for?

To fill out credit reimbursement, one must provide details of the expenses or credits incurred, along with any necessary supporting documentation.

What is the purpose of credit reimbursement for?

The purpose of credit reimbursement is to ensure that individuals or organizations are reimbursed for expenses or credits that are deemed eligible for reimbursement.

What information must be reported on credit reimbursement for?

On credit reimbursement forms, one must report details of the incurred expenses, including date, amount, and purpose, along with any supporting documentation.

Fill out your credit reimbursement for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Reimbursement For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.