Get the free Self-Employed Income amp Expenses

Show details

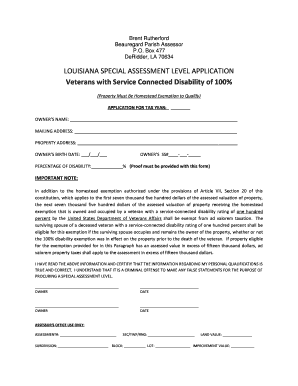

SELF EMPLOYED (SOLE PROPRIETOR INDIVIDUALS) ONLY Do NOT use this page for any W2 Employees income or expenses List the 1099s you received: MAJOR ITEMS PURCHASED FOR BUSINESS (Not Auto) (REEMPLOYED)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-employed income amp expenses

Edit your self-employed income amp expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employed income amp expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self-employed income amp expenses online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit self-employed income amp expenses. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-employed income amp expenses

How to fill out self-employed income amp expenses:

01

Keep track of all income: Make sure to record all the income you receive as a self-employed individual. This includes payments from clients, online sales, or any other sources of income related to your self-employment.

02

Document your expenses: Keep track of all your business-related expenses. This can include office supplies, rent, utilities, travel expenses, and any other costs directly related to your self-employed work. Make sure to keep receipts and invoices for these expenses.

03

Separate personal and business finances: It is important to maintain separate bank accounts and credit cards for your personal and business finances. This will make it easier to track your income and expenses accurately.

04

Use accounting software: Consider using accounting software to streamline the process of recording and categorizing your income and expenses. These tools can help you generate financial statements and reports, making it easier to file your taxes.

05

Calculate your net income: Subtract your total expenses from your total income to determine your net income. This will give you an accurate representation of your self-employed earnings.

Who needs self-employed income amp expenses?

01

Freelancers: Individuals who work as independent contractors or freelancers often need to keep track of their income and expenses for tax purposes.

02

Small business owners: Those who own and run their own small businesses need to maintain detailed records of their income and expenses to manage their finances effectively and fulfill tax obligations.

03

Gig workers: People who work in the gig economy, such as drivers, delivery persons, or online platform workers, often need to track their self-employed income and expenses for tax reporting.

In conclusion, anyone who is self-employed, whether as a freelancer, small business owner, or gig worker, needs to fill out self-employed income and expenses to accurately track their earnings and manage their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get self-employed income amp expenses?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the self-employed income amp expenses in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete self-employed income amp expenses online?

pdfFiller makes it easy to finish and sign self-employed income amp expenses online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in self-employed income amp expenses without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your self-employed income amp expenses, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is self-employed income amp expenses?

Self-employed income and expenses refer to the earnings and costs incurred by individuals who work for themselves rather than an employer.

Who is required to file self-employed income amp expenses?

Individuals who earn income from self-employment, such as freelancers, independent contractors, and small business owners, are required to file self-employed income and expenses.

How to fill out self-employed income amp expenses?

To fill out self-employed income and expenses, individuals should keep detailed records of their earnings and costs throughout the year and report them accurately on the appropriate tax forms, such as Schedule C.

What is the purpose of self-employed income amp expenses?

The purpose of self-employed income and expenses is to accurately report and calculate the net profit or loss from self-employment activities for tax purposes.

What information must be reported on self-employed income amp expenses?

Information that must be reported on self-employed income and expenses includes gross income, business expenses, deductions, and net profit or loss.

Fill out your self-employed income amp expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employed Income Amp Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.